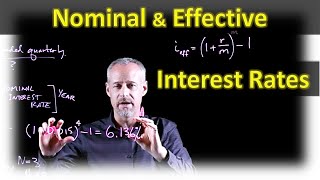

How To Convert (And Formula For) The Effective Interest Rate To The Nominal Interest Rate Explained

Вставка

- Опубліковано 28 чер 2024

- In this video we discuss how to convert the effective interest rate to the nominal interest rate. We go through the formula to make the conversion and show an example

Transcript/notes (partial)

The nominal interest rate is the stated rate and it does not take into account different compounding periods. The effective rate of interest does take into account different compounding periods.

As an example, if someone invests $1000 in an account that makes them $88 of interest over a year, the account compounds interest every 2 months, so 6 times per year, then the effective annual interest rate is 8.8%, $88 divided by $1000. What is the nominal annual interest rate?

Since the nominal annual interest rate does not take into account different compounding periods, we know that the nominal annual interest rate will be less than the effective rate of interest.

The formula to convert the effective rate of interest to the nominal rate is, nominal rate equals, the number of compounding periods times the quantity, 1 plus the effective rate, raised to the 1 divided by the number of compounding periods, minus 1. Here is the short version of the formula with the variables listed.

So, plugging into the formula, we have nominal rate equals, 6, the number of compounding periods, times the quantity, 1 minus .088, the decimal value of 8.8%, raised to the 1 over 12, minus 1.

Chapters/Timestamps

0:00 What is the difference between the nominal interest rate and the effective interest rate

0:10 Example set up

0:37 Formula to convert the effective interest rate to the nominal interest rate

0:55 Example calculated out on the screen