Fill out California LLC Form 568 using TurboTax with Schedule C

Вставка

- Опубліковано 2 жов 2024

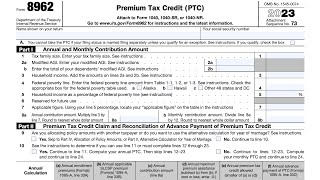

- How to Fill out California LLC Tax Return Form 568 using TurboTax with Schedule C. TurboTax also can print the California LLC voucher to pay the tax $800 LLC tax.

I am not a CPA and I did this a few months ago DIY using TurboTax(TT). In general, it is important to remember that TT will do classify the tax correctly on the schedule C business. You should be able to go into view forms mode on sch C CA and Fed to see how the LLC tax is being reported. Never override or try to add back a tax deduction because TT is doing this automatically the correct way.

We have been using Schedule C with Turbo tax for our business tax filing and now realize that we have to separately file 568 for our SMLLC in CA. What is the easiest way to file for multiple year 568 for FTB? We didn't see any link in the Tubrbo tax.

Thank you for sharing

Thanks for watching!

Thank you for sharing! I have a question regarding the LLC $800 fee, I know it's deductible for federal but not for CA, so I wonder do I need to manually adjust the $800 in 568? like add it back to ordinary income? I am so confused

I am not a CPA and I did this a few months ago DIY using TurboTax(TT). In general, it is important to remember that TT will classify the tax correctly on the schedule C business. You should be able to go into view forms mode on sch C CA and Fed to see how the LLC tax is being reported. Never override or try to add back a tax deduction because TT is doing this automatically the correct way.

Does everyone have to pay the 800?

First year is free. Then $800/yr. Don’t be late. Seems in CA you can only get a side gig if you have a LLC then you can start depreciating your home office / deducting some rent etc. IMO The ball park math works like this .. break even = ( .4 * llc expenses) - 800. If you have a positive number then LLC good else LLC bad. You need to do your own return I think. You don’t need a LLC to file a Schedule C but maybe your customer will require you to get LLC.

Thank you for sharing. I filed my schedule C for SMLLC with H&R block already and then realized that they do not allow you to file 568 form electronically. I also have Home and Business 2023 turbo tax. Do you know if I can e-file just 568 with Turbo Tax without filing personal income tax? Thank you.

I have only filed the 568 electronic with entire return. Don’t think TT supports individual return filing. I’d just paper file if I was in your situation.

Thanks for all the great information, I started my SMLLC December 29 2023, Do I Still need to file form 568?

I am not an expert but I think based on my understanding, I would file. The risk of not filing is too great due to the penalty of not filing. I assume you a will also file a schedule C and this will have some net losses to write off also?

I registered my LLC last January 18, 2024. Should I have file taxes before April 15, 2024 or am I due next year April 15, 2025?

I believe it’s April 2025 filing date and you may get the first year no cost in Ca if you have a simple LLC. I’m not an expert just a DIY tax filer.

Hi! This was very helpful! Can you explain like M-N and U-V that would be so helpful

I don’t remember reading about this when I filed. Can you let us know more info on this topic?