Relationship between bond prices and interest rates | Finance & Capital Markets | Khan Academy

Вставка

- Опубліковано 27 вер 2013

- Courses on Khan Academy are always 100% free. Start practicing-and saving your progress-now: www.khanacademy.org/economics...

Why bond prices move inversely to changes in interest rate. Created by Sal Khan.

Watch the next lesson:

www.khanacademy.org/economics...

Missed the previous lesson? Watch here: www.khanacademy.org/economics...

Finance and capital markets on Khan Academy: Both corporations and governments can borrow money by selling bonds. This tutorial explains how this works and how bond prices relate to interest rates. In general, understanding this not only helps you with your own investing, but gives you a lens on the entire global economy.

About Khan Academy: Khan Academy offers practice exercises, instructional videos, and a personalized learning dashboard that empower learners to study at their own pace in and outside of the classroom. We tackle math, science, computer programming, history, art history, economics, and more. Our math missions guide learners from kindergarten to calculus using state-of-the-art, adaptive technology that identifies strengths and learning gaps. We've also partnered with institutions like NASA, The Museum of Modern Art, The California Academy of Sciences, and MIT to offer specialized content.

For free. For everyone. Forever. #YouCanLearnAnything

Subscribe to Khan Academy’s Finance and Capital Markets channel: / channel

Subscribe to Khan Academy: ua-cam.com/users/subscription_...

![[실시간] 전철에서 찍힌 기생생물 감염 장면 | 기생수: 더 그레이](http://i.ytimg.com/vi/4nkFvwxGAfA/mqdefault.jpg)

Kahn helped me back in high school; now he’s helping me navigate the markets. Can’t get rid of this guy.

Haha, great comment!

Sameeeee. A big help in navigating and understanding the market concepts which I should have learned in school.

Hey I'm just curious, how has investing been going?

@@PunmasterSTP horrible lmao nassy falling 3% everyday

@@A2Cap By nassy do you mean Nasdaq? Yeah I agree things might not be the best right now. But just like you can sail into the wind, I would suppose that bear markets can present their own opportunities…

Thanks for explaining the SVB issue 9 years ago. Makes sense

Exactly why I came... So I could get a better understanding of what happened❤👍

hehe

SVB brought me here 😅

Hi, thank you so much for the video Sal!

I would just like to add on in case anyone was struggling to make sense of the inverse relationship between interest rates and bond prices like I did. You can think of it as the following scenarios:

1) If interest rates in general fall, the bond's interest rates become more attractive, so people will bid up the price of the bond.

2) Likewise, if interest rates rise, people will no longer prefer the lower fixed interest rate paid by a bond, and their price will fall.

Hope this helps :)

thanks!

Thank you

Still don't get it

This cleared it up for me. Thanks for the finishing touch kind sir!

Hi Derek,

Can you please explain what do you mean by interest rate here?

Older bond will trade-at-discount-to-par ( ie older bond price falls) , when interest rates rise (for newer bonds)

Older bond will trade-at-premium-to-par ( ie older bond price rises) , when interest rates fall (for newer bonds)

So hypothetically does that means that we should buy bonds when the interest rate is the highest as one can profit from rising bond price when interest rate comes down ?

@@kingwoo1900 Exactly. I think like in this way too

I don't know why I go to school. Why is it so much easier for me to learn from Khan Academy? ?!?!

and free

He knows everything. Just love Khan Academy

Is this the smartest guy alive ? How does he know every concept

Julian Hilgemann textbooks + genetics + will

@Donald Borum is that hard

@@ITALIANO0110 obviously! Extremely difficult. Also, requires a lot of hard work.

@@DaBestAround sorry i meant MIT is it harder than other unis

He was a Portfolio Manager at a hedge fund

Great teacher, thank you for contributing !

Best explanation available! Thanks a ton!

Finally somebody's able to put it in language I understand. Thanks!

Thanks a lot for making this one! Just in time too, got stuck on my financing course and you pop up some videos.

amazingly clear explanation. Thanks so much

Boom! Thanks. I now know more about economics than Janet Yellen!

Love it ! Finally now i get it ... also watched bonds explained . I have no finance education backgroud but i am now in the mortgage industry and i can definitely benefit from this !

I've slowly invested more into bond funds as central banks slowly cut interest rates since late 2018.

