Have pensioners been betrayed by the Budget? Feat. Nina Myskow & Belinda de Lucy | Storm Huntley

Вставка

- Опубліковано 7 бер 2024

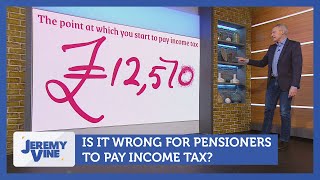

- Pensioners have been described as the 'biggest losers' over changes to tax thresholds and it's expected to leave 8 million of them £1,000 worse off.

Jeremy Vine on 5 is on television every weekday at 9:15am until 1:30pm on Channel 5.

Subscribe to the channel for more celebrity interviews, hot topics and debates: bit.ly/34DvAv4

Twitter: / jeremyvineon5

Facebook: / jeremyvineon5

Instagram: / jeremyvineon5

#stormhuntley #pensioners #tax

Still the lowest pension in the western world & now they have to pay tax on a small pension.

Not even a remotely apples to apples comparison. Other countries have different system regards to how much tax they pay throughout their working life and the arrangements with regards personal contributions. Anyone who even mentions our State Pension in the same breath as either the French, Australian or American system, or intimates it without specifically mentioning them, is gaslighting pure and simple.

They don't. The standard state pension is less than the tax threshold, so you don't pay tax on it. The only ones paying tax are those with additional private pensions or who receive SERPS.

No they dont. They only pay tax if they have additional pension income

@@TheDavecroft So we’re all idiots for paying into a private pension to try to improve ever so slightly our retirement. Better not to bother and claim benefits according to your thinking eh??

@@laurenceteague4099 Which they’ve worked scrimped and saved for ALL their working lives.

Tax threshold should be have gone up

The personal tax allowance should be raised to 15K.This would help low paid workers and pensioners.

Stop taxing pensions we've paid in for fifty years. Try taxing the foreigners,there's enough of them to clear the nation debt.

When National Insurance was first introduced it was for the NHS and pensions now it is just used as general tax revenue

8% on £165 and £220 which ever pension you get is a very small amount in relation to 8% on a salery for someone of working age.

Yes but people don't equate that sadly

The UK has the worst pensions in the developed world apart from Chile and Brazil

Yes and Brazil has cheap electricity!!

It astonishes me that younger people bemoan UK pensions and the Triple Lock. It's there to protect ALL our future pensions. When Sunak suspended the Triple Lock, it cost someone in their 30s over £1,500 a year in pension by the time they reach state retirement age. Stop attacking pensioners and try fighting against government cuts and austerity instead. Meanwhile the Super Rich just get fatter.

Ive been paying tax 75 years, but im not a wealthy pensioner. Born before well before the April 1935 threshold, i am considered as my husbands dependant wife, so have a tiny state pension, under £ 90 per week. But i am taxed as a single person! My small private pension traps me, tips me just into tax and just too much for any state support. The very old, ie over 90s , pay for social support, cleaning, shopping if you are childless. As we are. Our expenses are prodigious but can't be claimed against tax. I am a full time carer for my husband, but i am too old to claim carers allowance. It makes me feel unwanted now that I'm old, except when it comes to money. I have to pay for Internet connection or i am cut off from all forms of Admin, but no allowance for that. You might feel bad as a pensioner in your late 60s , but get ready for the shock of superage....you'll need a fortune ....which will be taxed.

So sorry 🥺

I thought i would get my pension at 60 but didnt until 66, i had to live on 600 pounds a month from 62 to 66

I don't buy this excuse. I'm male and I knew women's pension age was going up years ago. Every single woman I know who is in their 60's knew exactly when they would get their state pension. It has been publicised in the media and elsewhere for decades. Letting women claim their state pension at age 60 was age and sex discrimination. I find it unbelievable that anyone didn't know their pension age was changing.

Overseas pensioners have been subject to unfair discrimination.😡

So if you have a small private pension cash it in and they can tax the lump sum ?

Give me back all the tax I’ve paid through out my life. Income tax council tax vat national insurance car tax and all the other stealth taxes I’ve paid all my life. I wouldn’t need the messily pension then . God theres so much wrong in this cesspit country .

Most people get far more back in state pension than they ever paid in NI. In my last year of work (2014) I paid £2500 national insurance. Now I get over £10000 a year state pension. If I live for just 10 years in retirement I'll get back fat, far more than I paid in.

