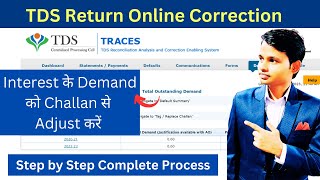

HOW TO ADD TDS CHALLAN & SUBMIT CORRECTION IN EARLIER FILED TDS STATEMENT AGAINST DEMAND

Вставка

- Опубліковано 11 вер 2024

- Sometimes, after filing TDS Statement, some demand is raised by the Department. The Deductor is required to pay such demand and upload the details of such Challan for effecting CORRECTION in the earlier filed TDS Statement. This is a common activity but the users find it confusing at times. This video by Envision Institute is aimed to solve all such problems.

Link to "How to download TDS justification Report":

• HOW TO VIEW AND DOWNLO...

Link to "How to Pay TDS Demand":

• How to pay TDS demand ...

Brilliant work 👏.

We Highly Appreciate your help 🙏

May god bless you 🙏.

A small request please make more videos.

We want more videos like this madam .thank you so much

Very good teaching Madam.thank you.

After paying the demand of short deduction notice, say 10000 short deduction and 500 interest, how will the assessee get 10000 tax credit in his 26AS statement?

Madam Thanks for the important video and Happy Woman's Day Today is woman's day 😊😊😊😊

It was very useful, Can you tell how to handle short deduction case. Interest part can be added by above method but what what about short tds?

mam aap ke youtube channel pe video nahi aate hai aap ki sikhane ka tarika bahut aacha hai please make more video on different topic and update on UA-cam channel its request from me.

THANK YOU MAM. THIS VIDEO REALLY HELPS ME ALOT.

VERY HELPFUL.THANK YOU.

Very Good Madam ji, Thank U, God Bless U

Thanks mam outstanding way of explanation....

Very nice .

Please make one video on TCS return.

And TDs.

Thanks a lot.

Very nicely explained

Superb demo. Thank you so much

very good, helpful and excellent video mam

Good Evening madam

Very informative

Good presentation

thanks mam.. excellent explanation

But same process i can't find any record after a day past payment, not received any challan no also.

Why in type of correction 3 options are displaying . where is the other option?

Hello ma'am we have demand in past year and I paid through challan but it's not shown in traces in types of correction in view details no any challan shows

Mam, How can we file TDS for "lower deduction certificate " deductees???

Mam add challam to statement e Jane ka bad chall select korke add challan to statement Meh click korne see bhit kuch hota nehi. That button not working. Why?

Madam you are great

10 year old challans h balance available h kya hum use add kr skte statement me?

Thanks Good video

Madam fy 2021-22 ke quarter 1 ka Return file karte samay kuch deductee ki details Jo ki quarter 4 se related thi quarter 1 me dal gayi ab ise fy 2020-21 ke quarter 4 me kaise dikhayenge please suggest if possible please make video on that matter

Again Nice Video

Demand pay karne se after how many days will update on site?

When can we file correction by adding challan?

if the challan which we have paid is not coming in the list of challan to be added..what should be done in that case

Please Explain How to register on incometaxfilling site so we need not go for tds centre and Please Explain how to Get EVM register.. Heartly Request you please Please Explain on this Two Topic

How to delete tds challan on WINMAN TDS software?

When do we use correct challan option?

TOKEN NO SHOWING NOT APPLICABLE. . WT TO DO???

Mam rpu nehi karna hoga?

Is dsc require for online correction???

Nice

Add chalan krne ke bad kya return ko ko revise Krna hoga?

Yes if the challan is related with some deductee but if the challan is only for demand/late fee etc. then no need to revise it. Just add Challan and follow the process as in the video.

@@envisioninstitute6334 thank u mam

Mam I have a question...

Salary/wages ka cash me payment ki limit kya h? Plz

25.07.2022 challa tds man