Like-Kind Exchange Reporting

Вставка

- Опубліковано 8 жов 2015

- This lecture reviews the rules governing like kind exchanges.

Topics Covered

* The types of property that qualify for like-kind exchange treatment

* Time frame for identifying and acquiring replacement property

* Use of qualified intermediaries

* Identifying boot and determining taxable gain on sale

* MACRS depreciation rules that apply to replacement property

* Sale of home

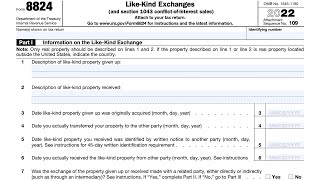

* How to report a like-kind exchange on Form 8824

You can purchase the manual for this course for $0.99 at pnwtaxschool.com/oc-catalog/al...

Pacific Northwest Tax School is approved by the following organizations as a provider of continuing education:

* The IRS

* NASBA QAS (NASBA Sponsor #109290),

* Oregon Tax Board,

* The Texas State Board of Public Accountancy (Texas Sponsor #009794)

* The New York State Board for Public Accountancy (Sponsor License #002479)

You can receive 1 hour of free CE by enrolling in this course at pnwtaxschool.com/oc-catalog/al...

Terms of use

Pacific Northwest Tax School's course materials and teaching techniques are valuable proprietary information of Pacific Northwest Tax School, and all such information is subject to copyright, including written, recorded, internet based as well as all other electronic media. Each Student agrees that she/he will use the information only for purposes of education and training; and as a condition of enrollment, that they will not disseminate the information to any third party and will treat the materials as confidential information of Pacific Northwest Tax School. As a condition of enrollment, Students pledge not use any information in any competitive fashion, including to create or derive competitive materials. Students further agree that any breach of these terms and conditions shall cause the school irreparable harm, entitling Pacific Northwest Tax School to injunctive relief, as well as any other remedy that may be available at law or equity. Students shall have twelve months from date of enrollment in any continuing education course, to successfully complete the course and receive their Certificate of Completion.

The best 8824 calculation I've seen!

Thank you for explaining how a new mortgage is delt with. Shocking how hard it is to find that info, since like you said, it is by far the most common situation

THANK YOU!!! Seriously the template you used and showing us where we can use it is literally life changing! This is incredible value. I truly appreciate you sharing this with the tax community.

Thank you so much for this video. This is such a life saver. The IRS instuctions for the 8824 is a nightmare. It leads you down a rabbit hole of confusion and through a circle that leads to nowhere but more confusion.Thanks again for bringing clarity, detailed explantations for different scenarios and resources that helps to minimize further confusion.

great! Thanks so much the irs.gov was a nightmare!

This is a great explanation of the 1031 Exchange. Would you have details on how these transactions get booked into the accounting side and how the resultant balance sheet would look before and after the exchange?

Thank you, this is very helpful. I have a question -At 49:50, you have a calculation for line 19, but on the 8824 it is simply line 17 minus line 18. In this case, it looks like they are coincidentally the same amount at $606,000. If some of the amounts in you line 19 calculation were different, it would no longer equal line 17 minus line 18. What is the correct way to calculate line 19? Thanks!

While it was light on explanation it appears to have gotten me over the hump. The IRA 8824 is crazy vague and I doubt if too many in the IRS really understand it. Thanks

We hope you enjoy this lecture video and find the information it contains helpful. We appreciate your feedback, but do not respond to tax questions posted by viewers.

Enrolled students have access to our Q & A forum where they can post questions and receive answers about subjects covered in this course. Enrolled students also receive a copy of the student manual, can complete course assignments and receive course answer keys, and receive CE credit.

Thanks for all the details. It was very helpful. If we give up 2 properties to exchange for one , do we fill out 2 separate Form 8824 or we combine all the info and numbers

on the one form ?

This was a fantastic rundown of the 8824. I do agree that IRS instructions are trash.

THE 1031 EXCHANGE: Building Wealth since 1921! Watch our latest video, where David Moore from Equity Advantage and Bob Nelson with Pacwest Real Estate discuss the best way to NAVIGATE YOUR 1031 exchange ID period!