Order Flow DOM Trading. Catching The Edge And Icebergs

Вставка

- Опубліковано 12 вер 2024

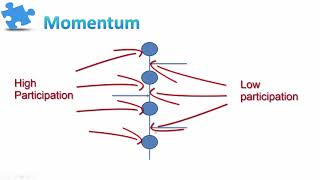

- We discuss two methods of taking advantage of the order book to gain an advantage in your entries.

Click "Join" to become a channel member and gain access to the Elite Indicator Package. More information at: www.speculators...

Please check out the below affiliate links. The channel gets a commission from affiliate links, and that goes into making better content for the channel.

Jigsaw Daytradr Independent affiliate coupon:

members.jigsaw...

Journalytix subscription affiliate coupon:

members.jigsaw...

FinancialJuice News Squawk Affiliate Link: rl110.isrefer....

Get your TRADERS GONNA TRADE mug: merch.streamel...

SpeculatorSeth on TikTok:

/ speculatorseth

/ realstockmarketsteve

SpeculatorSeth on Facebook: / speculatorseth-3670308...

Order Flow: / 421730445190982

Treasuries: / 983601728692661

Permanent Livestream URL: / speculatorseth

Join our discord server! / discord

Become a subscriber to my patreon campaign for exclusive indicators and data!: / speculatorseth

Open a free FDIC-insured savings account with Yotta! Every deposit helps you save money while entering you in our weekly sweepstakes with prizes up to $10 million. Use referral code SPECULATORSETH and we’ll both get 100 tickets automatically entered into next week’s drawing! : withyotta.page...

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

www.speculator...

Love the chalkboard set up. Feels like a lecture and gets me into learning mode.

I'm hoping that once some of our new gear comes in we'll be able to use it more often. Maybe even during stream

The content and your teaching are excellent. Subed to channel. Thanks a lot for your effort !

You mentioned making entries based off of larger edges. Could you make a series talking about examples of larger edges in further detail? Maybe a video or series on Seasonal Effects? I like how you teach things. Thank you for what you do!

Such edges are often based more on the current market. So a lot of this is more about reading lots of news etc. In the later half of the year I'm hoping to have more time to focus on current market macro analysis.

@@SpeculatorSeth I'm looking forward to it! Much love

True. Nice vid by the way. Looking forward to the next one. Add more cool examples and animations. More video angles, more voice effects.

A 50% win rate still equals losing money on commissions doesn't it? What am I missing here? Thanks for your videos!

Amazing information

These videos are golden, thank you Seth!

Question. Regarding your example in the video, when the iceberg is eaten up (causing a level to break on the charts) and price jumps up and runs the buy stops of the iceberg seller, causing price to jump up even further and then runs out of buyers...is that whats actually going on when we have failed breakouts?

It's certainly possible to see icebergs followed by false breakouts, but not always. But when it's mostly just market makers trading amongst themselves the tendency will be to mean revert.

IDK, maybe I am wrong, but this looks more like a video to show how much he knows than to actually teach anything.

I really enjoy your videos and the common sense way you explain things. However, if I come in with a market order of 500, why would that be bounced over to the bid column? I did not place a limit order for 500, it was a market order. So why would it be stacked up on the other side as though it was a limit order?

Hi man, where did you buy the led panel?

Thanks!

I made it myself using a rasberry pi and led matrix kit from adafruit.

How can you catch an edge if you are competing against bots that trade arbitrage in nano seconds?

How do I get to learn what moves the futures market like the /ES? What topics should I look up ?

Try reading a study called The Inelastic Markets Hypothesis by Gabaix and Koijen

Hello Seth, you mentioned trading with the Iceberg and placing a limit order. But aren't icebergs hidden? How would I know where to place the limit order if I don't know where the iceberg is?

Sometimes you can anticipate where they'll be, but generally you only know it is an iceberg because a portion of it already traded revealing the refreshing. It often takes several minutes for the big ones to fill so you have time to see it.

What is the math were you talking about when you said the queues will settle?

This subject is covered in Markets Under The Microscope by Jean-Phillipe Bochaud. To be brief the larger the queue is the higher the chances are of seeing an order cancel. There are points at which these forces cancel each other out, and that's why the queues in level 2 tend to stabilize around the same amounts.

WHERE IS THE ( DOM )

Where have you been all my life....lol