Bond Prices And How They Are Related To Yield to Maturity (YTM)

Вставка

- Опубліковано 9 лис 2022

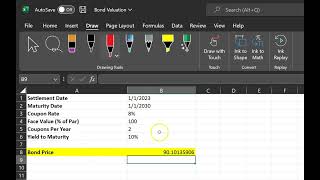

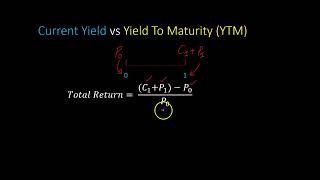

- In this video, you will learn how to calculate the price of a bond. In the process, you will also learn what is meant by a bond's Yield to Maturity (YTM), and why bond prices and yields are negatively related to each other.

This video will also help you understand why/when some bonds trade at a discount (i.e. at a price LESS than their face value), why some trade at a premium (i.e. at a price that is GREATER than their face value), and why some trade AT PAR (i.e. at a price EQUAL to their face value).

Finally, and perhaps more importantly, after watching this video you will clearly understand the distinvtion between a bond's coupon rate and its YTM.

Students will particularly find this video useful in understanding parts of Chapter 8 (Interest Rates and Bond Valuation) of Corporate Finance by Ross, Westerfield, Jaffe and Jordan.

WHAT A CLEAR WAY TO TEACH.....................GOD BLESS YOU!!!

That’s very kind of you. Thank you!

Clearest explanation of this I have seen yet, and I've been bouncing around multiple videos, audio books, etc. Thank you.

Very clear and concise explanation. Thank you Ikram! I'm a PG student trying to get into finance and this helps. Looking forward for more such videos

God bless you professor, very clear explanation 👏

This is a very good video. It is clear and avoids ambiguity (which other videos and explanations about these concepts often do). Keep up the good work. The way to go is simple and clear.

I have been struggling with this for months. Thank you so much for making it clear

Thanks so much, your explanation is so intuitive and clear.

Thank you so much for explaining everything in detail.Keep up the good work !

you are my FAVVV TEACHERR, THANKYOUSSS

Thank you so much for the clear explanation!

Great video, thank you so much.

the best explanation i have heard, and trust me, i have watched A LOT of videos thank you so much!!

Awesome explanation! Thank you very much!

Awesome stuff! Thanks Ikram! Can you also please make your magical video on the hypothesis testing and Jarque-Bera Test when you have chance?

priceless!!!

Great Explanation

fantastic video. This helps a lot

Thanks for educating us sir

thank you so much for those clear explanations, IN CRE DI BLE teaching skills.

great video and appreciate it

Excellent content

Legend

Amazing

Thank you so much. could you create a series of videos about a topic of analysis of financial statment, please?

Thank you! I do have a couple of videos on some ratios, but will make more and in the form of a series. Thanks for the suggestion.

Thanks

Good video! I have a question when the rr increased to 10% the value of the Bond became 877, and when It decreased to 6% It became 1147. Even tho the rr changed by the same amount, the price didnt change by the same amount. 1000-877 = 123 dollar price change, and 1147 -1000 147 dollar price change. Is this due to positive convexity in the Bond?

Great question! Yes, bonds vary in their sensitivity to changes in interest rates, and yes it has to do with convexity. You should look into “bond duration” which somewhat captures these ideas.

How do you determine the investor's required rate of return? Is it the next best available rate of return on an available safe asset, or maybe fed rate?

Required rate of return is always the next best rate you can get on asset of EQUAL risk! Not necessarily the fed rate.

can we say that YTM is equal to discounted rate ?

Bingo! That is exactly right! 👌

@@professorikram no that is not right at every point.

amazing explanation