Bank Loan Default Prediction: CART Model in SPSS with 5-Fold Cross Validation

Вставка

- Опубліковано 12 вер 2024

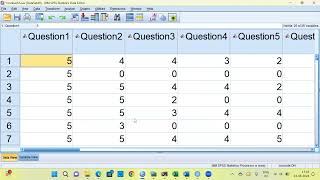

- Unlock the power of predictive analytics with our step-by-step guide to predicting bank loan defaults using the CART model in SPSS. In this video, we'll walk you through the process of setting up and running a 5-Fold Cross Validation, ensuring your model is robust and reliable. Whether you're a data science enthusiast or a finance professional, this tutorial will equip you with the skills to enhance your predictive modeling techniques and make data-driven decisions.

Key Points:

1. CART (Classification and Regression Trees): We'll dive into the fundamentals of CART, a versatile decision tree technique used for both classification and regression tasks.

2. Gini Index: Learn how the Gini Index is used as a criterion for splitting nodes in the decision tree, helping to minimize impurity and improve model accuracy.

3. Twoing Rule: Understand the Twoing rule, another splitting criterion in CART, that focuses on maximizing the difference between groups to create better splits.

4. Risk Assessment: Discover how to assess and interpret the risk estimates in your CART model to evaluate its performance and reliability.

5. 5-Fold Cross Validation: See how 5-Fold Cross Validation is applied to validate your model, reducing overfitting and providing a more accurate measure of model performance.

Don't miss out on learning how to leverage SPSS for accurate and efficient loan default predictions!