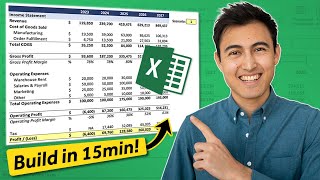

How to Show Upside, Base Case, and Downside Scenarios in Financial Model for Investors

Вставка

- Опубліковано 4 лип 2024

- We learn how to build a startup financial model for investors that shows upside, base case, and downside scenarios for our venture-funded business. Template included.

✅ Download the Excel template: bit.ly/scenariomodel

🚀 If you want to master the finance skills & frameworks to successfully scale technology startups, secure your spot in my "Finance for Startups" program, today: www.ericandrewsstartups.com/f...

Communities:

💼 Linkedin: / eric-andrews-1624b656

☑️ Twitter/X: / eric__andrews

🌟 Instagram: / ericandrews_startups

🔥 Discord: bit.ly/discord_eric

💻 Newsletter: bit.ly/joinericnewsletter

🎥 Clips: / @ericandrewsclips7818

Related Startup Videos:

🚩 Multiples Valuation Method: • Business Valuation 101...

🚩 How VCs Calculate Customer Retention & LTV: • Customer Retention & C...

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

We learn about how to build financial models for investors that show different scenarios for your startup - upside, base case, and downside.

The context and strategy around how to present these numbers and what investors are looking for is very important. Venture investors for example are looking for different opportunities / risks than private equity investors.

In this video, we build financial model scenarios for an advertising-monetized tech startup to show prospective venture capital investors our growth trajectory, with all the metrics that underpin it.

Sections:

0:23 context for financial scenario analysis - how to present numbers to different investors

3:17 setup for our startup financial model & model intro

6:06 breaking down our assumptions

8:36 forecasting the downside scenario

11:40 base case & upside scenarios

15:55 discussion around our different scenarios and if they make sense given our investors

By the end of this video, you will understand how to present upside / downside financial models to investors - I guarantee it.

If you have questions - leave a comment below and I'll try to help. Cheers!

#venturecapital #startupfinancialmodel #scenarioanalysis

Questions? Let me know in the comments happy to discuss.

💡 Also, if you want to learn how to systematically scale your startup without ending up as one of the 90% of startups that fail, check out my free training webinar ⇒ www.ericandrewsstartups.com/financeforstartups

Hey Eric,

Thanks for sharing the details on email. I have seen your sales page. I really appreciate you for taking this initiative and I do agree your course is top-notch.

I am your big fan, I have been subscribed to your youtube channel for the last 6-8 ago and your way of teaching finance things is outstanding. To be honest, I have learned a lot from this free material and whenever someone asks me for learning financial modeling, I ask them to go to your youtube channel. As you are the best Sir Eric.

I am a CFA student and appearing for level-1. I cannot express my feelings, I really want to be a top-notch financial consultant with robust financial modeling expertise. But sorry to say, due to Covid-19, I have lost my job and even cannot have enough to pay for my exams fees.

It's a humble request If your do allow me this course. I'll be really obliged for this opportunity.

Stay Blessed.

Junaid

Spot on Eric - really important to think about your audience when developing and presenting multiple different scenarios. Great video!

Yep, it's essential. Thanks for the comment!

Amazing video as always. You are really doing a great job, Eric.

Thanks for the support Junaid!

Man, you know stuff, and you know how to articulate it. :)

Glad it was helpful Mohammed!

Great video Eric 👍

Glad it was helpful!

Good presentation Eric.

Appreciate it!!

Hey Eric! Great video! It would be awesome if you could give us the template without the solution so we can do it with you! Thanks

Hey eric, Can you please give a scenrio answering the question "Tells us about a time you used excel to execute a project?" And if you have answered the question, Please reply with a link to the youtube video.

Dear Friends,

I have the following thought:

1/ If a company has many product lines, it is advisable to track the life cycle of each product line, it will be easy to determine the life cycle of a company. Is this correct?, because I read some documents they don't say clearly. Thank you