How to Calculate Yield To Maturity of a Bond -What is YTM and How to Use the Approximation Formula

Вставка

- Опубліковано 11 тра 2024

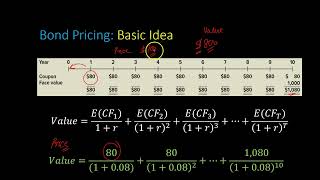

- In this video I will teach you what Yield to Maturity is (YTM). I will show you how you can calculate YTM for premium bonds, discount bonds and for bonds bought at issue. This video will focus on how to use the approximation formula but will also mention at the end how to use the trial and error method. This video will include clear explanations (I've tried to make it as easy to follow as possible) and fully worked examples with step by step solutions. Hopefully this tutorial helps you and you can easily and quickly find the YTM of a bond.

0:00 Introduction to Bond Yield

1:40 Premium and Discount Bonds

5:02 Yield to Maturity Approximation Formula

6:29 How to Calculate YTM: Worked Examples

11:18 Intro to Trial and Error Method

Watched many videos on this, yours is the clearest and easiest to understand. Thank you.

Thank you! I had been doubling the number for N for semi annual payments. Now I see what I had been doing wrong. Thanks so much!

Explaining the premium and discount piece made this click for me. Thanks!

This helped a lot, thank you so much.

As said just below, your video is the best at explaining all this. Thanks. One thing...none of my bonds were bought anywhere near the time when they were first issued. As such, I'm not sure how to use your formula. I'm assuming that 'n' in your equation would not be the full time length of the bond in my case.

Exceptional clarity! Thank you!:)

Excellent video. Explained very well.

Very helpful, thank you!

That's a great video to understanding for YTM

It was very helpful and especially with what is going with SVB on 03/10/2023

wonderful, thanks for the in-depth explanation!!

THANK YOU..... VERY MUCH !!!!!!!!

Sir, I'm doing fin 222 in uowd and this was taught by my prof a few weeks ago and I couldn't understand it at all but your explanation is literally making me cry from relief 💀 thank you so much

Glad it helped and you understand it now

@@TheCompleteGuide1 Passed it!

@@SaeedG1999 Great. Well done!

thank you so much it helped

Thank you, but you should use consistent casing for the letters. On the other hand, this the best explanation I ever seen. Congrats.

Excellent, Thank you

really helpful, thansk

sick explanation

thank u!!!!

helped for my series 65

Great vídeo, buddy!

I’m not your buddy, guy

Can you explain the meanings and the calculations of the running yield and the holding period return?

So what if you buy the bond AFTER some the coupons have been paid to the previous owner. In the simple equation I'd expect that you just lower n to whatever payments are left. In the example, the bond pays 5 coupons, but if 2 of them have already been paid, then your n=3. But what does that do to more accurate equation which is already not easy to solve?

Can you please tell us how you got the formula that you have mentioned at 11:25 ?

YTM? More like TYSM! This was an excellent video; thanks for sharing.

What if I'm trying to calculate annual payments instead of semi-annual payments?

just multiply it by 2 and u get the annual thing

Sorry it's too deep for me. I'm shopping for a municipal bond. It says Current Yield = 4.966%, Yield to Maturity = 2.037%, Yield to Worst - 2.037%. If I buy the bond now and hold until maturity, I will get the 4.966%, right?

Yeah. But the returns are comparative values. For example, you might get better returns than this with some other bond after one year. At that time, this 4.966% will not be a good return.

Isn’t this formula for approximate YTM ?

Do you mean I can make profit if I buy lower than face value from stock market and hold to maturity?

Yes. However bonds trading below par are higher risk. Skilled distressed debt investors do very well.

❤👍🏿

How did you get 5 % profit

250÷1250)×100%=20%

So why would I buy a bond at a premium price?

I guess it would depend on the current bank interest rate/rate of inflation. If the interest rate in a savings account is running at 1% but a bond had a YTM of 3% you would be taking on more risk but get a higher return. Plus you have the potential of selling the bond on the secondary market and potentially making a profit if you did not hold to maturity.

You're already going wrong at 20 seconds in. Consider the following facts, (A) and (B).

(A) At 00:17, you say it pays "semi-annually", that means "two payments per year".

(B) Five seconds later you're saying "You're going to receive 5% payment each year, so it means in the first year you receive 50 dollars".

(A) and (B) together are at the very least ambiguous (it's not clear what is meant), and possibly contradictory.

Try to be clear in your explanations, and avoid confusion.

If the compounding period or pay period isn't stated it is always paid semi annually 1000 x 5% is 50 , 2 pays of 25

Just in 2 years, bonds being sold in price less than face value is a norm lol

Nice to know

still confused. Why we divide numerator by 2?

he did semi-annual payments

If you are talking about the APPROXIMATION, formula, he actually divided the bottom part, which is called the denominator rather than the numberator as you stated) , by 2 in the approximation formula. The reason he did this was that it was an APPROXIMATION formula, and he is just taking the AVERAGE of 2 TWO things, the face value of the bond and the Price you paid for the bond. ( ( FACE value plus PRICE you actually paid) divided by 2) is sort of an approximated, or estimated amount). I hope this helps.

bil

Screw Christ. I'm just kidding.

this is wrong

This video is so bad it only tells you how to calculate it without telling any definition or relationship. He didn't even tell us what's YTM. With this kind of teaching I may as well just plug everything in the formula and save 12 minutes

NOT HELPFUL