Zero Coupon Bonds: Pricing and Yield to Maturity (Using Excel)

Вставка

- Опубліковано 26 гру 2022

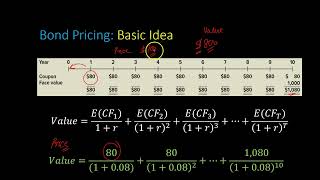

- In this video, I explain what zero coupon bonds are and how their prices and yield to maturity can be calculated using Excel's =PV, =IRR and =RATE functions. After watching this video, you will understand why zero coupon bonds are also commonly referred to as "deep discount bonds".

Students will particularly find this video useful in understanding parts of Chapter 8 (Interest Rates and Bond Valuation) of Corporate Finance (13th Edition) by Ross, Westerfield, Jaffe and Jordan.

The best explanation for bonds & using UA-cam to make this learning experience affordable & easily!

Loving this channel

would suggest you calculate it normally on a plain page without the sheet

Why when i calculate the YTM normally using YTM function the result is 13% ?

Sir, you are a legend 💪

What about if a have 100 k to invest and I want to know how much I will get pay till maturity