How To Calculate The Present Value of an Annuity

Вставка

- Опубліковано 6 чер 2020

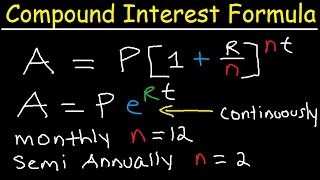

- This finance video tutorial explains how to calculate the present value of an annuity. It explains how to calculate the amount of money you need to invest now to generate a stream of monthly cash flow payments for a specified number of years given a fixed interest rate.

Liquidity Ratios:

• Liquidity Ratios - Cur...

Assets, Liabilities, & Equity:

• Personal Finance - Ass...

The Short Ratio:

• How To Calculate The S...

Debt to Equity Ratio:

• Long Term Debt to Equi...

Time Value of Money:

• Time Value of Money - ...

_____________________________

Future Value of Annuity:

• How To Calculate The F...

More Examples on Annuities:

• Annuities - How To Cal...

How To Calculate The Monthly Mortgage Payment:

• How To Calculate Your ...

The Present Value of an Annuity:

• How To Calculate The P...

Net Present Value & Internal Rate of Return:

• Net Present Value - NP...

____________________________

Annual Percentage Yield:

• Annual Percentage Rate...

Amortization Loan Formula:

• Amortization Loan Formula

Amortization Table:

• How To Create an Amort...

Rule of 72:

• Rule of 72

Bond Yields:

• Intro to Investing In ...

Final Exams and Video Playlists: www.video-tutor.net/

Today😂😂

who's here because they have exams tomorrow :))

MEEEE

✨👉🏻🙋🏻♀️👈🏻✨

@@junclaireang5584 ti may pulos? HAHHA

@@lilyjanineentila7703 napuslan man? HAHAHA

@@lourediemurillo6126 wala kay wala ko gin lantaw HAHAHHA nag comment lang gid kodi ya

Your voice calms my nervous system when interacting with math. Bless you!

This guy really does it all

it took me 3hrs to find this. i have been scrolling over the videos but i only got math formulas. i wanted this for financial accounting. got bless your content. thank you so much

Thank you alot man. You did easily what my Prof didn't for more then 3hrs

Looks like he should’ve taken four hours because it’s ‘than’….

@@radi0bezel825 prof should also do the fifth hour for your bullying

Thank you so much ! the explanations and the examples are so clear.

Jesus Christ loves you. John 3:16

Thank u so much, ur videos ar really helpful.

Could u do one on source transformations, i would be grateful

Who's here because they can't understand what was in their modules?😭

you helped me pass statistics last semester, lets see if we can save the semester and pass my financial management finals later today :)

How’d it go? 😅

Excellent explanation!!! Thank you. 🐕

thanks a lot i needed this

Thank you so much 😊❤

Thank you so much. I know how to write English now

DUDE!!! after like 50 hours 2 minutes into this video you made the thing that I could not understand click. The top part of the formulas order

God Bless You, Thank you so so much

Thank you so much ☺️

What formula would I use to solve this? How did they get 119.1616? [Annuity PV factor I=0.09/12; N=25*12] = 119.1616

Great job.

Thank you so much🙏🙏

Thank you so much!!!!

ah, this saved my life. May God bless ur soul I SWEAR IM CLOSE TO GIVING UP BUSINESS MATH T__T

Another interesting series of financial mathematics! Which is my favorite haha

Turrete ur n hi pool

I don know what is about but I click on notifications

Thank you so much for helping me

thank you Sir!!! luvuuu

i love your work you've been helpful

can i ask a question though is the answer for your second method suppose to be 943.39?

okay you got it lol

yep he made a mistake

Thanks Sir❤!

Excellent ahahaha 😍🧐

thank you.

Easwest college brought me here. am a subscriber now.

thank you so much for everything.

Hahahah. I have exams tomorrow for financial management in the afternoon. Am here catching up. Thanks for the video

I love you reallly❤️❤️❤️❤️❤️

Bro knows everything

Last year, I made a property sale and had over $1 million in proceeds. I allocated $400k to index annuities and put the rest in the trending High Frequency Trading style. So far I've more than doubled the annuity premium from the stock market and sure enough will not need an annuity for the rest of my life. However I won't discredit annuities in any way, they buy you peace of mind but then a lot of people buy them out of fear of what's yet unknown even when it's not the best decision for them. If you need growth, try other stuffs. Annuities should be a backup plan, just like an insurance. Concepts like HFT/ algo trading and diversification of assets can be of great help for growth oriented individuals while still retaining control of your money. My two cents

I agree with the idea of considering annuities as an insurance rather than an investment. Nice portfolio you have going on though. kudos!

How does algo trading work? Might just be what I need now. I still need growth as much as the downside protection that annuities provide

@@George-hl7jf It's when your account mirrors someone else's trades. Trick is knowing who to copy. I managed to work my way into Josephine Guevara Laporte's popular algo trading program. She's a renowned CFA, you should check her out. There are other similar options out there but consistency and smart diversification skills were the clincher for me with Josephine.

@@profderek8111 hi I'm already in retirement and have like $700,000 in a CD account with a very low interest. I only need $30,000 for liquidity purposes(emergency fund) and plan on growing the bulk to over a million. I found Josephine Laporte's official website after looking up her name. Quite impressed at her portfolio and will schedule a call with her right away. What's the fee structure?

