IRS Form 8824 walkthrough (Like-Kind Exchanges)

Вставка

- Опубліковано 15 чер 2023

- Subscribe to our UA-cam channel: / @teachmepersonalfinanc...

Please feel free to check out our article, where we've written step by step instructions to help you walk through this tax form! www.teachmepersonalfinance.co...

If you’re looking for tutorials for other IRS Forms that you can file directly through the IRS website, check out our free fillable forms page: www.teachmepersonalfinance.co...

Use Parts I, II, and III of Form 8824 to report each exchange of business or investment real property for real property of a like kind. Form 8824 figures the amount of gain deferred as a result of a like-kind exchange. Use Part III to figure the amount of gain required to be reported on the tax return in the current year if cash or property that isn't of a like kind is involved in the exchange. Also, use Part III to figure the basis of the like-kind property received.

Certain members of the executive branch of the federal government and judicial officers of the federal government use Part IV to elect to defer gain on conflict-of-interest sales. Judicial officers of the federal government are the following.

Chief Justice of the United States.

Associate Justices of the Supreme Court.

Judges of the:

United States courts of appeals;

United States district courts, including the district courts in Guam, the Northern Mariana Islands, and the Virgin Islands;

Court of Appeals for the Federal Circuit;

Court of International Trade;

Tax Court;

Court of Federal Claims;

Court of Appeals for Veterans Claims;

United States Court of Appeals for the Armed Forces; and

Any court created by an Act of Congress, the judges of which are entitled to hold office during good behavior.

I am a real estate agent and tax professional. I am just learning this form. Thank you for teaching this. It has saved me this tax season!

Please explain fully difference between Realized gain and Recognized gain. Great video and help for the form filling

Generally speaking, a realized gain is the amount of capital gain that you would realize at the end of a transaction. Recognized gain is the part of realized gain that you pay taxes on.

According to IRS Publication 544, you might need to report recognized gain on either IRS Form 8949, Schedule D, or IRS Form 4797, depending on the circumstances (see links below).

For example, in a like-kind exchange, you would generally only pay tax on the 'boot,' or cash and non-like kind property received, as part of a transaction.

IRS Form 8949, Sales and Dispositions of Capital Assets

Article: www.teachmepersonalfinance.com/irs-form-8949-instructions/

Video: ua-cam.com/video/O5P_L9zdXME/v-deo.html

IRS Schedule D, Capital Gains and Losses

Article: www.teachmepersonalfinance.com/irs-schedule-d-instructions/

Video: ua-cam.com/video/wpPXe8z40lY/v-deo.html

Playlist: ua-cam.com/play/PLYHzJrFFCrpx8fntib5MeAQ7xMEfvPVHZ.html

IRS Form 4797, Sales of Business Property

Article: www.teachmepersonalfinance.com/irs-form-4797-instructions/

Video: ua-cam.com/video/2eEaDPh97Zc/v-deo.html

Needed this!

Thanks for this video. I have a question. Where do we report the sale proceeds reported on the f1099-S on the property that was given up?

According to the form instructions, if you received cash or other non like-kind property, then you would use Part III to report the transaction and calculate any taxable gain.

Thank you. Do you have any video explaining what would happen when we end up selling a property acquired through 1031 exchange? (in your example, how do we factor the deferred gain and new basis when we sell that $210,000 property?)

I don't have a video on that. If you have a real-life example, feel free to email it to me, and I can create a video out of it.

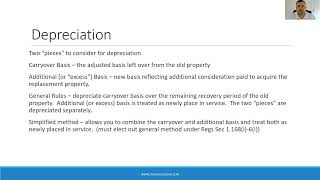

For this video, the basis for the property that we received (Line 38) would become the new basis when we sell it, with any adjustments that you make during your ownership period. If you're selling through another 1031 exchange, that basis would go into Line 13 as adjusted basis.

Very helpful video! How would you file this form if you sold one single family home and acquired two single family homes? And paid some amount of money out of pocket for the second home? Thanks

If you sold a home, then used the money to purchase another home (or 2 homes), then it might not be a like-kind exchange for tax purposes. If you sold your primary residence and meet the ownership and use rules (in general, you must have owned and used the home as your primary residence for 2 of the prior 5 tax years), then you could simply exclude up to $250,000 in capital gains from your taxable income.

