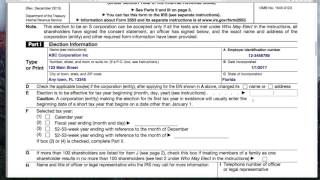

IRS Form 2553 walkthrough (Election by a Small Business Corporation)

Вставка

- Опубліковано 5 вер 2024

- Subscribe to our UA-cam channel: / @teachmepersonalfinanc...

Please feel free to check out our article, where we've written step by step instructions to help you walk through this tax form! www.teachmeper...

If you’re looking for tutorials for other IRS Forms that you can file directly through the IRS website, check out our free fillable forms page: www.teachmeper...

Purpose of Form

A corporation or other entity eligible to elect to be treated as a corporation must use Form 2553 to make an election under section 1362(a) to be an S corporation. An entity eligible to elect to be treated as a corporation that meets certain tests discussed below will be treated as a corporation as of the effective date of the S corporation election and doesn’t need to file Form 8832, Entity Classification Election.

The income of an S corporation generally is taxed to the shareholders of the corporation rather than to the corporation itself. However, an S corporation may still owe tax on certain income. For details, see Tax and Payments in the Instructions for Form 1120-S, U.S. Income Tax Return for an S Corporation.

Who May Elect

A corporation or other entity eligible to elect to be treated as a corporation may elect to be an S corporation only if it meets all the following tests.

It is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files Form 2553 and meets all the other tests listed below. If Form 2553 isn’t timely filed, see Relief for Late Elections, later.

It has no more than 100 shareholders. You can treat an individual and his or her spouse (and their estates) as one shareholder for this test. You can also treat all members of a family (as defined in section 1361(c)(1)(B)) and their estates as one shareholder for this test. For additional situations in which certain entities will be treated as members of a family, see Regulations section 1.1361-1(e)(3)(ii). All others are treated as separate shareholders. For details, see section 1361(c)(1).

Its only shareholders are individuals, estates, exempt organizations described in section 401(a) or 501(c)(3), or certain trusts described in section 1361(c)(2)(A).

For information about the section 1361(d)(2) election to be a qualified subchapter S trust (QSST), see the instructions for Part III. For information about the section 1361(e)(3) election to be an electing small business trust (ESBT), see Regulations section 1.1361-1(m). For guidance on how to convert a QSST to an ESBT, see Regulations section 1.1361-1(j)(12). If these elections weren’t timely made, see Rev. Proc. 2013-30, 2013-36 I.R.B. 173, available at IRS.gov/irb/2013-36_IRB#RP-2013-30.

It has no nonresident alien shareholders (other than as potential current beneficiaries of an ESBT).

It has only one class of stock (disregarding differences in voting rights). Generally, a corporation is treated as having only one class of stock if all outstanding shares of the corporation's stock confer identical rights to distribution and liquidation proceeds. See Regulations section 1.1361-1(l) for details.

It isn’t one of the following ineligible corporations.

A bank or thrift institution that uses the reserve method of accounting for bad debts under section 585.

An insurance company subject to tax under subchapter L of the Code.

A domestic international sales corporation (DISC) or former DISC.

It has or will adopt or change to one of the following tax years.

A tax year ending December 31.

A natural business year.

An ownership tax year.

A tax year elected under section 444.

A 52-53-week tax year ending with reference to a year listed above.

Any other tax year (including a 52-53-week tax year) for which the corporation (entity) establishes a business purpose.

For details on making a section 444 election or requesting a natural business, ownership, or other business purpose tax year, see the instructions for Part II.

Each shareholder consents as explained in the instructions for column K.

See sections 1361, 1362, and 1378, and their related regulations for additional information on the above tests.

A parent S corporation can elect to treat an eligible wholly owned subsidiary as a qualified subchapter S subsidiary. If the election is made, the subsidiary's assets, liabilities, and items of income, deduction, and credit generally are treated as those of the parent.

For details, see Form 8869, Qualified Subchapter S Subsidiary Election.

