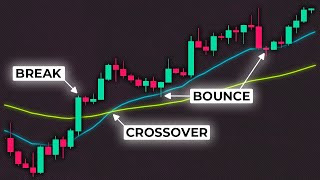

10 SMA + 20 SMA with 200 SMA | Swing Trading Strategy | Moving average Crossover

Вставка

- Опубліковано 22 чер 2022

- 10 SMA + 20 SMA with 200 SMA | Moving Average Trading Strategy | Moving average Crossover | swing trading strategy

Comment down your suggestions & suggest videos that you want to watch.

Let's build an interactive community of traders🔥.

📈Follow our Blog website:

fortunetalkstrading.blogspot....

🤯Follow us on Instagram for smart infographics and shorts😎

/ fortunetalks

🚀Follow us on our other youtube channel, for Hindi videos:

/ @fortunetalkshindi

I am not a SEBI registered analyst. All videos on this channel are strictly for educational purposes. The channel will not be responsible for any personal losses whatsoever.

We don't provide any paid courses or Trade Signals. We don't have a telegram group or Twitter account.

#fortunetalks #movingaverage #shorts

![ПОЛНАЯ ИСТОРИЯ ЭКЗОРЦИЗМА [Топ Сикрет]](http://i.ytimg.com/vi/qBySr6Bt0B8/mqdefault.jpg)

![🔴 [86% Win Rate] 1 Minute EMA SCALPING Strategy - NEVER LOSE AGAIN](/img/n.gif)

Price action course full Playlist:

ua-cam.com/play/PLU9f1fTtAn5oZxHxZVa50-myUJfohUGt9.html

Chart patterns Course Playlist:

ua-cam.com/play/PLU9f1fTtAn5rCgq2tCbpaJkEru3bzxF7x.html

Supply & Demand Course Playlist:

ua-cam.com/play/PLU9f1fTtAn5qSOuwkc5PT0STeLF0mW8Ur.html

Technical Trading Playlist:

ua-cam.com/play/PLU9f1fTtAn5r0om7hq7nhRs45kzSBZMcl.html

Open an account with My Brokers:

Zerodha : bit.ly/3IyZF4h

Finvasia Shoonya (Zero brokerage) : bit.ly/3CuZfIk

My Money Apps:

Zerodha Coin (SIP) : bit.ly/3WbA9W9

INDmoney (US stocks) : bit.ly/3GR8FRd

Smallcase (All weather investing) : bit.ly/3CA7suW

My Gadgets:

My laptop - amzn.to/3jZhlMc

My chair - amzn.to/3WWZswc

My Microphone - amzn.to/3VWGWCR

My Trading Journal - amzn.to/3iidYjb

Useful Book Links:

20 Favorite Finance & Self Help books - bit.ly/3Ze1R78

My favorite Trading Books - bit.ly/3Qrlox0

My Trading Favorites:

For Options Paper Trading - neostox.com/sign-up?m3=8e7087e66b42

For Investing (Screener) - www.screener.in/

For finance news & Updates - www.moneycontrol.com/

My online presence:

UA-cam(English) - ua-cam.com/users/FortuneTalks

UA-cam(Hindi) - ua-cam.com/channels/tL3HNi_QbOMUKjX00sENzw.html

Instagram - instagram.com/fortunetalks/

Wait for a pullback after the cross don’t just take the cross!

that's what he said in the video

How to identify valid pullback

@@1111abhijeet retracement that doesn't go beyond 50% beyond the impulsive wave.

@@AriesWarlock can you make video on this

@@AriesWarlock how many candles required for pullback ? 1,2 or 3?

I like the 20+50 ema on the 15 min chart

Stock ?

Real trade experience with emotional control

Good clip, most wouldn't know where the trend starts or ends nevertheless a bullish or bearish crossover. Two thumbs way up 👍

This strategy is a simple one

yess it is !!

All strategies look simple but in real markets are hard

Some traders use the 8 EMA, they call it "T-LINE".

Yess true 👍🏽👍🏽it works to much times

yessss it iss !

What time frame is better

Informatief. Het is triest dat veel mensen hun kapitaal verliezen door gebrek aan kennis van het vak of gebrek aan discipline. Dit was mijn geval totdat ik de heer Gerard stuks vorig jaar op een conferentie ontmoette, het is nooit te laat om te beginnen.