@@nagasako7 I came across your comment and was just curious. If I might ask, how has your investing been going?

Thank you so much! Was really helpful :)

Very well explained, what could take someone hours in the library to understand, you do that in 13 minutes, thank you very much.

I loved your explanation. This made sense to me.

Thank you very much. This video helped me to get the understanding of Keynes' Speculative demand theory of money.

This was the best video that explains the relationship between Bond and interest rates in a simple term so that one can understand.❤

This explanation is a God sent explanation. Well done!

Exactly the kind of lesson I was looking for. Thank you.

That was really useful thanks. I understood it before, but this was so clear and concrete.

This is REALLY applying to what’s happing today. Glad it showed up on my UA-cam feed.

Super clear simple explanation in the most profound way.

Thank you so much for the explanation! Really helped me!

Each time I see you, I get light from your eyes.

Simple and straightforward explanation, thanks.

Thanks for the great video and I'm glad you showed the math.

THANK YOU. It took me over a half dozen videos to find this one that makes sense of this insanity. It shows the relationship in real numbers.

The best video you can find on UA-cam about the relationship between interest rates and bond prices.

Hands down the best explanation of bond price fluctuation with an excellent mathematical demonstration. Thank you so much.

Perfect explanation! Thank you

Wonderful explanation. Thank you so much for this.

Kahn is great and Sal is a good man

Sal u are doing a great and appreciable job...

The Federal Reserve's intention to raise interest rates until inflation is under control is still viewed with skepticism by the markets, even if bond yields are rising while stock prices are falling. What is the best approach to profit from the current down market while I'm still considering whether to sell the $401,000 worth of stocks I own?

If the market has taught me anything, it's that it typically makes a comeback, but I can't seem to focus on the long term, particularly because crucial factors like my retirement and my reserve are having a devastating influence on inflation. As soon as is practical, I need a solution and a data trajectory that I can trust.

One of the primary reasons I utilize a portfolio coach to oversee my daily investing decisions is that their whole skill set is centered on trading long and short at the same time, utilizing profit-oriented techniques and minimizing risk as a hedge against unforeseen events.

@@alexanderjames3043 Due to the significant falls, I need advice on how to rebuild my portfolio and develop more successful tactics. Where can I find this teacher?

@@AnthonyHart34 In fact, I'm not sure whether I'm permitted to say this, but I'd suggest searching for "sharon lee casey" as she gained a lot of attention in 2020. She is both my coach and the manager of my portfolio.

@@alexanderjames3043 She has excellent credentials and an outstanding occupation. Hence, I swiftly copied Sharon's whole name and typed it into my browser. I'm curious to discover why she is so busy, and despite the fact that she has unquestionably good credentials, I nevertheless schedule a meeting with her.

Brilliance man. Really thank you ❤️

It's usefull and simple to understand. Thanks.

Please keep doing lessons like this ;)

Explained very well. Thank you.

now the real question is where can i find that 15% coupon bond lol

ANGL junk bond etf

I would even take 10%

@@dantheman4011 I would even take 5% given that currently, the interest rate on 30 year US bond is 2.34% & 1.6% on a 10-year bond.

@@ronniebine1325 which barely covers inflation.

@@dantheman4011 Inflation will shoot up soon as theres no chance that FED can reduce it's balance sheet. Gold is on the way to shoot to the moon.

thank you, perfect!

His writing is so pretty 🤩 every symbol is perfect!

Thanks for the video!

This was good. The examples were awesome. Thank you

Great video I finally get it thank you so much!

thank you so much that was helpful

Thanks Khan Academy! You saved my finance class :P

Thanks Sejal! That tought me in 12min. what would have taken hours to learn in finance textbook research.

Great Explaination! thank you

This is perfect. Thanks!

Huh. Good explanation. Definitely found that helpful.

Beautiful!!🙌🏾

This video is a gem!

Thank you, super helpful!

Finally got that from you !! thanks much

Khan academy is actually the goat. I’ve been using Khan for over 5 years now

Bond prices and interest rates? More like "Better and profound information that's great!" Thanks for everything you do Sal.

Thank you so much Sir for this explanation. You are helping alot of people out here.

Quantitive easing makes sense now. Buying bonds increases their value thus bringing down the yield!

