Це відео не доступне.

Перепрошуємо.

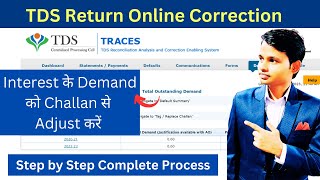

HOW TO ONLINE CORRECTION AND ADD TDS CHALLAN ONLINE ON TRACES ||

Вставка

- Опубліковано 18 сер 2024

- HOW TO ONLINE CORRECTION AND ADD TDS CHALLAN ONLINE ON TRACES ||

Steps for Online Challan Correction

•Step 1: Login to TRACES website

•Step 2: Go to “Request for correction” under “ Defaults“ by entering relevant Quarter, Financial Year, Form Type , Latest Accepted Token number

•Correction category should be “Online”

•Request number will be generated

•Step 3: Request will be available under “ Track Correction Request”

•When request status become “Available” click on Available / In progress status to proceed with the correction

•Provide information of Valid KYC

•Step 4: Select the type of correction category from the drop down as “Challan Correction”

•Step 5 : Make the required corrections in the selected file

•Step 6 : Click on “Submit for Processing” to submit your correction (Only Available to Admin User)

•Step 7 : 15 digits token number will be generated and mailed to Registered e-mail ID

FOLLOW US ON UNACADEMY

unacademy.com/...

FREE INCOME TAX COURSE :

• LECTURE -1 : INCOME TA...

for more about GST ANNUAL RETURN Provision visit our ALL ABOUT GST ANNUAL RETURN Series in our playlist :

• GAR#01 : जानिए GST ANN...

for more about TDS Provision visit our ALL ABOUT TDS Series in our playlist :

• जानिए TDS से जुडी हुई ...

for more about GST E-WAY BILLS Provision visit our ALL ABOUT E WAY BILL Series in our playlist :

• अगर (CUSTOMER) कस्टमर ...

FOR MORE SERIES PLEASE VISIT :

/ @allabouttaxes

#gst #incometax

If you like this video don't forget to hit like button and also share this video with your friends.

And don't forget to subscribe our youtube channel for more videos like this.

very helpful and i have added challan in trace with the help of your video

Thankyou so much sir....Bahut achhe se apne samjhaya he video me....🙏🙏

first of all: Great efforts by you in all your videos. Appreciate a lot...

Quetion: - Suppose Comapny revise there TDS Retur for FY 2018-19 now (i.e. in 2020-21).

Deductee already filed their Income Tax return for FY 2018-19.

How can deducted claim this new TDS in Form 26AS of FY 2018-19 which is due to Deductor late revision in return.

Thankyou

Very Nice Sirji

Very good information sir jee and thank for give me valuable information once again thanku very much sir jee

Thank you it was very easy to understand in this way you guide. Thanks again and again.

superb step by step really appriciate

Thank You very much. It was very clear to understand.

BEAUTIFULY EXPLAINED SIR !

HOW TO ONLINE CORRECTION AND ADD TDS CHALLAN ONLINE ON TRACES ||

NEXT STEP

HOW ADD DEDYCTEE DETAILS

Really well explained thank you for the clarifications

Glad it was helpful!

VERY NICE EXPLAIN, THANK YOU.

Thanx a lot sir.....It helped me a lot....

Thank you for good information please ek esa video banaiye jismai short deduction correction online kar sake or kese short paymat ko corrections karna hai bhot badi help hogi aap ki please jaldi se video bana k share kariye aapka bahut bahut dhanyvad....

Thank you sir 😊 for this informative videos

SO NICE EXPLANATION SIR

Thank You. It was helpful.

Thank you so much sir....i have to file. Revide Tds return but know idea how to do it..then i req for conso statement but in that i am not able to add challan...so i am confuse how to do it..but now watching your video i got the clarity now..how to do it...thank you thank you soooooo much sir...love from mumbai

Thanks

Thank you sir

Sir, Thank you very much,

Thanks for your valuable feedback. Join our whatsapp channel for daily tax updates

whatsapp.com/channel/0029Va4V1uWL7UVXsm8WSO2l

Thanks it's very helpful

Thanku sir

very nice

Good

very useful video

thank you

Thank you sir useful video

Thank u for the video👍👍😊

But sir ek question hai we can download conso file from traces Portal itself to phir department se kyu mangani hai?

Thanku for the vedio

Thank you so much sir

THANK YOU GOOD VIDEO

Thanks sir very very thanks

thanks

Thanks sir g

thanks useful

THANKS for this video. i am stuck with 2 problems. one is now resolved with this video. second one is, how to generate part b of form 16 ? i have successfully generated part A, but utility for part B has just folders in it. its not like part A utility. could you please help ?

Thank u 🤗

Please upload a video on revision of tds return

sir please share next video link, coso file kaise request karte hai or aage ka process please..

SIR PL DO VEDIO ON EDIT MATCHED CHALLANS

Aapne to challan me na to intest, ya short payment sort deduction ke bare me kuch bataya hi nahi to matlab kya hua

How to delete tds challan in WINMAN TDS software? Or online too ? Please help

What This is necessary to submit return again on tin nsdl if we have made corrections on trace website/ have been make payment of demand.

And return statement show proceed without default.

