IRS Schedule F walkthrough (Profit or Loss From Farming)

Вставка

- Опубліковано 19 жов 2023

- Subscribe to our UA-cam channel: / @teachmepersonalfinanc...

Please feel free to check out our article, where we've written step by step instructions to help you walk through this tax form! www.teachmepersonalfinance.co...

If you’re looking for tutorials for other IRS Forms that you can file directly through the IRS website, check out our free fillable forms page: www.teachmepersonalfinance.co...

Here are links to articles we've written about other tax forms mentioned in this video, article, or form instructions:

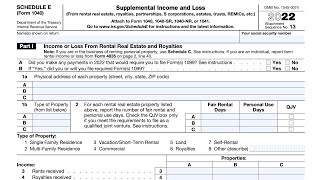

IRS Schedule E

Article: www.teachmepersonalfinance.co...

Video: • IRS Schedule E walkthr...

IRS Schedule SE

Article: www.teachmepersonalfinance.co...

Video: • Schedule SE walkthroug...

IRS Form 3800, General Business Credits

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 3800 walkthro...

IRS Form 4562, Depreciation and Amortization

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 4562 walkthro...

IRS Form 4684, Casualties & Thefts

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 4684 walkthro...

IRS Form 4797, Sales of Business Property

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 4797 walkthro...

IRS Form 4835, Farm Rental Income and Expenses

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 4835 walkthro...

IRS Form 6198, At-Risk Rules

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 6198 walkthro...

IRS Form 8582, Passive Activity Loss Limitations

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 8582 walkthro...

IRS Form 8824, Like-Kind Exchanges

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 8824 walkthro...

IRS Form 8990, Business Interest Expense Limitations

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 8990 walkthro...

IRS Form 1045, Application for Tentative Refund

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 1045 walkthro... - Навчання та стиль

Good evening I’m a farmer last year I processed my return on less common income … and now I can see schedule F on profit and loss on farming … please what do I do !!!

I'm not sure that I can help you in the comments section of this YT channel.

I highly recommend that you see a tax professional that specializes in filing Schedule F for farming income. That way, you can better understand how to properly report the income and expenses from your farming activities and avoid paying more taxes than you have to.

Can a farmer elect to be an S-Corporation and pay a reasonable comp to avoid the SE Tax?

This is possible, but walking through the process is probably out of the scope of this comments section. If you're looking to do this retroactively (to avoid paying for 2023 income), that's probably not likely to happen.

Most tax professionals (CPAs and EAs) help their clients do this, as well as advise on the pros & cons of doing so. There might be situations where you're better off as-is, so I would advise hiring one (after tax season) to help do this properly.