Please feel free to check out our article, where we've written step by step instructions to help you walk through this tax form! www.teachmepersonalfinance.com/irs-form-2553-instructions/

Great explanation I now have a better understanding of completing form. Thanks for your time.

Thanks for doing step bye step instructions

Thank You so much. Greatly appreciated.

What if the tax return was filed and requested an extension with a balance due? Can you still request for an election mid August ?

According to the IRS, you are supposed to complete and file Form 2553:

-No more than 2 months and 15 days after the beginning of the tax year the election is to take effect, or

-At any time during the tax year preceding the tax year it is to take effect

It seems that the only scenarios in which you could request an election mid-August are if this is the first tax year of your corporation's existence, or if you are making the election to take effect next year.

I'm not 100% clear. If I want my 2023 LLC taxes to have an S Corp filling I need to wait until Jan 2024 to submit the form?

It's too late for your 2023 S corporation filing. You can elect S corporation status for the 2024 tax year any time this year, or up until March 15, 2024 (assuming your tax year is based on a calendar year). Below is the guidance directly from the form instructions, as well as 3 examples (I think Example 2 is closest to your situation).

Complete and file Form 2553:

-No more than 2 months and 15 days after the beginning of the tax year the election is to take effect, or

-At any time during the tax year preceding the tax year it is to take effect.

For this purpose, the 2-month period begins on the day of the month the tax year begins and ends with the close of the day before the numerically corresponding day of the second calendar month following that month. If there is no corresponding day, use the close of the last day of the calendar month.

Example 1. No prior tax year. A calendar year small business corporation begins its first tax year on January 7. The 2-month period ends March 6 and 15 days after that is March 21. To be an S corporation beginning with its first tax year, the corporation must file Form 2553 during the period that begins January 7 and ends March 21. Because the corporation had no prior tax year, an election made before January 7 won’t be valid.

Example 2. Prior tax year. A calendar year small business corporation has been filing Form 1120 as a C corporation but wishes to make an S election for its next tax year beginning January 1. The 2-month period ends February 28 (29 in leap years) and 15 days after that is March 15. To be an S corporation beginning with its next tax year, the corporation must file Form 2553 during the period that begins the first day (January 1) of its last year as a C corporation and ends March 15th of the year it wishes to be an S corporation. Because the corporation had a prior tax year, it can make the election at any time during that prior tax year.

Example 3. Tax year less than 2½ months. A calendar year small business corporation begins its first tax year on November 8. The 2-month period ends January 7 and 15 days after that is January 22. To be an S corporation beginning with its short tax year, the corporation must file Form 2553 during the period that begins November 8 and ends January 22. Because the corporation had no prior tax year, an election made before November 8 won’t be valid.

Thank you so much for your detailed response!! I have another question. If the company was formed in 2022. And I submit the 2553😢 to take effect for 2024 will I still need to add a " late filing explanation" when I submit the form?

@@user-md1ou3bg1z I would refer to Example 2:

Example 2. Prior tax year. A calendar year small business corporation has been filing Form 1120 as a C corporation but wishes to make an S election for its next tax year beginning January 1. The 2-month period ends February 28 (29 in leap years) and 15 days after that is March 15. To be an S corporation beginning with its next tax year, the corporation must file Form 2553 during the period that begins the first day (January 1) of its last year as a C corporation and ends March 15th of the year it wishes to be an S corporation. Because the corporation had a prior tax year, it can make the election at any time during that prior tax year.

As long as you file on or before March 15, I don't believe you need to make a late filing explanation.

If an entity was opened on April 2024, do I need to wait to file form 2553 on Jan 2025? or can I file form 2553 selecting election January 2025 and explaining why its late?

If your business entity did not exist before April 2024, then you would have 2 months and 15 days from the date that your business entity was established to file this form.

If you wished to make the election starting in 2025, then you would have 2 months and 15 days from the beginning of the 2025 tax year (or all of the 2024 tax year) to make that election. For most S corporations who operate on a calendar year basis, your 2025 deadline would be March 15.

So meaning my election date should be same as when the entity was formed?

@@cathsilvamusic It can be, but doesn't have to be.