So I've worked and paid tax and NI for 50 years, and if I get my pension for 10 years I'll get more than I paid in, not sure about that 🤔

@@TheDavecroftand what about the people who payed all their lives and died before the was pension age.we all don’t live the same age you are very lucky

8.5 % of not a lot doesn't give them much

No it isn't then we get taxed

Lower tax means less money for public services, including the NHS. Plight of the WASPI women also needs addressing.

Agreed but I paid taxed for sixty years not forty years because I took out a private pension at seventeen years old for 10 SHILLINGS a week,

just the word pensioner in the uk means poverty income we all know that, thats before any other gov scams are legislated on the meagre return for paying nrly 50yrs tax and ni , lowest pensions in the eu almost ,

Even worse is the cutting of national Insurance which means eventually people will get a free old age pension paid for by pensioners who have already paid 44 years and will have to pay extra tax to pay for them

It is only people on the new pension which came in 2016 some people on the old state pension get much less.

Yes but they get access to pension credit which opens up all the cost of living extras

New state pension excludes that

I had 46 years contribution

We have been let down by the labour and tory goverments

Dead right they have . They are always in the firing line

Paying more now than ever get rid con

Tax threshold should be increased for all groups of people. But absolutely pensions should be taxed, same as all income. Pensioners already receive an NI break and many of who are asset rich. Personally, I feel sorry for the youngsters coming through now, with no real prospect of ever retiring.

Yes they have been let down and left out. What younger people forget is that your income does not become tax free when you retire. I ha v

Be paid

I'm pre pensioner, age 64, I don't get thripple lock, I don't benifit from N. I reduction I GET nothing and left to struddle

You'll be struggling even more when you are 92 and still paying tax as you just catch the threshold , like me. Pensioners born before 1935 get the worst deal of all. There are not that many of us left to form a pressure group so we are fair game. My advice is learn to play the system , I see people your age who have barely ever worked, driving a Mobility car, rent paid, free specs and teeth, hospital travel expenses and first in the queue for appointments at the surgery because of their stress levels. Poor mental health is the buzzword, I give you that for nothing. That should be your ambition because you'll retire in comfort paid for by idiots like me!

My mum is 86 years old was left a private pension by her late husband she pays tax ,i have a relative that only started working 8 years ago reared their family on the state only work part time now so has never payed tax and still doesn't pay tax ,and another relative in their 30s popped 2 kuds out as a teenager got a house and all the benefits that goes with it only works 10 hrs a week and spends their family tax credit on botox and lip fillers! how is that fair 5.5 million people of working age on benefits and this government is taxing pensioners!

If you think it's unfair now wait until Labour get in. They love to throw money at the workshy.

They keep saying pensioners will be £1000 worse off. Where does this figure come from??? If you get an 8% increase and pay 20% tax you still have 80% of your increase so youre better off not worse off

Yes

Nina Myskow says Tories put profits before peope. Well it was only self profit not countriea profit.

In so much trouble

👍👍👍👍👍👍

Average pension including additional and state is 18,000, 2 million Pensioners are currently in over (20%) + 4 out of 10 retiring will be joining them

Budget served 32,000 - 55,000 the sweet spot is 50,000 every one else had a tax increase

Where do you get 18,000 from

@@christopher554 The government's most recent data (as of 2022) shows the average weekly income for pensioners to be £349 - that's after you've taken away direct taxes and housing costs. This works out at around £18,148 per year.11 Jan 2024

Most pensioners I know just got 12,305 with this April rise

@@christopher554 It's averages, most people I know have multiple work pensions as well as the State pension

There the lucky ones

Nina contributing to the country 😂😂😂, Jesus wept.

Firstly, you only pay 20% tax on anything over the threshold. So if your pension goes up by say £10, you still keep £8. It is impossible for most pensioners to be 'worse off'. Secondly, people pay far less in NI during their working lives than they get in pensions - I paid £2500 in NI the last year I worked. Now I draw over £10000 a year in state pension. Thirdly, people who have worked for 40 years or more have had plenty of time to pay into a private pension.

Yep, well I paid into a company and a private pension.

Through a bad patch in my life I had to stop paying into the private one . The company paid a small annuity which doesn't increase. However it tips me into paying tax.

I get no cost of living help as new state pension is 2.00 over pension credit.

I am not rich and not likely to be.

A lot of pensioners are classed as poor.

Don't categorise all pensioners by those more comfortable, a lot simply aren't

Omg whst attiude these presenters have when a callet mentioned about wasting money on immigrants ,she tryed to snuff it out it all psrt of the problem ,which pisses poeple of when they get everything for feck all ,she obvuoisly not favour of british poeple first tut tut 😡🤬😈😈