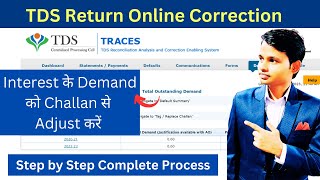

TDS RETURN ONLINE CORRECTION ON TRACES |TDS RETURN ONLINE REVISION ON TRACES| TDS FILING BY AADHAR

Вставка

- Опубліковано 11 вер 2024

- Download Link for Documents:

Store Link- capuneet-in.st...

(Download option will be available after successful payment)

Steps for Online Challan Correction

•Login to TRACES website

•Go to “Request for correction” under “ Defaults“ by entering relevant Quarter, Financial Year, Form Type , Latest Accepted Token number

•Correction category should be “Online”

•Request number will be generated

•Step 3: Request will be available under “ Track Correction Request”

•When request status become “Available” click on Available / In progress status to proceed with the correction

•Provide information of Valid KYC

•Step 4: Select the type of correction category from the drop down as “Challan Correction”

•Step 5 : Make the required corrections in the selected file

•Step 6 : Click on “Submit for Processing” to submit your correction

•Step 7 : 15 digits token number will be generated and mailed to Registered e-mail ID

#tdscorrectiononline

#traces

#incometax

#tdsrevsionontraces

#tcsreturnonlinecorrection

#rpudownload

#freetdssoftware

#TDSRETURN

#TCSRETURN

#cagurujipuneetjain

@CAPuneetJain

#capuneetjain

#whatsapp

#twitter

#capuneetjain

#youtube

#facebook

#instagram

#HOWTOFILETDSRETURN

#howtofiletdsreturnonnewportal

#newincometaxporaltdsreturnfilingprocess

#tdsreturnverifybyaadhar

#tdsreturnverifybyevc

#tdsreturnonlinefilingprocess

#tcsreturnonlinefilingprocess

#tdsreturnfilingthroughfreesoftware

#tcsreturnfilingthroughfreesoftware

#etdsreturnfiling

#etcsreturnfiling

#tdsreturncapuneetjain

#tdsreturnfiling2021

#tdsreturnQ4fy202021

#tcsreturnQ4fy202021

#tdsreturnQ4fy202122

#tcsreturnQ4fy202122

#tdsreturnonlinefiling

#tcsreturnonlinefiling

#tdssalaryreturnfiling

#tds24Qreturnfilingsoftware

#tdsrpudownload

#tdsreturnpancorrection

#tdsreturnadddeductee

#newincometaxporal

#TDSRETURN

#TCSRETURN

#TRACES

#HOWTOFILETDSRETURN

#tdsreturnchallancorrection

#NEWWAYTOFILETDSRETURN

#TDS

#TCS

#INCOMETAXIN20201

#TDSLASTDATE

#HOWTOUSETDSRPU

#TRACESPORTALREGISTRATION

#TRACESPORTALRETURNREISION

#HOWTODOWNLOAD27Q

#HOWTOUPLOADTDSTHROUGHDSC

#TDSRETURNFILINGDUEDATEFY202021

#TDSRETURNFILINGDATEFY202122

#incometaxnewportal

#tdsreturnfiling

#howtofileTDSreturn

#incometaxnewportal

#tdsreturnfiling

#howtofileTDSreturn

#TDSTCSreturnfiling

#howtouploadTDSreturnonnewincometaxportal

#tdsreturn

#TDSupload

#TDSreturnonlineuploaderror

#TDSretunuploadonnewportal

#decodenewincometaxportal

#newportal

TDS TCS Return Filing on New Income Tax Portal

How to Revise Online Tds Return | Tds Revise Return | Correction in Tds Return

How to File TDS Return Online | How to File 24Q & 26Q Return

HOW TO FILE TDS RETURN II HOW TO UPLOAD TDS RETURN ONLINE

HOW TO FILE TDS RETURN ONLINE & OFFLINE I PROCEDURE FOR FILING TDS RETURN

How to file TDS Return | TDS RETURN FILING PROCESS | FORM 24Q & 26Q

HOW TO FILE TDS RETURN FORM 26Q (FY 2019-20) (FY 2020-21)ll TDS RETURN FILING LIVE

How to Prepare and File online TDS Return

How to File TDS Return of NRI Payments in Form 27Q I Income Tax TDS Software

HOW TO ONLINE CORRECTION AND ADD TDS CHALLAN ONLINE ON TRACES

24Q - TDS ON SALARY

26Q- TDS OTHER THAN SALARY

27EQ- TCS

27Q- TDS ON NON RESIDENTS

HOW TO FILE TDS RETURN,

HOW TO FILE 24Q

HOW TO FILE 26Q

TDS RETURN FILING,

TDS RETURN WITH RPU,

TDS RETURN FILING FREE UTILITY,

26Q TDS RETURN,

24Q TDS RETURN,

TDS DEDUCTED HOW TO FILE,

FILE REVISED/CORRECTION IN TDS RETURN 26Q

FILE REVISED/CORRECTION IN TDS RETURN 264

TDS REVISED RETURN CORRECTION

FREE TDS RETURN FILING UTILITY,

HOW TO FILE TDS RETURN FOR FREE,

Online Procedure to revise TDS return

TDS RETURN CORRECTION

FILE REVISED CORRECTION IN TDS RETURN 26Q

FILE REVISED CORRECTION IN TDS RETURN 264

FILE TCS RETURN,

TDS RETURN FILING ONLINE

TDS RETURN 2021-22

TCS RETURN FILING,