Where is the video of revised return filling after conso file is received

ONLINE TDS LATE FEE PAY KIYA HU KITNE DIN ME TRACES ME ADD CHALAN HETU UPLABDH HOGA

Dear Sir,

how to pay short deduction and interest on short deduction of tds online and solved default return

SIR SHORT PAYMENT KI TDS REVISED RETURN K VIDEO UPLOAD KR DO PLZ

Dear Sir,

While filing of 26Q for the 4th Quarter FY 2020-21, i used previous unused challan, while validating the file, 8 challan are unmatched due to exceed the time limit in cis for 24 month

sir , Q4 of 2019-20 (financial year )Tax was less deducted of an employee Later on it was submitted with penalty through challan in PAN of that employee . Can this Challan be added in Tan of The deductor and after that a new conso file request can be send to Traces . In the last how revised TDS statement will be filed .

What we can do if add/ Modity deductee details tab is not showing when we are requesting for online correction statement

Short description ka demand kese on line correction kare

If i paid TDS in challan 5000 but in my 26Q return all entry total TDS is 4200 so excess paid 800 how to adjust next quarter and current quarter which amount show in challan details

Dear sir how to correction govt bin challan correction

Ater adding challan we have to do revised return?

I am getting error while requesting for Q4 TDS correction of FY 20-21 :

Online Correction related to Form Type 24Q, Q4 has been disabled for F.Y. 2021-21

Please help when it will get enable or any other part I am missing.

I have filed Original Q4, 13 days before

Hello sir, my add chalan status is showing " processed" shall i request for conso file?

Maine self assessment tax k challan me assessment year galat bhar Diya ha . Maine traces ki site se login kar RHA hu to default option nhi aa rha ha. Request for correction kar RHA hu to 26Qb and 26Qc option aa rha ha. Kaise Mai challan me assessment year change Kari bataiye

Sir kitna days me new challan Jo pay kiye hai show Karega add challan me

Sir how I know challan details of Bin deductor. It is very difficult to know. From bin match I simply do hit and try but it is very difficult. Please provide me guidance

Sir, How can i add challan of F.y. 2016-17 in F.Y. 2020-21.

Sir, How I file tds return (24Q) 4th quarter online. I have done the correction and add Challan in Q3 .But 4th quarter return is not filed

I have downloaded the conso file in the 1st step......and didn't perform the add challan step......so do I need to do this process again?

Sir humne late fee pay kiya hai 800 jo ki maine add kar diya hai challan mai but amount paid/ credited mai kon sa amount dalege sir or rate of tds kya dalege sir please sir aap jaldi reply karke meri help kijiya sir

Sir I have added Challan same as shown in your video still i am getting intimation from Traces.... Please help me

Sir ,kya conso file download kar challan add kar sakte hai

Sir kya hum conso file income tax se download karke TDS return me add challan aur deductee ki detail sath me bhar ke revise tds return file kar sakate hai?

No you have to add challan first then request for conso file

Next vedio

Tds short payment online kaise hoga

Sir interest demand ka challan kaise deposit karna hai. Challan 281 hi karna h kya. And nature of payment kya select karna h

MRUNALI KAMBLI

How is tds challan correction after tds return filling?

kitne din lagte hai challan show hone me.....??

How excess tds deposited what is adjestment way

If we doesn't know the token number, how we can tag challan

how to correct address in Traces form as Tax Payer

revised return k video kider hai

Dear Sir,

I've received demand notice from TRACES for short deductions, then made payment against notice and tried to add the challan for set-off. But, it was failed two times. anyone can help me accordingly.

Same problem is with me

Sir meri IIIrd qtr m deductee or challan reh gya tha to kya m unhe IV qtr m add kr skta hu ya IIIrd qtr hi revise Krna hoga

sir mene NSDL ke through return file ki thi lekin me chahta hu ki correction return file incometaxefiling ke through kar sakoo kya yesa ho sakta he sir please replay most welcome

Yes you can

Sir iska next vedio kha ha

How already challan details appear there when we want to add challan details,please reply

Sir challan add Kar Diya but wrong qtr me add ho Gaya to ab Kiya kare

Short payment ke case me kya karte hai sir??

Dada challan statement me add karne ke baad to direct wahi se ADD DEFUCTEE kar saktey hai na

ompal Sharma

Sir if any challan is not shown on traces I'd...then how can we add challan manually

Can one challan be added for two or more quarter?

Sir TDs return online kaise check kare

Sir, hmari ek firm me sep month ki salary ki details or challan return me submit nhi hua tha to abhi Maine Challan to add kar Diya h but usme deductee add kaise kare?

You have to file revise return by requesting conso file then adding deductee.

How to pay interest on TDS of demand

SIR, I GOT ONE MISTAKE IN TDS RETURN I HAVE WRONGLY ENTERED CHALLAN DATE IN RETURN STATEMENT THEREFORE I GOT NOTICE FROM DEPT. BUT I CAN'T EDIT THE DATE IN TRACES, IF I CORRECT THE STATEMENT WHAT SHOULD I SELECT CHALLAN CORRECTION OR ADD CHALLAN?. PLEASE REPLY SIR IT'S VERY URGENT

How to add party after that

how to correct the date of challan

Sir how to file

Interest and late fees

How to get the BSR code? It is saying invalid details in bsr/ date/ challan serial number page.Where can I get the details for the challan?

FROM BANKER WHERE WE CHALLAN PAID

TDs challan deposit in sec 194 instead 194c . But misteklly TDs return is filled, and demand notice received. And I am unable rectified TDs challan correction. Pls suggest?

You can correct the tds challan details online. Watch our playlist ALL ABOUT TDS for complete details

Conso file kaise mangwa h?

IF STATUS IS PROCESSED THEN

Can i change date of challan?

How to get token no