Coupon Rate vs Current Yield vs Yield to Maturity (YTM) | Explained with Example

Вставка

- Опубліковано 11 тра 2024

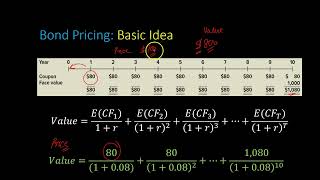

- In this lesson, we explain the coupon rate, current yield, and yield to maturity (YTM). We go through the coupon rate formula, current yield formula, and the yield to maturity formula. We also explain the difference between the face value and the market value of the bond and their relationship to the coupon rate, current yield, and yield to maturity (YTM). We go through examples of calculating the coupon rate, current yield, and the yield to maturity (YTM). We also show how to calculate the yield to maturity using excel.

Check out other straightforward examples and business-related topics on our channel.

We also offer one-on-one tutorials at reasonable rates as well as other accounting and tax services. Email us and/or visit our website or FaceBook page for more info.

Connect with us:

Email: info@counttuts.com

Our Website: Counttuts.com

Our Facebook Page: / counttuts

Support our Efforts: paypal.me/counttuts

with you im actually learning to understand, thank you

amazing video, thank you so much, I appreciate you going step by step through the equations

Excellent presentation along with the formula. Easy to understand. Thanks.

excellent and much better than my finance lesson at university and text book.

Good explanations. A very helpful next step would be a video of you shopping for bonds, explaining what attributes you look for vs what to avoid. Thank you.

The visuals are so good at 13:31. This panel should be the standard for quick explanations.

Thank you so much; it is an excellent explanation that is very helpful for my upcoming exam.

Thank you so much. It is helpful indeed.

This is exactly how I want to be taught!

Excellent work sir ❤❤

Thats awesome bro

This was helpful

Thank you🙏

excellent

thank you

Too good

Excellent video 👌

HP 10bII+ Video?

is the face value of the bond same as the yield to maturity ?

What is the calculator links

how 11.28 % but if u normally calculate it with face value of 100rand, then 10% for 5 years 50rand will be the interest right?, so 50% is the return but how 11.28%?