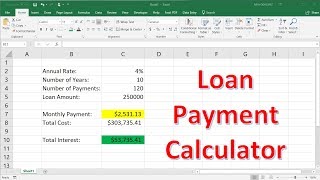

How to Calculate Loan Payment with Excel PMT Function

Вставка

- Опубліковано 26 сер 2024

- How to calculate loan payment with Excel PMT Function?

In today's tutorial, I'll show you how to use the PMT function in Excel to calculate your monthly loan payments. We'll start with a practical example: calculating the monthly payment for a $30,000 loan with a 5% annual interest rate over 5 years. I'll guide you step-by-step through entering the loan details, adjusting for changes in loan amount and interest rate, and how to display the result without a negative sign. This method is adaptable to various loan scenarios. So, grab your Excel and follow along!

Steps to Calculate Monthly Loan Payments in Excel Using the PMT Function:

1. Prepare Your Spreadsheet:

- Open Excel and set up your spreadsheet with the loan amount, annual interest rate, and loan term in years.

2. Calculate Total Number of Monthly Payments:

- In a cell, type `=B7*12` (assuming B7 contains the loan term in years). This formula calculates the total number of monthly payments for a 5-year loan term.

3. Use the PMT Function to Calculate Monthly Payment:

- Click on the cell where you want to display the monthly payment.

- Type the formula: `=PMT(B6/12, B8, B5)`, where:

- `B6` contains the annual interest rate.

- `B8` contains the total number of payments (calculated in the previous step).

- `B5` contains the loan amount.

- This formula will output the monthly payment amount.

4. Adjust for Positive Number:

- If the result shows as a negative number (representing cash outflow), you can adjust the formula to `=-PMT(B6/12, B8, B5)` to display it as a positive number.

5. Dynamic Recalculation:

- If you update the loan amount or interest rate in your spreadsheet, the monthly payment will automatically recalculate to reflect these changes.

Don't forget to like, subscribe, and drop any questions or feedback in the comments below.

Subscribe to WebWise - / @web-wise