If you can't exclude the capital gain because of that, then there are very specific criteria that you would have had to follow to make this a tax-deferred exchange (also known as a Section 1031 exchange or Starker exchange). You probably should discuss this with a tax professional to understand if you can do this, or if the IRS would disallow your tax deferral.

Thank you for the video, very helpful. I too needed this. My wife and I bought a property in 1988 (86K) with a friend. Sold the property in Sept 2023 (420K). My wife and I took our half and invested in a Delaware Statutory Trust - two properties which totaled our half. Part II of Form 8824 - do I identify my wife as a related party? I divided all the costs and profits in half to complete Part III, lines 16 -25. Is that correct? We file a joint tax return.

I'm not sure that I have all the information to give you affirmative answers, but I'll do my best. As always, I recommend that you discuss this with a tax professional.

Unless you conducted the exchange with your wife as the other party (i.e. you sold a property to her, or a business owned by her), then that would be a related party transaction. As it stands, I don't think this would be considered one, but you should have someone professionally prepare your returns so they can get a closer look at the specifics here.

I don't believe that you would divide everything in half. If you and your wife are reporting the transaction on the same tax return, I believe that you would report everything from the transaction without dividing it in half. Again, I would strongly advise that you have someone take a closer look at the details and give an informed opinion.

Please feel free to check out our article, where we've written step by step instructions to help you walk through this tax form! www.teachmepersonalfinance.com/irs-form-8824-instructions/

If you’re looking for tutorials for other IRS Forms that you can file directly through the IRS website, check out our free fillable forms page: www.teachmepersonalfinance.com/free-fillable-tax-forms/

Thank you! One question: why 0 in #21, for example if I rent the house for 10 years and depreciated total $100000 in 10 years, shouldn't I fill #21 with $100000?

It depends on your circumstances. Here is what the form instructions say for Line 21 with regards to Section 1250 property (residential rental real estate):

Section 1250 property. Enter the smaller of:

1. The gain you would have had to report as ordinary income because of additional depreciation if you had sold the property (see the Form 4797 instructions for line 26); or

2. The larger of:

a. The gain shown on line 20, if any; or

b. The excess, if any, of the gain in item 1 above over the FMV of the section 1250 property received.

If you look at the Form 4797 instructions for Line 26, they say to enter '0' in Line 26g (representing Line 26) if you used straight-line depreciation. The larger amount of gain (subject to ordinary income tax) would be any additional depreciation you took on that property. You could also come up with scenarios in which #2 meets the mark, most notably by not having a gain in Line 20.

Thank you so much! I did 1031, acquired property is cheaper than the property given up so I wonder if I have to fill out #21 with the depreciation I took, sounds like I don't need since I did straight line depreciation. Wonder if you know some accounts who help fill out form 8824. Thanks again for your kindness!

@@hzhang9024 If you want to email me, I can put you in touch with a CPA, if that's what you would like: forrest@teachmepersonalfinance.com

I have a cash boot. How do I report that?

Cash received from a like-kind exchange goes onto Line 15. From there, you'd complete the rest of the form to determine the taxable amount of any gain.

I have sold 3 rentals to purchase one other. I am not sure how to enter the info

IRS Form 8824 does allow you to report multi-asset exchanges, but you may need to attach your own statement showing how you

figured the realized and recognized gain, and enter the correct amount on lines 19 through 25. Then, you would report any recognized gains on your Schedule D (Form 1040); Form 4797, Sales of Business Property; or Form 6252, Installment Sale Income, whichever applies:

IRS Schedule D, Capital Gains and Losses

Article: www.teachmepersonalfinance.com/irs-schedule-d-instructions/

Video: ua-cam.com/video/wpPXe8z40lY/v-deo.html

Playlist: ua-cam.com/play/PLYHzJrFFCrpx8fntib5MeAQ7xMEfvPVHZ.html

IRS Form 4797, Sales of Business Property

Article: www.teachmepersonalfinance.com/irs-form-4797-instructions/

Video: ua-cam.com/video/2eEaDPh97Zc/v-deo.html

IRS Form 6252, Installment Sale Income

Article: www.teachmepersonalfinance.com/irs-form-6252-instructions/

Video: ua-cam.com/video/PAeflip0oFk/v-deo.html

In this situation, you might consider hiring a tax professional to help you complete your tax return.