@@theexpendables3152 Since it's an algo trading based model, it's very much transparent because you can actually see what assets you have and how much growth your portfolio has achieved. She takes 10% of the profits, no hidden fees.

Great video. Do you mind showing how we can find r (the interest rate), if we know PV, C, n and t ?

Multiply both sides by r/c, then subtract1, divide both side by a negative. Then multiply both side by n, boom you'll get I

Hi , how can i work out the PMT if i have the NPV 43 460, n 5years, i% 20%. Formula please

What if we have a compound interest??? Does the same formula work??

Could you make one about a missing rate?

Hello can you do a video on pthly annuities plz

*Approximately* the same answer. If you run an If function, you'll realize they aren't equal. They deviate at 11dp

what if ur looking for the time?

can u make a video wherein there's no given C but only the overall ammount in 9 years for example

i was shocked when i red THE ORGANIC CHEMISTRY TUTOR

inclined plane and rod and B vertical. explain us 11 times the sense of the F-L

Got it 💪💪💪

Please help us LUMO and UMO tutorial

I’m literally learning about this right now wtf???

How to solve present value with missing terms? such as T-time

7:52 wow this one is great formula for present value as no formula to remember as such😂

Should have explained how the equation is derived.

Present value of perpetual annuity of the investment - present value of perpetual annuity of last month's cash flow (cause it ends you need to subtract the value of perpetual annuity).

For a 20 year guaranteed annuity at 6600 per year per 100k what is the value after 10 years? =PV(0.066,10,6600) 47,225?

in the second question I didn't understand where the 12000 is coming from????

Is this what they call general annuity ?

Exam in less than 2 hours😂

Me right now. 🤣

When I divided 1000 by 1.06 I did not get 949.3962, I got 943.3962. Am I crazy? Because I cannot continue the problem if I am unable to get the same answer as you. Please help, thank you!

He changed it watched the whole video

For no.2 annual credit, shouldnt C be 60k per year and r 0.07? I hope its a mistake

Boom 💥

what if the question has no interest rate?

8.Alex has won a scholarship for master’s degree and will leave for Canada eight months from now. He wants to provide his mother a monthly income of Br 125 during his two years stay in Canada, the first income to be earned a month after his departure. How much money should Alex deposit at the end of every month for eight months he will be in Ethiopia in an account which pays 12% interest compounded monthly to have money which is just enough to enable his mother withdraw the above-mentioned monthly income during the two years of his stay in outside Ethiopia? please help me as much as you can

Same after year . Same situation. Tomorrow i have paper . If again i fail 😬

Sir why number of year Is taken negative

I appreciate u! but the value of C is not the amount of money we earned but it is the amount of installment to earn in retirement!

at 4:00 its supposed to be 1000 / 1.06 = $943 .3962

Hoping you were going to go over how to solve manually. Non programmable calculators aren’t going to do this math

Highly recommend getting a financial calculator if you need to be doing this. They have them available online for free as well as for sale under $30. Hope you found something that helps you!

A STABLE INCOME IS MORE IMPORTANT THAN ANNUITY FOR RETIREMENT PLANNING. Big ups to everyone working effortlessly trying to earn a living while building wealth. I'm 40 and my wife 34. We are both retired with over $3 million in net worth and no debts. Currently living smart and frugal with our money. Saving and investing lifestyle made it possible for us this early even till now we earn monthly through passive income.

Can I get any investment advice from you?

can i have some $$$ pls? I am broke.

What I Don't Understand I Wish somebody would Explain In The 10 Videos I've Seen Is In Which Order Are We Calculating. Nothing Seems To Work

This formula is correct only if the flow is annuity, and all inflows are reinvested with the very same rate of return. (!!) You can't wastee these 1000's obtained on spending (!)

The example since that is incorrect: there can be no transfer of payments, all these 5000's have to be reinvested, not consumed.

Why we didn't made the Calcul with this formular "P=A/r(1+r)(1-(1+r)^-n"

The fourth step. How and where did it came from?

I am here for my report tomorrow 😭

Malcolm

Why do I keep getting negative?

The second problem, the cash flow was per month, why didn't you multiply by 12

G11 mag ingay:>

I can't sleep

Understood 10℅ out of everything only huhuhu

Check your PV, step one is incorrect, it's 943.39 not 949.39

he fixed that after he wrote it

Who's here because of their exams tomorrow ?

test in 2 days @ ul

1st comment, first view

My exam is in 30 mins

Bruh the solution is similar but we just have different values

Exam in 2 hours.😭

Thanks Mark Wahlberg.

Here to calculate how much i would earn 😂

Hi BKNHS students HAHAHAHAHHA

😅Is there any topic you dont know?

WHAT THE FUCK IS ANNUITY

PLEASE DADDY DO A FACE REVEAL LIKE IM BEGGING YOU

Tf is wrong with u

mozdan alaziz girl don’t act like you don’t want him to do a face reveal. He’s a damn legend. “tF iS wRoNg WiTh U” headass

Lets Be Honest. We Came Here Coz The Formula And Solutuon For This Topic Doesnt Make Sense In The Friggin Books.

when you do the formula pv= 1000 (1-(1.06)^-5 divided by 0.06 and you get 1000(4.212363786) What is the order of operations for the (1-(1.06)^-5 divided by 0.06 part in order to get the answer 4.212363786

Please help us LUMO and UMO tutorial

For no.2 annual credit, shouldnt C be 60k per year and r 0.07? I hope its a mistake

Who's here because they can't understand what was in their modules?😭

We know you are naturally talented myob