Thank you so much!!!

Thank you for the video. It was easy to understand and informative. Thanks. 감사합니다!

Sick calculator. Nicely explained aswell.

Thank you so much:) I love that you have the subtitle in the video

Sal, awesome video.

thank you, very clear

It helped sir.

I was stuck in economics for 3 constant days.

Thanks.

Thanks for the video. I believed that with interest rates going down it would want to drive bond holders from bonds and elsewhere due to the low yield, I guess it is true with bonds with variable rate.

Never thought Id watch another Khan Academy video again in my life.

You don't know what you are missing

Amazingly well done.

thank you so much for this one

Now that's a saver! Thank you 😘

Simple , and accurate

Thanks for saving my life ❤

Perfect. Thanks

Awesome video! Thank you!!!

Very good and easy explanation. Cheers.

Yes, it was amazing thanks!

Very lucidly described.. thanks.

I just the way u explained… simple terms n clearly …

i am happy

Know what your thinking

Shambhu Neupane: Yes, anything which is not too out of my control I am happy with my knowing this is not a chance game like the stock market, or worse, an individual stock. When you touch it, especially a rising market, there is no guarantee that it will do what you desire. Bonds are not a "greedy" vehicle. These are a nexus to the sound rewards it provides.

Great video!

Beautiful explanation

Great explanation !

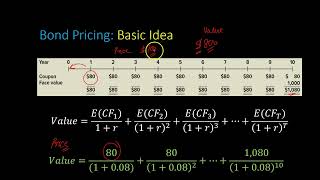

What a brilliant way of explaining the present value of a bond using discounted cash flows, without even introducing it as an NPV of a bond. This inductive reasoning is brilliant.

PV of Zero Coupon Bonds= Bond's Price/(1+R) where R= Coupon Payments

PV of Normal Bond= Bond's Coupon payments/ (1+R)^t +Bond's Principal/ (1+R)^t

t= number of years

Every time the interest rate, or discount rates, increase, the price of a bond, or its present value decreases.

We also have to distinguish between:

Current Yield= Annual Coupon Payments/Current Market Price of a Bond

Yield to Maturity= [Cash-Flows + (F+P/Number of years to Maturity) / (F+P/2)

where F: Face Value of a bond

P= Market Price of a bond

When the credit issuers are solvent and there's no or every small change of default, then there bonds' yields are lower while their prices are higher. This is because they will most likely pay their debt obligations.

That's the reasons economically-weak countries like Greece, Spain, Portugal and Argentina offer very high yields on their bonds.

In other words - staking shitcoins

Well explained here, i now understand better

Great explanation. Thanks

If i have a teacher like you i never feel finance is difficult from nepal😭😭😭😭🇳🇵🇳🇵🇳🇵

Thank you very much, very helpful ❤️

i need this now

people at Khan academy are such good teachers

very helpful. thank you

Very well explained!

Loved this♥️

Finally, I get it! Thanks!

you are my saviour

Understood. Well explained

Thank you sir!

나도 미국에서 수년가 칸아카데미 이용했던 사람으로서 이 칸 선생님응 진짜 존경한다. 미국은 달라... 이분은 공짜 무료 로 이런거 갈키는데 거의 창시자임... 미국이어서 가능 한국에서는 절대 불가능... 대학교육만 봐도 미국대학 근처에 한국처럼 술집 번화가 자체가 생겨날수 없음 그냥 닥치고 아닥하고 공부 ... 기본적으로 전문대 강사라도 해도 미국에서의 교육에대한 자부심이 쩔고 .. 내대학의 경우도 통계교수가 얘기했던게 우리가 미국에서 티칭 스킬이 10위권이다 올해는 14위로 내려갔다 이러면서 점수를 안주려고 하지만 학점에 관계없이 어려워도 이런 교수들 만나 의미있는 교육 받고 공부했다는거에 자부심이 든다. 이 칸 선생님때문에 인도사람들이 더욱 친근해지고 조아졌었징 똑똑합니다 진짜 수학 25구구단이었던가 25진법인가 까지 외우는 나라. 한국은 진짜 달라져야돼 자기 밥그릇만 챙기면 더이상 미래가 없음. 공무원 마니 뽑지 말고 중소기업 마니 뽑아요

love u khan... u r always awesome

Great work!!