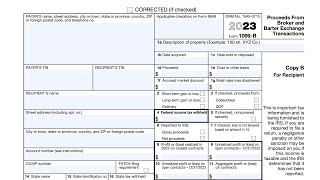

IRS Form 1099-OID walkthrough (Original Issue Discount)

Вставка

- Опубліковано 5 жов 2024

- Subscribe to our UA-cam channel: / @teachmepersonalfinanc...

Subscribe to our newsletter: tinyurl.com/3b...

Do you use TurboTax? If not, is the reason because you're not sure which TurboTax software is the right one for you? In that case, head on over to this page to learn more about all the things that TurboTax has to offer: tinyurl.com/3d...

Please feel free to check out our article, where we've written step by step instructions to help you walk through this tax form! www.teachmeper...

If you’re looking for tutorials for other IRS Forms that you can file directly through the IRS website, check out our free fillable forms page: www.teachmeper...

Here are links to articles we've written about other tax forms mentioned in this video:

IRS Form 8822, Change of Address

Article: www.teachmeper...

Video: • IRS Form 8822 walkthro...

IRS Form 8822-B, Change of Business Address or Responsible Party

Article: www.teachmeper...

Video: • IRS Form 8822-B walkth...

IRS Schedule B, Interest and Ordinary Dividends

Article: www.teachmeper...

Video: • IRS Schedule B Walkthr...

For The Recipients Name On The 1099OID Do We Put Our ESTATE Name Or Our Beneficiary Name On There .?

If you're the recipient, you would expect to receive this form from the financial institution. *The financial institution* should enter the appropriate information about the recipient, based upon their files and records.

@@teachmepersonalfinance2169 Thank You

Wrong channel to ask I think this channel is supporting the fraudsters. The recipient is the bank you are the payer.

Very informative. Thank you!

Very welcome!

Glad it was helpful!

Do need to put the dashes in your social security number?

This is an informational form, so you shouldn't have to enter any information here.

I think no. I’m in U.K. and I’ll use my NINO

@@Lisa_M_V You need an ITIN

I want to fill my 1099 but i don't know which one to fill any ideas on which one i need to fill

Most individuals shouldn't have to fill out a Form 1099, unless you hired someone and have to complete a Form 1099-NEC (non employee compensation form).

But for most people, you should expect to receive a Form 1099 from the sources of each type of income by January 31 of the following year. For example, if you earned interest on a CD that you owned at a bank, you'd receive a Form 1099-INT. If you pulled out money from a College 529 plan or Coverdell ESA, you'd receive a Form 1099-Q, etc.

Here are articles and videos about some of the more common 1099 forms that you can expect to see. I'm also writing my article on Form 1099-NEC today, so you should see the article and video up this afternoon.

IRS Form 1099-R, Distributions from Pensions, Retirement Plans, etc

Article: www.teachmepersonalfinance.com/irs-form-1099-r-instructions/

Video: ua-cam.com/video/xyIt6e33sso/v-deo.html

IRS Form 1099-DIV, Dividends and Distributions

Article: www.teachmepersonalfinance.com/irs-form-1099-div-instructions/

Video: ua-cam.com/video/erjDQs338DA/v-deo.html

IRS Form 1099-INT, Interest Income

Article: www.teachmepersonalfinance.com/irs-form-1099-int-instructions/

Video: ua-cam.com/video/WBnysIIwrl0/v-deo.html

IRS Form 1099-Q, Payments from a Qualified Education Program

Article: www.teachmepersonalfinance.com/irs-form-1099-q-instructions/

Video: ua-cam.com/video/wW5_IloVi6s/v-deo.html

Do some research 🧐 but it depends what you want to do

1099A Possibly The 1099OID And Add The 1096 Form As Well

Can you explain the red form as well please

The red version is identical to the issue you would receive, except that it is sent to the IRS.

Can you use these forms to pay off cars or esstates?

No. 1099 forms (of any sort) are simply informational returns that are reported to an income recipient (in this case, original issue discount interest) and to the IRS. Generally, this information should be reported on your tax return but is probably not very useful for non-tax purposes.

Yes you absolutely can.

How do we find a cusip #

The CUSIP number should be associated with your fixed income instrument. You might have to check with the financial institution to find the CUSIP for a specific bond or CD.

All good