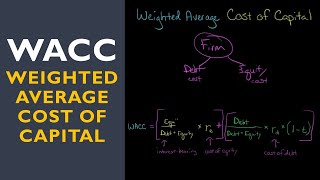

WACC - Weighted Average Cost of Capital, WACC formula and Cost of Capital explained in detail

Вставка

- Опубліковано 14 вер 2022

- WACC - Weighted Average Cost of Capital, WACC formula and Cost of Capital explained in detail

WACC.

Goal for this Video: 1 Like and 1 subscribe click from you. Please can you help me in this goal?

Link to download all pmtycoon files: forms.gle/fe1VqMmFJ37XjhB99

Topics to learn in sequence after this video.

(You can find these topics on my channel here: www.youtube.com/@pmtycoon/videos)

1. Learn Capital Budgeting Techniques)

Skip it: WACC (You already learnt it here, so you can skip it).

2. Learn CAPM (Capital Assest Pricing Model)

3. Learn Beta Analysis

4. Learn Sharpe Raito

5. Learn Financial Accounting

6. Learn DCF (Discounted Cash flow)

7. Learn MIRR (Modified Internal Rate of Return)

8. Learn Company Valuations

Disclaimer:

=====================================================

Disclaimer: Some contents are used for educational purposes under fair use.

Copyright Disclaimer under Section 107 of the Copyright Act 1976, allowance is made for "Fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship, and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use.

=====================================================

Keywords:

корпоративные финансы

средневзвешенная стоимость капитала

wacc berechnen

wacc

capm

wacc tax shield

cost of equity share capital

cost of capital

cost of equity

wacc erklärung deutsch

cost of preference

cost of preference share capital

cost of preference shares

wacc erklart

wacc finance

wacc and capm

capm in wacc

wacc capm

weighted average cost of capital

wacc explained simply

wacc weighted average cost of capital

cost of debt

what is cost of debt

dcf valuation

how to calculate wacc

wacc calculation

wacc definition

wacc dcf

calculation of weighted average cost of capital

wacc explained

corporate finance wacc

what is wacc in corporate finance

weighted average cost of capital explained

wacc cost of capital

how to calculate weighted average cost of capital

weighted average cost of capital explained simply

weighted average cost of capital example

weighted average cost of capital calculation

cost of debt.

wacc formula

wacc example

how to use weighted average cost of capital

what is cost of capital

what is wacc

how to use wacc

how to find wacc

wacc rate

how to calculate wacc in excel

como wacc finbox

how wacc is calculated nepali

que montos se considera para el wacc de una empresa

how to edit wacc calculation meroshare

how to calculate wacc and edis and my purchase sourse from edis

how to calculate wacc in share sansar

what is wacc hindi

how calculation of wacc

how to calculate wacc no debt

como descobrir o wacc

how to do wacc payment nepse

como sacar el wacc en excel

how to calculate wacc for bonus share

what are the projects npv assuming the wacc will change

how to find the ratio of wacc math

how to know wacc

what is cost of capital and wacc

how to find wacc of private company

how to do wacc of a company

how to count wacc from financial statements

how to determine cost of debt for wacc

what is wacc calculation

como calcular wacc en excel

como calcular wacc

how to calculate wacc from annual report

which company should choose wacc excel

how to do wacc calculation

thanks for the smooth teaching. the fact that you recorded this video in the wee hours of the night(3.48am) shows 100% commitment to share with the world what you know. cheers

Thank you so much 🙏 you got an eye for details 😊

Thank you! This was such a clear explanation. I have passed it on to fellow MBA students.

Sorry for the f word, but you are fucking amazing and the teaching skills could'nt be any better than this, everything so well explained like stick using a glue into someone's brain. Keep it up man!! cheers to you

Glad you liked.

Why have you stopped making videos???you are one of the best teachers on youtube

No time mate. Opportunity cost is high at the moment 😉

Thank you so much! Very helpful!

there is no any example Sir thank you.😍

Feedback taken , Will make another video with example questions,, just thought of teaching the concept of WACC

Great, just great. Narrow topic, but highly useful explanation for professionals!

Glad to hear that ☺️

You here , removed the fear of that wacc formula just in a simple way , great job sir 👍👍👍

Glad it was helpful

it's such a brilliant I have made every before. Thank You so much sir, a big brave for you. Your teaching technique amazing.

Thank you 😊

BLESSED may be your endevours. Thank you for this

🙏

A great way of teaching sir , it's highly highly appreciated 👍👍.

Thank you Neha

You removed the fear of WACC formula. Thnqq Soo much (:

Honestly that was the intent to remove the fear. Now that you know the concept you can derive the formula yourself anytime in future without having to by heart. Watch my capital budgeting techniques video to learn the concepts

Great video. What is the impact on the WACC if the company uses self-financing (Reserves/Amortization)? Would the cost be higher to self-finance than getting a bank loan?

Thank you

Thank you so much! You are absolutely a good professor in UA-cam university! It'd be better if you can invest on your microphone thus the students can hear better, thanks again!

Sure will do. Bought one already 😀

U're really a lecture 😊 I really like your teachings already... I'm a graduate in Finance...Well explained

Thanks 👍🙏

amazing class sir

Thank you 👍

please we need you to make video about devidend policy please if u can

Excellent class

Many thanks

Thanks

Welcome

thanks

you should post this link before exam and help :P

Good explanation

Thank you

Please help to add a case study and problem too.

please make a video on time value of money

Sure

Sir, can cost of capital be more/less that owners capital/fund? Thank you.

No...How can cost of capital which is interest of loan we have to pay or dividend which is also not compulsory to pay will be more than the total capital which is borrowed fund or promoters money.??think like this..

@@Abhishek-ye9kq sir, can it be volatile depend upon the market risk? Thank you

@@debrajdaschaudhuri411 u mean cost of capital are being volatile or not upon market risk?Is this what u asking?

@@Abhishek-ye9kq yes sir.

Sir, if market risk is higher or lower , than cost of capital becomes high or low irrespective of owners fund. Am I thinking correctly or not? Thank you sir.

Pmtycoon Recommended Courses: tinyurl.com/pmtycoon-advised-courses

Pmtycoon’ s Google Drive: tinyurl.com/pmtycoon-Google-Drive

Follow me on Twitter: twitter.com/pm_Tycoon

Subscribe to my UA-cam channel: tinyurl.com/pmtycoon-subscribe

Follow me on Instagram: instagram.com/pmtycoon/