Community input grid trader expert

Вставка

- Опубліковано 15 тра 2024

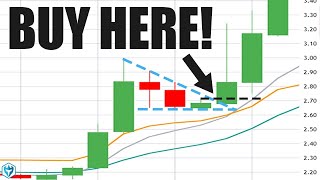

- As something of an experiment I want to see if community input can improve a simple grid trader.

Part 1 just builds the basic trader and I can show where there is a problem with standard grid trading.

Leave comments with reasonable suggestions for improvement that I can incorporate into later videos.

The next part will just make this MT4 compatible and some code improvement before later parts where I take your suggestions.

Looking for a broker? Support the channel by using this link. We receive a commission on your trades from the broker at no cost to you:

orchardforex.com/live-account

If you maybe want a prop account without the problems of meeting challenges (and help out Orchard at the same time) try

xrading.com/orchard-forex/

This code is on github

github.com/OrchardForexTutori...

Now coming from beautiful Port Macquarie - Розваги

Thank you for the nice coding👌💯

Plain Grid will always have high DD and may lead to blow the account eventually.

Following inputs may can reduce DD in my little knowledge

1) Make it one direction grid based on a high timeframe trend direction. Trade for only X$ profit/Y$ loss in one direction and wait for the trend to reverse to trade again. This will cause long days of no trading days. To avoid that, trade multiple pairs from same EA ( so that it can be backtested in MT5). To be honest, I think this will be the most profitable grid trading strategy I can visualize.

2) If you are not convinced with point number 1, you may consider modifying existing code with following inputs

2a) Enter trades with BUY STOP and SELL STOP pending orders instead of Fixed Grip Gap trades

2b) Option to close multiple bucket trades with breakeven or small profit

2c) Option to hedge the pair after x% DD on that pair and recover trades in losses with the profits from hedge slowly

3) Make grid trading module as a separate function which can be called in any other EA with multiple confirmation to enter the trade.

While in the middle of the range it would be a good time to clean up the outlying trades. Pair up a series of win trades to erase a large loss trade.

This is very exciting. Looking forward to seeing how it will develop. How about introducing a hedge mechanism? And perhaps also a smart martingale algorithm. Another thing to consider is closing old trades after certain amount of time. Maybe find a way to use the ATR, risking more when the ATR is high and less when it is low.

Glad you back, I like the new intro music so far 🙂

Glad you like it!

Thanks for this video. A way of improving ?

1-apply the entry after a pullback and put tp and sl

2- enter in the direction of other timeframe

3- close all trades when $X (or Y% of the account) is reach (profit or loss)

Excelent work, thanks. Improvement thoughts, button ON/OFF (enable/disable EA) and another button to close all EA orders. Thanks

Thank you for your comments on my suggestions. I understand your reasons, let me explain my explain why I did those suggestions. First I want to backtest an hybrid daytrading and scalping system, I have several EAs working at the same time and i cannot disable auto trading, and I wanted to use the Grid EA to hedge other EAs in their drawdown period, that's why I suggested a close orders all orders for this EA, of course I can do it manually but in scalping mode a second can change everything. Thanks again for taking the time to address my suggestions. Continue the excellent work.

Manual intervention is not a bad idea, often it is a good idea but I couldn't ru it through the strategy tester and there are already ways to syop the expert and close trades so I won't be writing code for this.

You can disable trading on an individual expert in the expert properties. But still, it can't be backtested.

I like grid trading too.

Glad to hear it.

I like grid trading too

Good to hear

This will be a very interesting exercise. Thanks

What about only taking trades in the direction of positive swap?

Base on how the buying and selling .

You would have to take in consideration of 3 daily candle and for price to be trading inside the 1st and 2nd candle range . So buying and selling would be in a consolidation using order flow chart ..

2. You can use order flow + Trend .

Where M30 and H1 timeframe Trend lock base on 5ema,8ema cross 21ema + Stochastic Indicator + RSI + MACD indicator histogram Bar cross cross signal line.

Then M5 timeframe Entry using the grid for entry !!

This is one of several that propose methods for setting a trading range. I'll see how many I can get through. M5 timeframe would be irrelevant for entries based on price movement.

Fantastic grid, it occurred to me to use for example a reverse RSI instead of entering a long position when the RSI is oversold, using it to prevent it from doing any type of operation.

Use it only when RSI is around between 35 and 65 of its value.

another interesting thing if I use a size of 0.01 for all operations when RSI is between 45 and 55 I would use a size of 0.02.

Interesting idea, I'll try that in one of the videos.

1- Having a target% and stoploss% of which stoploss% is a multiple of target. Usually 10 to 20 times more than target.

Then you must be in a market condition where the chance of success is 10 to 20 times higher than reaching a stop loss.

In practice it is not that bad because of the fluctuation in the price.

