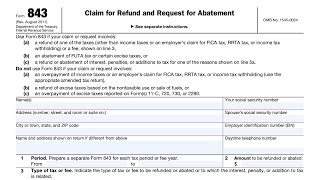

Form 843 - Request for Penalty Abatement

Вставка

- Опубліковано 21 січ 2024

- Are your IRS penalties crushing you? Book a call with us at www.Bowenstaxsolutions.com

If you had the opportunity to lower your tax bill would you take it?

What if you were able to get a refund for part of the penalties you paid?

Your answer was most likely yes, immediately. However, how long have you been looking at those tax notices and not taking any action?

In today's video, I explain what IRS Penalty Abatement is, simply forgiveness from the IRS. I also walk you through how to request forgiveness from the IRS on Form 843.

If you have already paid the penalty you may be eligible for a refund of those penalties. But you have to make sure that you make your request before the refund expiration date (RSED). This date is 2 years from the date you paid the taxes and the last date you can request a refund.

If you need to pull your tax transcript to confirm the amount of penalties on your account you can learn how to pull your account transcript here: www.americasfavoriteea.com/po...

If you would like to learn more about First Time Penalty Abatement or Reasonable Cause Penalty Abatement check out the Tax Relief with Timalyn Bowens podcast, right here on this channel.

First Time Penalty Abatement - • IRS Penalties First Ti...

Reasonable Cause Penalty Abatement - • IRS Penalties Removing...

If you are interested in working with my firm, Bowens Tax Solutions to get your IRS penalties abated and your back tax issue behind you then book a call with us at www.Bowenstaxsolutions.com

❤ this

Awesome stuff. Keep sharing your knowledge...

Thank you! 🙏🏽

@@AmericasFavEA you're welcome 😊

learned tons...especially need to acquire transcript...

I'm glad you found the video informative.

Hello, this has been helpful thank you. I read a comment that this 843 Request for abatement if approved will only apply to the penalties, what about the interest accrued. My argument is the IRS took almost 2 years to finalize a decision on my OIC which cause increased fees and interest. I was including this in my supplemental explanation form. Is this a waste of time because interest will not be abated. Please advise?

2 years? If they haven't made a decision after 24 months the offer defaults to being accepted.

Did you not hear from them or was more information requested during that time?

To answer your question - yes, this is the penalty only.

Where do you get your transaction

You can pull the amount for the penalty from your transcripts.

Would this be the right form to use to recover the FICA taxes that your former employer withheld from a final distribution from a SERP after termination from service, if they had already previously withheld FICA taxes on all the previous years when they made the contributions to the plan? If so, do you file this form before or after you already filed your taxes for the year when you received that distribution?

I am sooooo sorry I missed this. Did you already find your answer?

I filled one of these out. How do you know they received and respond to you?

I recommend sending it certified. It could take 3-9 months before you hear back.

@AmericasFavEA Wow I didn't know it took that long. I unfortunately didn't 😕 send it certified. I have to check. I didn't pay yet and they are sending the bill with interest! Grrr Thanks so much for responding!

@@JustWonderingMg you're welcome. Wishing you all the best! Keep in mind that only the penalty will be removed if they accept it.