Het is mogelijk om winst te maken met handelen en beleggen als je de juiste bron volgt en een mentor hebt om je te adviseren over de te nemen stappen en acties. Ik doe ook mijn investeringen via het Gerard's platform en het is zeer gunstig voor mij geweest.

Ik besloot toen ik veel getuigenissen van verschillende investeerders over Gerard stuks begon te zien, ik besloot hem eens te proberen en zie, hij was degene naar wie ik al die tijd op zoek was, handelen met hem was zo lucratief, leerzaam en winstgevend.

Kun je me de contactgegevens van Gerard geven?

Hij is actief op Telegram.

Gerardstukes is zijn actieve tag

Only Tarde in the direction of trend

Wait for Rsi to cross 60...

For a powerful breakout...

whats the RSI settings, on default it's on 14

Rsi 14..

Default.

Works best on weekly, daily, 4H

@@sarupsagar5805 thanks for sharing

@@sarupsagar5805 tell me please how to use the stochastic rsi with the moving average?

Just use 1) RSI

2) Moving average 8, 20, 50, 100

3) wait till all these MAs are lined up in sequence, on top of each other.

4) Buy when Rsi crosses above 60.

5) you can also tweak the strategy according to the volatility of your trading instrument.

Sometimes these are lined up in a compressed state...

6) one can buy once Rsi crosses 60 ,

7) I use these criterias in a scanner for stocks. ( daily time frame)

8) have got good results

9) for short , wait till rsi cross below 40

Hi, how about day trade on 1hr timeframe?

For 1:2RR doesn't deserve this swing strategy. 😅

Right and awesome. 🎉🎉🎉🎉

شكرا❤

Which time frame

I heard 13 ma cross 48 ma works great too Chris S. Strategy

I've been trading the 13 and 48 on the 5 minute chart, and I like it.

Tell Time frame for Japanese candlesticks pls

Why 4h 1D? Can't that same be applied in a lower time frame?

Very good I use

Does it work? Accuracy?

Is there any scanner to find the stocks for this strategy?

Time frame to trade👉 : ua-cam.com/video/47uBYwH9yCk/v-deo.html

Thanx

but how we sell in swing?

Wait till chopy market

2 min this is how I trade futures

its working for you or not

@@mouadq4488 everyday

Working

😊

How profitable is this strategy?

8+20+200

Im using this strat with ema 10 and 20

😢Excuse me, is it profitable, please tell me

What time frame is best for intra day

5 min

but 15 min if you re beginner

What about when the crossover is down, but above the 200 ma? Or vice versa, an upward crossover but below the 200 ma?

You wouldn't enter a trade

i simply use breakout strategy...but it 's good to leave the trade FVG

Anyway to receive a alert on price move Above 200 SMA?🙏

It's very difficult to track on every day...😥😥

You can set alerts in tradingview. Just right click on 200 MA and 1st option is to add alerts. Set your alert accordingly. Hope this helps.

@@FortuneTalks This process is done in every stock chart? 😓

Any alternative way for free...😊

@@manishchaudhary56 Yes. Learn some beginner level python code and do it yourself.

@@dexter_hacks I don't know how it done 😔... But still thanks for such information.🙏

Please share screener also sir how to fine stock please guide

in sideways it becomes shitty

agreed. this works well on trending markets or stable. When the market becomes choppy you're going to lose many trades if you don't watch out

Correct. Could play Keltner or Bollinger bounces when that happens.

just gotta wait

Always wait on the pullback after the cross! If no pull back then you missed it get the next one! If pulls back and keeps going then you dodge a loss!

Use support and resistance and retest in Sideways or ranging market.

200sma + fvg

same with 14,20,200?

The sensitivity will reduce. Number of signals generated will also reduce. The entry will be late. The noise or randomness will reduce.

@@FortuneTalks it means better use 10,20,200😊

@@n92nie you can still use it if you are a conservative trader. Please backtest on charts to get more insights

@@FortuneTalks Anyway to receive a alert on price move Above 200 SMA?🙏

It's very difficult to track on every day...😥😥

@@manishchaudhary56

Use 4Hr chart

This works but u will need 3 things more

Which one's

U do swing trd??

@@sssldrago975yes😊

what is sma

Simple moving average

I'll try 20 and 200 much better

44SMA strategy is also good search it up

44 high and Low + 20 +200 ema best try it

@@RafiqSayyed-el2ls Slaam bro what does 44 high and low mean ?