A bond's coupon vs. current yield vs. yield to maturity: StreetSmarts

Вставка

- Опубліковано 9 тра 2024

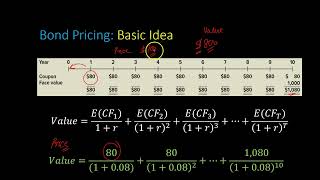

- In this episode of StreetSmarts with Howe & Rusling, Charity Willett, Fixed Income Associate, goes beyond the bell to teach us about the difference between a bond's coupon, current yield, and yield to maturity.

Wow, so beautifully explained. The straight scoop. Well done. Great voice.

Thank you! Very clear explanation of these confusing concepts ;)

You cleared out the confusion, thank you

Thanks. Simple and clear.

Excellent Video !!!

Really helpful, thanks!

Very clear explanation. Thank u

Thank you so much

It must be (200/10500)*100 which is 1.90. If we calculate as you said: (0.02/10500)*100 , then it is 0.00190. Coupon amount helps to know the current yield.

what is the 200 for? what does represent? isn't it supposed to be 0,02?

@@luneelferdaous6015 2% out of 10 000$ = 200$

Thank you for clarifying!

thank you!

AMAZING

Thank you

Good explanation

Now I'm ready to buy my 1st T Bond.

she needs to replace my finance teacher asap

thank

Does the same apply to T bills? I.e., would a 4 week non-coupon t bill at a 4% maturity to yield rate recoup that 4% interest + the principal at maturity, or would it only recoup the difference between the par and the purchase price?

A zero-coupon bond doesn't pay any interest, so the YTM purely comes from getting the full face amount (after buying it initially at a discount) when the bond matures! (in your example, the T-bill)

beautiful

Very clear. I'm puzzled by the price. Say I'm buying a t-bill for $1000 and it's got a YTM of 5%. But the price is something like 99.668. Paying $99 for a $1000 t-bill would be a huge yield so that's not what's going on. From watching your video, it sounds like that price means 99.668 cents on the dollar. Right?

That's correct Chip!

@@howerusling165 Thanks!

HART-/C-MarfKieTY //nd.D

HART-/C-MarfKieTY //nd.D

HART-/C-MarfKieTY //nd.D

HART-/C-MarfKieTY //nd.D