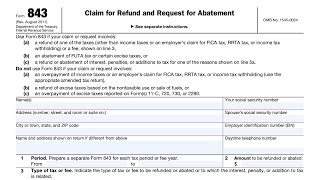

IRS Form 843 - Request a Refund of FICA Taxes

Вставка

- Опубліковано 5 жов 2024

- Form 843 can be filed by international students who worked in the U.S. and had payroll taxes (FICA) incorrectly withheld from their wages. The Form 843 should be filed in conjunction with IRS Form 8316.

For a larger database of tutorials, please visit our website and search for your question:

knottlearning....

DISCLAIMER: The information provided in this video may contain information about tax, financial, and legal topics. Such materials are for informational purposes only and may not reflect the most current developments. These informational materials are not intended and should not be taken as tax, financial, or legal advice. You should contact an advisor to discuss your specific facts and circumstances. Self-help services may not be permitted in all states or jurisdictions. The use of these materials does not create an attorney-client or confidential relationship. This video does not include information about every topic or issue related to these informational materials.

#IRS #Form843 #FICA #TaxRefund

You saved so much of my time and provided the information I was googling for hours.

Glad it was helpful!

How do I know to which office I have to send the 843 Form with the supporting documentation?

This is SO helpful!!!

At least I can now try to fill it with no mistakes.

My employer said she doesn’t know about it, and she said to request it from IRS directly

Sir, Can you give the address where we have to mail these forms to. Many thanks for the great video. I worked for 2 employers and both of them deducted FICA taxes over the limit. Now i have to claim the refund.

Hello Jason, thanks for the informative video. do you have any videos explaining how to fill IRS form 8316?

Thanks for watching! We don't have any videos yet, but we do handle these social security refund claims. We can add a video that covers IRS Form 8316 👍

Hi Jason,

Thank you so much for your video! Can you please let me know which IRS address should I use to file this form as a North Carolina resident?

I am currently in F1 STEM OPT. I paid these taxes for last 3 years. But I became a Resident Alien in 2019 because I have been in USA for more than 9 years now. I pass the substantial presence test. Do I have to pay Social security and medicare taxes if I am a Resident Alien?

How many months does it take to refund

Hi, thanks for making this video. I had a question. What should we do if the employer did refund but only a partial amount of FICA and the W-2 shows the complete amount. Let's say $2000 was the total FICA, that's the amount on W2. $1000 is refunded in the tax year, the rest is still withheld.

Would this be the right form to use to recover the FICA taxes that your former employer withheld from a final distribution from a SERP after termination from service, if they had already previously withheld FICA taxes on all the previous years when they made the contributions to the plan?

2:07 do you have a video about the religious reasons? And how do you know if you are eligible?

I had overpaid fica tax. My employer would not adjust and told me to apply for a refund.

what address do you mail the forms to?

Which address did you send the forms to?? Are you from CA?

Thank you for the video!

How will IRS pay the FICA tax refund? Will they ask us for a number account for a direct deposit or are they going to mail a check?

They will mail you a paper check. I'm not sure if there is an option yet to receive this refund via direct deposit.

Which IRS location to mail form 843 to? Thank u!

I paid fica taxes for 12 years in the army never knew you could get a refund how far can they go back

Refund claims are generally only allowed for 3 years. However, not every taxpayer is eligible for fica refunds

@@JasonDKnott ok thanks

Thanks!

You're welcome!

Hi Jason. Thank you for sharing the information. I had a question. I am an F-1 student currently on OPT. Should I file my taxes first(1040NR, W-2(which has the Social security tax and Medicare tax boxes filled) and other documents) or should I request for the FICA refund first? What should be the order?

Hi, how about number 4?

Field 4 is only completed if you are filing Form 843 to request an abatement of penalties. For this video, we are demonstrating how to file to request a social security and Medicare tax refund, so there is no penalty component.

Thanks for the nice explanation. I just have one question. My employer has agreed to issue the refund. But they agreed to refund me as a new paycheck, for which I have to pay tax next year. Do you think if it is the right aproach? Also, the want to issue a new amended W2 (W2C)

I did lost my refund check.which customer care I need to call? I am an F1 student

Super helpful - thanks a lot!

I'm glad it was helpful!

Hello Jason,

Thank you so much for this video. I had filled this form in Feb 2021 and I have still not gotten any response for my claim. Do you know How I can find the status of this claim or who I can reach out to regarding this matter? I had tried calling the IRS number several times and it was impossible to get through the automated robot. Any help here would greatly be appricated.

Unfortunately, it does take a long time to receive any refunds or contact from the IRS. The IRS takes several months to process regular mail during the best of times. For a FICA refund claim, it is not unusual to wait this long.

@@JasonDKnott

Hi Jason, I was on a J1 visa, but my former employer where I did my internship just sent en email telling me I should contact the IRS, but I have already filed and sent my tax return. Do you know if that modifies my return and I have to do an amendment to my return file?. Or I just have to file this form?. In this request of the 843 form, is there a way to ask the refund to my bank account in the US?, I mean I don't live anymore in the US so check would be almost imposible for me. Thanks man for the video, really helpful

Hello, how would the IRS send my refund? I changed apartment and I usually put direct deposit for federal taxes but in this form I couldn’t find it. I thought they would send to my bank they have in file. I haven’t received anything, what can I do?

The IRS tries direct deposit first, but if it is rejected for any reason, the IRS will then issue you a paper refund check to the last address on file. If the refund check is lost in the mail, you can file Form 3911 to report the lost refund check and request a new one.

Hi kimberly, even i'm in the same situation. Did you find a way out of it?

@@JasonDKnott Hello Jason, does that mean we need to include Direct deposit information within the application? or the IRS takes the information form the tax return document?

Do i need a tax consultant to file my taxes or i can do it on my own.

My employer said u have to work with tax consultant to file the claim we cannot refund u.

Can i file ficca taxes separately after 18 th april. My tax consultant is asking 50 dollars just to file fica and not taking guarantee that my money will come back.

Could u please suggest what to do

As a taxpayer, you are always allowed to represent yourself for tax matters and file your own tax returns. We always recommend hiring a tax attorney or CPA to assist with any refund claims, as they can be quite complicated filings.

Can we file fica taxes separately after 18th April pr it has to be before that for last year