If This Breaks, Could Trigger 1st Volmageddon Crash in History

Вставка

- Опубліковано 29 вер 2024

- Technical analysis of the stock market S&P 500 ( SPY ) Dow Jones ( DIA ) NASDAQ ( QQQ ) stock market bottom & reversal indicators, recession indicators & Money Time Machine Indicators.

You can support me and gain access to all of my real-time trades, investments, analysis and much more via our private Discord trading community here:

/ moneytimemachine

Get up to 30$ off TradingView by signing up here :

shorturl.at/jvGJY

Love your breakdown

What do you think about that Dr Kal. The vix, NOT making a higher high…is it being suppressed? How does one suppress it? Do the market makers do that? Thank you

It’s being suppressed by the 0DTE traders, both retail and pros. They are taking momentum trades in the direction of price action on the day the options expire. Since they expire the same day or sometimes the next day, that put and call volume and price movement don’t significantly affect the volatility of the longer dated options that the VIX is based on.

As you may know, it’s really the demand for those longer dated options during dramatic price movements that cause VOL to spike up. Simple supply and demand. That’s why put prices skyrocket during capitulation moves, sellers want more money to compensate for the increased risk and uncertainty they are taking.

Don’t forget about the Fed Jackson Hole meeting next week

That NVIDIA bubble holding is one of the most crazy things in this world. More crazy than me buying calls on the Netherlands index that droped after market close another 2% just for fun. (actually it wasn't after close, i was at work)

But don't worry .. NVIDIA and AI will save me. Actually NVIDIA has to be more valuable then whole Netherlands so i believe in 3% rebound in 6 hours xD

VIX tells how the market feels right now (today). It's not reliabe prediction of near term

Is Nvidia looking like a Textbook distribution pattern?

Jackson Hole is next week Dr. Kal

Long story short... stay with cash

Wrong! Go short! ❤

Buy SQQQ ❤ breakout!!

I prefer precious metals, like steel pipes, lead, brass, nitrocellulose, that last one is not a metal.

And of course, shorts, but not just yet they got one more short lived stampede for the cliff, I'm thinking this coming week, might only be a couple days

Gold 🥇 and silver 🥈 😃👌

Dr. Kal is smart. Today is Oct 3rd and SPY closed 421.57. Exactly where he predicted.

Max pain is the most debunked theory in the market. it doesn’t account for how much the contracts were sold for and therefore “max pain” is not the real “max pain” where MM would make the most money

Do you think we will go to top again before we will go lot lower like recession type of sell off?

Thank you 🙏🏻 🍀

You called the breakout right. I was wrong on that one. Becoming a fan.

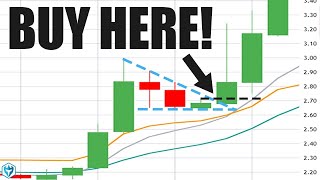

the "double" line is called "Andrew's pitchfork"

Puts puts puts

max pain is 435

We have a Jackson hole waiting on the 24th what is it at Thursday that could be very

And Powell speaking too

Good stuff !!

Crypto’s broken that trend line today!! Stocks should follow!

The 2022 crash started with a crypto crash. Risk off and new 12 month lows coming

TY❤

Can you please answer a question? MM are net sellers of options, but when you just sell one back dont you normally sell back to MM? Dont we know most short dated options arent held to maturity which would mean the MM is the largest net buyer of options also by the end of the day most have been sold back to them. Is this accurate? Please let me know why it is or isnt? Thanks!

I’m gonna give this a go, just a friendly answer.

The MM do something called “Delta Hedging” where as the price moves towards strikes with large open interest they are either buying or selling shares trying to stay neutral from the price action. (This can also accelerate the move/trend) They don’t want to have to cheer for the market to go one way or another they want to be neutral. So this is why after large OPEX dates the market usually goes the other way it had been trending rather quickly, because the market maker then has to unwind their Delta Hedge that they needed to be neutral. So they either sell back long shares or buy back short shares which can cause a rapid move and cascading effect. (Not always of course)

@@nickvanfossen5300Thx...that helped me out. I will try and apply that in my trades nxt month

I personally expect around 12 months of up and down sideway movement and then major capitulation around August 2024.

Quite a vague analysis

@@XxJoshua2012xX I base it on past chart history. Rate hikes, election year, time span.