Black Scholes Explained - A Mathematical Breakdown

Вставка

- Опубліковано 13 січ 2024

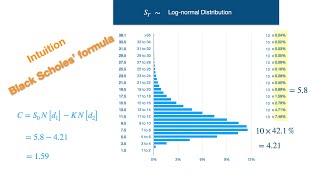

- This video breaks down the mathematics behind the Black Scholes options pricing formula.

The Pricing of Options and Corporate Liabilities:

www.cs.princeton.edu/courses/...

Excel Model

docs.google.com/spreadsheets/...

3b1b Normal Distribution Video

• Why π is in the normal...

Note: Be sure to download the sheet in Excel, as not all formulas will populate in Google Drive.

![[柴犬ASMR]曼玉Manyu&小白Bai 毛发护理Spa asmr](http://i.ytimg.com/vi/0TsXQ7z2Dh4/mqdefault.jpg)

This channel is a hidden gem. Incredibly insightful, explained clearly and perfectly presented!

That’s incredibly kind! Stay tuned for more upcoming videos

Absolute magnificent. I have been wondering about how options work for years+! Thank you so much for the in-depth walkthrough!

Thanks for the concise explanation. Very helpful and easier to understand than the one my professor gave.

3:34 what’s your justification for reducing d2 to d1?

d2 is not reduced to d1, there is still a negative sign in d2 that is not in d1. However, the reason I reduce it down from the original long form of d2 = (d1 - sig(T)) is because it is a little easier to see visually, and it highlights that the difference between d1 and d2 are their inverse relationships with regard to volatility (sigma). I show the long form initially because when you see Black-Scholes, much of the time d2 is shown in the long form.

@@financeexplainedgraphics I see thanks