HOW TO USE TDS RPU UTILITY,

RPU TDS FILING

TDS RETURN FILING NEW DATES Q4 F.Y 2019-20| TDS AMENDMENT |LAST DATE OF FILING TDS RETURN F.Y2019-20

TDS RETURN FILING NEW DATES Q4 F.Y 2020-21|LAST DATE OF FILING TDS RETURN F.Y 2020-21

HOW TO ONLINE CORRECTION ADD TDS CHALLAN ONLINE ON TRACES

WHAT IS TDS RETURN HOW TO GENERATE FVU FILE

How To File TDS Return For Salary Free Form 24Q

How to file TDS Return In Form 26Q With CompuTax

How to File TDS Return FORM 26Q | TDS Return How to File TDS Return Online

How to file TDS return form 24Q & 26Q TDS RETURN

TCS & TDS return 4th quarter for 2020-2021

How to file salary TDS return Form

How to Revise TDS Return 24Q Offline Procedure

How to Revise TDS Return 26Q Offline Procedure

How to Revise TDS Return 26Q ONLINE Procedure

How to Revise TDS Return 24Q ONLINE Procedure

TDS & TCS return filing on new income tax portal, How to file TDS return on new portal of income tax

Link to download RPU utility from tin website www.tin-nsdl.c...

Link to download challan csi file tin.tin.nsdl.c...

Link to upload TDS Return : www.incometaxi...

Link of TRACES Website: contents.tdscp...

Thankyou so much sir.. Ap sirf point to point information detay ho 🙏🙏🙏🙏

Shirt deduction and late payments, pan correction prover video banaye practical 👌online correction.

Sure we will provide soon

Sir Kisi Party ka TDS hamne October me deduct nhi Kiya at the time of payment, humne Payment ke baad Back date me TDS book kar Diya party ke against, kya ye return revised ho jayegi next month me agr me December me TDS deposit krta hu October month ka.. or Date kya fill kru Add challan statement - Add deductee ke time.

yes its can be done through Revision

🙏🙏🙏 thank you Sir 🙏🙏🙏

Sir I want to know that can a restaurant supplying through ECO (Swiggy, zomato) intrastate opt for composition scheme? If yes, then where will they show supplies through ECO as tax is paid by ECOs on such supplies? Please reply. Thankyou

Composition Scheme under GST applicable in case of Intra State Supply and not applicable in case of Inter State Supply, Also as per GST rules composition Scheme not available for E commerce operaters like swiggy or Zomato.

Hello sir m already tax pay kr chuka hu but fir b utne hi amount ka tax pay krne ka Notice aaya h ..what to du? Complain ki thinwo bole json format m rectification form fill krk challan detail fill krk submit kro but sir kese krna h y smj n aa rha pls help sirji

Download the Console file from TRACES Website

Then Revised the details after importing the console file into RPU utility

Create JSON file and upload on New Income Tax Portal

Sir,

I have selected wrong deductee in Q3 return FY 22-23 . Sir pls reply that now it can be changed or not. Sir,

I am waiting your reply sir pls reply.

Yes its can be changed

This Video already available on my UA-cam Channel " CA Puneet Jain"

How to Revise TDS Return

Thank u so much sir for reply

Hai sir. My employer is supposed to deduct my salary under section 192 but deducted under 194C. Is it possible to submit for correction in this issue?

Deductor Having the Power to rectify the Tds details with revision or correction of TDS Return

Sir, I have filed TCS return of 3rd quarter and i forgot to claim 1 challan ..and so i couldnt download Certificate of that particular customer.... Can i claim it in 4th quarter ?

Yes

SIR ADD OR MODIFY DEDUCTEE IS POSSIBLE WITHOUT DSC

No

Sir authentication procedure mai challan details invalid aa raha h

Try after sometime

Hlo sir

how to solve if tds deducted 1% instead of 2% in 26q

File TDS Correction form 26Q with addition of New Challan

How to Revise/ Correct TDS return online this Video already available on our UA-cam channel

@@CAPuneetJain ok

Sir Muje ek demand aayi hai portal par challan ki date galat chd gyi hai to uska kya kare uski demand alag s aayi hai apka number Mil skta h kya sir

Download the console file and then correct the details. The process for it already on our channel