Don't Lose Your Home in Bankruptcy. How your home is protected when you file bankruptcy.

Вставка

- Опубліковано 24 сер 2024

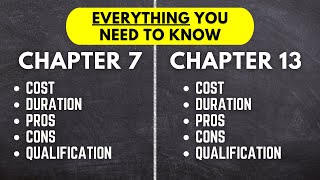

- How not to lose your home in Bankruptcy? Will you lose your home if you file bankruptcy and what can you do to stop that from happening. This simple and accessible video should help you understand your options and solutions for filing bankruptcy if you own your home.

Matt Berkus is a Colorado licensed bankruptcy and debt relief attorney with 18 years of experience. I offer free phone consultations to residents of Colorado for the purpose of bankruptcy. Click on my websites for additional information and for the phone number to call and schedule.

My Websites.

mattberkus.com/

mattberkus.com/...

www.personalto...

#bankruptcy, #chapter13 #chapter13bankruptcy, #bankruptcyattorney, #bankruptcylawyer

![Bankruptcy - [Keeping your House and Car]](http://i.ytimg.com/vi/QspST8Kw4FQ/mqdefault.jpg)

![Bankruptcy - [Keeping your House and Car]](/img/tr.png)

Awesome content appreciate the one question I have I can't seem to find out is. If only one person files for bankruptcy and your married both jointly on the mortgage how does that effect your spouse?

If you want to keep the house, then you continue to pay the mortgage. The bankruptcy should not affect the non-filing spouse. If there is too much equity in the house to be protected, the house can/will be liquidated (sold) even though the other spouse is not filing.

at what point can apply for bankruptcy. after one of not paying mortgage or two years when is a good time??

I am not following your question. To save a house from foreclosure, one must file bankruptcy before the foreclosure sale. If the foreclosure sale already occurred, it is too late. Beyond that, one should not delay filing bankruptcy to save their home. The longer one waits, the more you have to pay to catch-up. So, as soon as the person is more or less financially secure (i.e. that the reason they fell behind on the mortgage in the first place is mostly resolved), they should get with an attorney and determine their options.