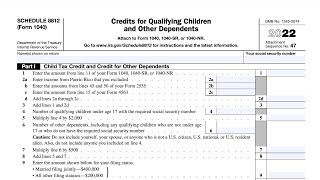

Credit Limit Worksheet A Walkthrough (Schedule 8812)

Вставка

- Опубліковано 7 вер 2024

- Taxpayers looking to claim a tax credit for a qualifying child or dependent might need to complete credit limit worksheet A, located in the Schedule 8812 instructions.

In this walkthrough, we take you through this worksheet, step by step, so you get the correct answer.

To see the entire article, visit our site: www.teachmeper...

If you'd rather watch the video that covers Schedule 8812, check it out: • Schedule 8812 walkthro...

Finally, if you want to purchase a digital copy of this worksheet, complete with instructions, calculations, and helpful links, check out our Etsy Store listing: www.etsy.com/l...

Here are links to articles we've written about tax forms mentioned in this video.

IRS Form 1116, Foreign Tax Credit

Article: www.teachmeper...

Video: • IRS Form 1116 walkthro...

IRS Form 2441, Child and Dependent Care Expenses

Article: www.teachmeper...

Video: • IRS Form 2441 walkthro...

IRS Form 8863, Education Credits

Article: www.teachmeper...

Video: • IRS Form 8863 walkthro...

IRS Schedule R, Tax Credit for the Elderly or Disabled

Article: www.teachmeper...

Video: • Schedule R Walkthrough...

IRS Form 8910, Qualified Alternative Vehicle Credit

Article: www.teachmeper...

Video: • IRS Form 8910 walkthro...

IRS Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit

Article: www.teachmeper...

Video: • IRS Form 8936 walkthro...

IRS Form 8396, Mortgage Interest Credit

Article: www.teachmeper...

Video: • IRS Form 8396 walkthro...

IRS Form 5695, Residential Energy Credits

Article: www.teachmeper...

Video: • IRS Form 5695 walkthro...

IRS Form 8978, Partner’s Additional Reporting Year Tax

Article: www.teachmeper...

Video: • IRS Form 8978 walkthro...

Can line 2 be greater than line 1? If so, is line 3 a negative number?

I'm not sure. It seems that you could (in theory), but I believe that most of the tax credits in Schedule 3 that are reported on the credit limit worksheet are nonrefundable tax credits. Most of these credits have limitation worksheets that serve as a forcing function so that you cannot reduce your tax liability below zero.

I'm sure that I could go in and try to 'break' the form, but on first glance, I think that this would be pretty difficult to do.

What if I haven’t claimed any of those credits?

If you're not claiming any of the tax credits listed in the video, then Line 1 of Credit Limit Worksheet A should look exactly like Line 5, which means these tax credits would not lower the amount of tax credits that you're claiming in Schedule 8812.