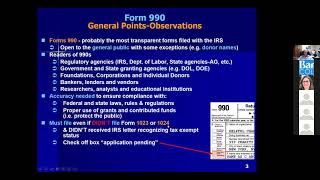

Nonprofit Tutorial: How to file the "IRS Form 990 Information Return?"

Вставка

- Опубліковано 2 лип 2024

- Nonprofit professionals MUST file the appropriate "IRS Form 990 Information Return" each year. If they miss filing the appropriate form for three consecutive years, then the IRS automatically revokes the 501(c)(3) status.

What you will learn in this tutorial ...

This video tutorial describes the following:

1) the three types of Form 990 Information Returns

2) how to select the appropriate type of Form 990 to file

3) how to determine the due dates for Form 990

Stay connected!

Susan Woods, Nonprofit Consultant

Phone Number: 704-968-2769

Website: www.TrustSusanWoods.com

Facebook: / asksusanwoods

Thank you. This is a good intro. This is my first year to file.

This was so good, awesome information, I was just like the lady in the video until I came across your page, I love it

Thank you!

This was hands down the THEE most informative, detailed and easy to understand video about this subject that I have ever heard!! For someone who was completely confused. I feel confident in my understanding of the 990 filing.

Thank you so much!! I'm glad the video helped you.

So helpful!!!!!

Thank you so much

Susan is so amazing and breaks things down so easy to understand! Thank you I would recommend her to anyone. She has help me so much and I'm on my way, slowly but surely.

You are so welcome! I really appreciate your feedback. I'm in the process of updating all of my "how to start 501(c)(3) nonprofits" videos to reflect recent IRS changes.

This is the best I have seen yet !!!

Thank you my luv, this was very informative and thorough.

Thank you for this informative video. The table you provided in regards to the filing date are they the same every yr or does tht table change?

thank you for this!!!

Great info thank you :)

Good tutorial. Thanks fellow WU Grad!!

Happy to help!

Thanks 🙏🏿

Thank you

Hello, how do you establish your fiscal year to file the 990. Our business was started in July of 2020.

You determined your fiscal year when you applied for 501(c)(3) status. It was one of the questions in the application.

The fiscal year represents the time of year when your accounting period ends. Most organizations use December 31 as their fiscal year end.

Your Form 990 is due five months and 15 days after your fiscal year ends. Therefore, if your fiscal year ends on December 31, then your Form 990 is due May 15 of the following year.

What if you applied for your 5013C status but you haven't been approved but you are operating

If you are accepting donations without a 501(c)(3) status, you are committing fraud.

Even if you’re a social enterprise?

And can’t you find a fiscal sponsor?

Thank you

You're welcome