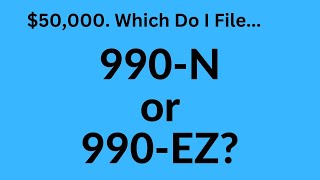

Get Help Filing IRS Form 990-N for Nonprofits

Вставка

- Опубліковано 4 лип 2024

- www.nonprofittaxguy.com Does your small nonprofit organization need to file a tax return and you are not sure what form to file? Information in this video can help you determine if your organization might be eligible to submit the Form 990-N electronic postcard. I also invite you to contact me if you need help filing.

![Lp. Последняя Реальность #97 ЧЁРНАЯ МАТЕРИЯ [Анти Скинт] • Майнкрафт](http://i.ytimg.com/vi/k4MjXCzKsYw/mqdefault.jpg)

Thank you for sharing this information in your videos. the information you provided is clear and helpful. Much appreciated!

Hi Dave, your videos are great. I have filed schedule C 1040 for our DBA for 8 years, but we just incorporated our 501(c)(3) in June 2020. We have our EIN# and our tax exempt status from the IRS dated 5/29/2021 but is effective from our incorporation date of 6/17/2020 with an accounting period ending June 30. We only received about $38,000 in revenue the first 1/2 year from June to December, 2020 and didn't file 990N. Now we are ready to file 990EZ as our revenue is about $96,000 from January to December 2021. Do we (can we) file 990N for the last half of 2020, or do we have to stick with an accounting period ending June 30? Do we have to wait until July 2022 to file 990EZ from the accounting period of July 1 2021 through June 30 2022, or can we file a calendar year from Jan to Dec?

This is great and thanks so very much. How can one reach out to you, in the case for additional support?

Click on the "Contact" link at the top of this page: nonprofittaxhelp.podia.com/

I have my brother who opened a non profit company but now he has to get his EIN, my question, he still has to prepare to apply for his EXEMPT, but he says he will wait a bit, my question is:

WHAT FORM DOES HE HAVE TO FILL IN THE TAXES HAVING THE COMPANY AND EIN BUT DOES NOT HAVE THE EXEMPT, AND HE IS ALREADY OPERATING IN THE CHURCH AND CARRYING OUT ACTIVITIES AND THERE ARE MONEY AND EXPENSES.

WOULD IT BE THE 990? BECAUSE WHEN I ENTER SECURITIES, I GET ALL ZERO TO PAY

Elena, an organization has 24 months from the day it was incorporated with the state to apply for tax-exempt status. During that time, it still has an annual filing requirement with the IRS. If total income for the year is $50,000 or less, it is probably eligible to submit the Form 990-N electronic postcard. The organization MUST have an EIN before it can file a return and before it can apply for tax-exempt status. However, it is not illegal for it to operate without an EIN and without officially having its tax exempt status recognized by the IRS. However, be aware of state charitable solicitation registration requirements. If the organization intends to continue operating, it should go ahead and get an EIN from the IRS with Form SS-4. Before it can submit a 990-N, it will have to call the IRS at 1-877-829-5500 and explain that it needs to submit the Form 990-N but it has not yet filed an application for tax-exempt status. The IRS will create a computer record of the organization so it can file. This can take a few months. There is no monetary penalty for late filing a 990-N. www.irs.gov/charities-non-profits/form-990-series-which-forms-do-exempt-organizations-file-filing-phase-in www.irs.gov/charities-non-profits/annual-electronic-filing-requirement-for-small-exempt-organizations-form-990-n-e-postcard

Thanks for the information David. Does 990-N consider net asset amount?

Bruce, there is no asset test for determining eligibility for submitting the 990-N.

Hi, I been thru all the videos following everything. Question? on Schedule A, since the nonprofit is private there is nothing to write on the form except name and EIN. Is this correct? I'm doing the 990 EZ and it's A PRIVATE FOUNDATION.

A private foundation must file a Form 990-PF, not a Form 990-EZ. Schedule A is not applicable to Form 990-PF. www.irs.gov/charities-non-profits/private-foundations/private-foundation-annual-return

@@NonprofitTaxHelp Ok, I will check this out Monday morning.

Can I just file the 990 N? There has been no income just all zeroes in the prior years. 2018 just got $10,000 and thats it. I worked all day yesterday on the 990 EZ then I had to do schedule O, Schedule A, and Schedule B. Not quite thru. Ok I remember now 990 N is not for private foundation.

Correct. A private foundation cannot file a 990-N. A form 990-PF does have a schedule B though.

@@NonprofitTaxHelp I wasted 3 days last week listening to your videos and learned how to do the 990 Ez. But come to find out the 990 PF can't be done on EZ, right?Now you don't have any videos on 990PF. I am doing it for someone. Should I buy some software and do interview?

@@NonprofitTaxHelp We only talking about $10,000

I noticed there are a lot of charities that are a year old and show no report gross or income is that normal?

Yes, that is fairly normal. It's a lot harder to get donations than people think when they start a charity. Many never raise any donations from the public at all and end up folding. Sorry for the late reply.

@@NonprofitTaxHelp Thank you for your answer. But there seems to be a youtuber that has admitted they raised 23k in donations using their superchats and merch sales to fund the charity under a christian charity while doing true crime. Claiming his true crime channel is under the christian charity.

@@btim9974 It would be perfectly legal for the youtuber to do that. As long as the income is $50,000 or less, there is no financial reporting required with the IRS. The only issue I see is whether the superchat donations would be considered charitable donations, or payment for the true crime entertainment being provided. If the latter, it is possible the "donations" could be taxable. True crime merchandise sales could be taxable. But I don't know the facts and that is some rather wild speculation. If you aren't comfortable that the money is being used the way it is represented, don't donate. Other donors can decide for themselves.

I can't even figure what line to put the 10,000 grant on.

Which form are you filling out? 990-EZ or 990-PF? Is this a grant you received or a grant you paid to another organization?

@@NonprofitTaxHelp It's the 990 PF . I learned to do the 990-Ez from you last week.

1111