Present Value of a Growing Annuity

Вставка

- Опубліковано 3 лип 2024

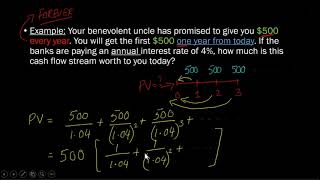

- This video shows how to calculate the present value of a growing annuity.

-

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education accessible to all people.

-

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES

* eepurl.com/dIaa5z

-

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

* edspira.thinkific.com

-

LISTEN TO THE SCHEME PODCAST

* Apple Podcasts: podcasts.apple.com/us/podcast...

* Spotify: open.spotify.com/show/4WaNTqV...

* Website: www.edspira.com/podcast-2/

-

GET TAX TIPS ON TIKTOK

* / prof_mclaughlin

-

ACCESS INDEX OF VIDEOS

* www.edspira.com/index

-

CONNECT WITH EDSPIRA

* Facebook: / edspira

* Instagram: / edspiradotcom

* LinkedIn: / edspira

-

CONNECT WITH MICHAEL

* Twitter: / prof_mclaughlin

* LinkedIn: / prof-michael-mclaughlin

-

ABOUT EDSPIRA AND ITS CREATOR

* www.edspira.com/about/

Thankyou so much

Thanks

what happens if the growth is by a constant amount (i.e. 100 dollars per year)

Is the discount rate the same as the MARR ?

*Greetings Sir, since the cash flows are being discounted to their present value, can you kindly tell me why the index in not negative, ie, -5?*

Ivor - Negative sign is usually used to represent cash OUTFLOWS, i.e. when money is going OUT of your pocket. In this case, since the CEO will be RECEIVING a payment, i.e. cash will be coming IN, it is more useful to depict them with a positive sign.

What if both values are the same in the denominator (r and g) in a growing annuity?

Unlikely that interest rate and growth rate are the same

@@Muchaucho They can't be the same because it's a rule that the K has to be bigger than the G and cannot be equal. Why? Because if K=G, then the denominator is 0 and the answer is null. If the K is smaller than G, you will get a negative answer which also doesn't make sense. So K always has to be bigger than G.

@@adequatequality Nope. There is actually a different formula to use in the rare case of r=g. In this case, PV = PMT * n/(1+i) .

@@TheRedstoneChallenge what does PMT mean

@@TheRedstoneChallenge Wow, amazing! I’ve been looking for this. Thank you!

This formula gives you a wrong result. If you use the formular you get 86.153,27 dollars. But if you calculate the cash flow individually and add their present value together you get 94.768,71 dollars. The only way to get the right result is to multiply the initial cash flow of 20.000 dollars with the growth rate (1.10) before plotting it into the formula.

I just did the math and I believe that you are mistaken. The present values for all 5 payments are:

17857.1+17538.3+17225.1+16917.5+16615.4=86153.4

Which is very very close what the formula gives. I think you are computing the present value as if the initial $20,000 were given today, instead of in one year as in the example. (Which does raise the question: What would be the formula for an annuity whose initial payout is today and not in one year?)