2- You start with a small percentage of your capital and average down/up when the market goes wrong.

3- Only trade at 1 hour and above.

I have already made one video with tp/sl and you can set the size as desired. Detecting the market condition would be the difficult part for this suggestion. How would you suggest doing that?

Averaging is a possibility, not sure when I'll get to that.

Timeframe is not relevant because trades are entered at price movement.

Hello, heres an idea to minimize the gap between balance and equity. Why not keep track of if you are in a range, uptrend or downtrend. Then if in a range, trade as you doing now. But ifyou are trending then change the grid width. You mentioned that conceptually its easier for you to code it as a grid for buys and a grid for sells. I'd take that further and say you actually have two separate grids. If you are in an uptrend then make the buy grid wider (e.g. 2x the sell grid) and if you are in a downtrend, then make the sell grid wider. This will introduce risk/reward into the equation. In an uptrend, you expecting bigger pushes up, so why not hold for longer, hence the wider buy grid.

That is achievable. How would you suggest to detect the trend

@@OrchardForex Hi, thanks! I think an initial (time-saving) step could be to create a wider grid for (say) uptrending market. Then run Strategy Tester in a section of the market that is uptrending and compare the wider buy grid with using equal grid sizes for buys and sells (as currently coded) in the same section of the market. If the results are better with the former (on a few different pairs' uptrends), then it would be worth turning attention to the problem of trend identification. And if not significantly better, then it saves the time of coding that when we already know it does not work, even with "perfect" trend identification. Much respect, love your work!

Hmm.. What do you think about buying at the low of the cancles and selling at the high? That way we do not keep with opposit positions I think.

How about a price range whose level is freely selectable and which is shifted up or down with the market price. As soon as the market is at the lower level, the upper open orders are closed and vice versa. As I understand the strategy, it benefits from the upward and downward movement of the market. A positive effect here would be that open outside positions would not remain in the market for long.

I have a number of similar suggestions, using a trading range. I'll add these into the mix.

First: You should add a grid multiplier. Second : instead of opening buy and sell individualy a waiting for each order to hit profit. They should be part of a basket of Buys and another of Sells so you can close the basket at a tp stipulated by user. (In that way if you have lets say 10 buy trades they will close on and average point and you will make profit because the ones at the bottom will cover for the loss of the ones at the top once the profits hit the user input). That´s all. 🙂 I hope my explanation is clear.

For grid multiplier you mean increase the size when new levels are created. Then close everything when there is an overall average profit. I can add that in, results will vary depending on the multiplier and target profit.

@@OrchardForex Yes, having a grid multiplier , meaning if the starting grid is 20 points, and the user has a by 2 multiplier then the next position opens at 40 points instead of the original 20 points the next one at 80 and so on. I do have an EA that does a similar thing. I have it with 2 independent cycles and grids, for buys and sells , ( althought I have found that it does works best if there is ony one cycle either buy or sell at the time, but that´s another history), with the grid multiplier, and also some kind or low risk martigale for the positions. Instead of the typical martingale that opens positions 1,2,4,8.... so you will find yourself in deep waters very soon. what i´m doing is the first 3 positions opens at 0.01, then the next 3 open positions in the grig if it goes against us opens at 0.02, the next 3 at 0.03, the next 3 at 0.05, then 0.08, 0,12, 0.32 etc. Basically streching the martingale so it is a bit more difficult for the market to cut with you. Also instead of using it on EU, I use it in AUDCAD or any similar pair that doesn´t get wild moves and have lots of corrective moves that will give you the chance to recover your trades. You´re right the result will vary depending of the multiplier and the tp. What i have is a very small tp lets say 0.75 $, because on this kind of strategies where you make the money is by been wrong meaning when price moves against you and you stack orders than will close at the average price. I hope it helps. ;)

Exit: save current Equity OnInit, also save it into MT4 global terminal.

In some point Current Equity will be bigger than your Global one, then you close everything.

I assume you mean continue trading as normal, opening and closing, but when equity exceeds starting equity close everything. I can do that but I would add equity exceeeds start by some amount, otherwise you will just keep returning to zero

Yes, i did that and worked, I added $3.66 plus to it. AccountEquity() > AccountBalance()+3.66. The whole thing as boolean. If it's true, close it all.

Hello sir Can you please create a video on how to separate buffers on mt5 indicators

I don't know what you mean by separate buffers. Each buffer has a number, already separate.

Hi family, please is there a way to code or have an indicator that detects the double Top or double Bottom? (Trained on horseback between 2 weeks) That is to say 1 top during this week and the other the week after. Timeframe H4

You can use zigzag indicator wave to identify equal Highs and Lows with ATR indicator

Maybe close all trades after trade session, midnight profit or loss !

I'll give it a try.