The Black-Scholes-Merton Model (FRM Part 1 2023 - Book 4 - Chapter 15)

Вставка

- Опубліковано 28 тра 2024

- For FRM (Part I & Part II) video lessons, study notes, question banks, mock exams, and formula sheets covering all chapters of the FRM syllabus, click on the following link: analystprep.com/shop/unlimite...

AnalystPrep is a GARP-Approved Exam Preparation Provider for FRM Exams

After completing this reading, you should be able to:

- Explain the lognormal property of stock prices, the distribution of rates of return, and the calculation of expected return.

- Compute the realized return and historical volatility of a stock.

- Describe the assumptions underlying the Black-Scholes-Merton option pricing model.

- Compute the value of a European option using the Black-Scholes-Merton model on a non-dividend-paying stock.

- Compute the value of a warrant and identify the complications involving the valuation of warrants.

- Define implied volatilities and describe how to compute implied volatilities from market prices of options using the Black-Scholes-Merton model.

- Explain how dividends affect the decision to exercise early for American call and put options.

- Compute the value of a European option using the Black-Scholes-Merton model on a dividend-paying stock.

Your teaching is an "Absolute beauty", professor.

Thank you! If you like our video lessons, it would be appreciated if you could take 2 minutes of your time to leave us a review here: trustpilot.com/review/analystprep.com

Great explaination! Always grateful.

I would have failed all my units if I didn't have these videos to teach me, I sincerely thank you.

Thank you Professor Forjan. We need more videos from you.!

Nicely explained! Lot of thanks.

Glad it was helpful! If you like our video lessons, it would be appreciated if you could take 2 minutes of your time to write us a review at www.trustpilot.com/review/analystprep.com

Great work! Thank you for sharing!

You're welcome!

very simplified and helpful.

thank you!!

Glad it was helpful! If you like our video lessons, it would be helpful to spread the word if you could take 2 minutes of your time to leave us a review at www.trustpilot.com/review/analystprep.com

What a man!!!

Glad it was helpful! If you like our video lessons, it would be appreciated if you could take 2 minutes of your time to leave us a review here: trustpilot.com/review/analystprep.com

Wonderful !!! THANK YOU SO MUCH !!!

Glad you like it!

Great class so nicely explained sir

amazing help. thank you so much

This should be the nobel prize. Thx.

Glad you think so. If you like our video lessons, it would be appreciated if you could take 2 minutes of your time to leave us a Google review using this link: g.page/r/CQIlM78xSg01EB0/review

Thank you very much Professor Forjan

You simplified that so well! Thank you!

You're welcome!

Thank you!

Great one! I just have one question Black-Scholes model uses constant volatility. What do you mean by this? Because volatility changes when we apply iteration.

in the textbook the the black scholes model variance is SD• root of T, but here it’s using SD^2

Hi Venus. Could you give us a timestamp?

@@analystprep 4:25 , it is different way of writing normal distribution. Written as N(u , variance) is the formal way, Written as N(u , Stdev) in the textbook is understood. At 6:09 the confidence interval is calculated correctly with stdev

(SD) x (Root of T) which is given in the textbook is just the root of (SD²) x (T) which is shown in this video.

so, the textbook one gives you the standard deviation and the one here gives you the variance.

it's basically the same thing.

@@rutammokashi2146 Its not the same thing. Here it is sigma square * square root of T but textbook, it is sigma square * T

@@ishankjain2393 I think its an error.

5:55 "Since lnSt is log-normally distributed". Isn't this wrong? lnSt is normally distributed as St is log-normally distributed.

Why is return on time value different in d1 and d2?

Well done

Thank you!

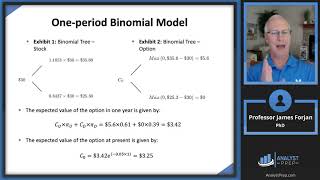

@@analystprep I wanna ask something. Why when you add one more step on the binominal tree the option value increase??

The lognormal the return not simply stock price

Why do we use the model to price option

thank you, prof J