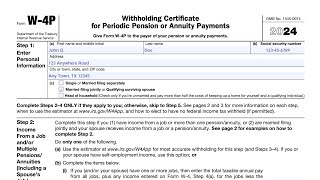

IRS Form W-4P walkthrough (Withholding Certificate for Periodic Pension or Annuity Payments)

Вставка

- Опубліковано 14 жов 2024

- Subscribe to our UA-cam channel: / @teachmepersonalfinanc...

Subscribe to our newsletter: tinyurl.com/3b...

Do you use TurboTax? If not, is the reason because you're not sure which TurboTax software is the right one for you? In that case, head on over to this page to learn more about all the things that TurboTax has to offer: tinyurl.com/3d...

Please feel free to check out our article, where we've written step by step instructions to help you walk through this tax form! www.teachmeper...

If you’re looking for tutorials for other IRS Forms that you can file directly through the IRS website, check out our free fillable forms page: www.teachmeper...

Want to use the IRS online estimator tool, but don't know how? Check out our tutorial! • How to use the IRS Tax...

Here are links to articles and videos we've created about other tax forms mentioned in this video or its accompanying article:

IRS Form W-4, Employee’s Withholding Certificate

Article: www.teachmeper...

Video: • IRS Form W-4 walkthrou...

IRS Form W-4R, Withholding Certificate for Nonperiodic Payments and Eligible Rollovers

Article: www.teachmeper...

Video: • IRS Form W-4R walkthro...

Form SS-5, Application for New Social Security Card

Article: www.teachmeper...

Video: • Form SS-5 walkthrough ...

IRS Form 1116, Foreign Tax Credit

Article: www.teachmeper...

Video: • IRS Form 1116 walkthro...

IRS Form 8863, Education Credits

Article: www.teachmeper...

Video: • IRS Form 8863 walkthro...

IRS Schedule 8812, Child Tax Credit or Credit for Other Dependents

Article: www.teachmeper...

Video: • Schedule 8812 walkthro...

IRS Form 5695, Residential Energy Credits

Article: www.teachmeper...

Video: • IRS Form 5695 walkthro...

IRS Schedule 3, Additional Credits & Payments

Article: www.teachmeper...

Video: • IRS Schedule 3 walkthr...

IRS Schedule 1, Additional Income and Adjustments to Income

Article: www.teachmeper...

Video: • IRS Schedule 1 walkthr...

IRS Schedule A, Itemized Deductions

Article: www.teachmeper...

Video: • IRS Schedule A walkthr...

IRS Form 1099-INT, Interest Income

Article: www.teachmeper...

Video: • IRS Form 1099-INT walk...

IRS Form 1099-DIV, Dividends and Distributions

Article: www.teachmeper...

Video: • IRS Form 1099-DIV walk...

IRS Form 1099-R Instructions (Distributions from Pensions, Retirement Plans, etc)

Article: www.teachmeper...

Video: • IRS Form 1099-R walkth...

IRS Form 4684, Casualties and Thefts

Article: www.teachmeper...

Video: • IRS Form 4684 walkthro...

IRS Form 1098-E, Student Loan Interest Statement

Article: www.teachmeper...

Video: • IRS Form 1098-E walkth...

IRS Form 2106, Employee Business Expenses

Article: www.teachmeper...

Video: • IRS Form 2106 walkthro...

IRS Form 8889, Health Savings Accounts

Article: www.teachmeper...

Video: • IRS Form 8889 walkthro...

IRS Form 3903, Moving Expenses

Article: www.teachmeper...

Video: • IRS Form 3903 walkthro...

IRS Schedule SE, Self-Employment Tax

Article: www.teachmeper...

Video: • Schedule SE walkthroug...

Thank you for your information on Form W4P. I got hit hard with the "widow's tax" this year and I am really struggling to keep this from happening again. I feel like I have been penalized for good planning at a time in my life when there is already a tremendous amount of stress. I wish someone had told me about this after my husband died.

Earlier this month I submitted a 2024 W-4P form to my pension. I wanted to add an additional $100 to the existing deduction. I must of made an error on the form because insted of an addional $100 nearly $600 additional is being deducted now. Married both over 65; we only socoal security in addition to my pension. My question is is there a way I can just submit the exact amount I want deducted from my pension? I did watch the video and it is very informative, thank you for posting it. update, you coverd my question in the comments below-Thank you! Contacting my pension people.

I'm so happy I found this video! We were struggling to fill this out. One question, regarding the amount that goes on Line 2(b)(i) - which would you you input from the W-2 - the amount from Line 1, 16, or 18? They are all different. I appreciate your help!

I would follow the literal instructions from the form itself:

Enter the total taxable annual pay from all jobs,

*plus* any income entered on Form W-4, Step 4(a), for the jobs

*less* the deductions entered on Form W-4, Step 4(b), for the jobs

So you'd need to have a copy of your old W-4 to see what those Step 4a and 4b numbers are. And if it's been a while since you updated your Form W-4, you may want to do that first.

IRS Form W-4, Employee’s Withholding Certificate

Article: www.teachmepersonalfinance.com/irs-form-w-4-instructions/

Video: ua-cam.com/video/a7qxsGYLtkU/v-deo.html

Thank you for the walkthrough on the W4P. I would simply like to enter a flat percentage for my withholding, 15 percent. Can this be accomplished on line 4c by entering 15% withholding and not fill in the other sections of steps 2,3 and steps 4a & 4b. I have called the IRS and NO ONE can answer this question, tried to make an appointment for our local office and they won’t allow that either. Makes me wonder if the IRS hasn’t made this overly complicated once again. Thanks for the assistance

I don't think that this form, which was revised in 2022, will allow that option. However, this form is also guidance to your payer, and not the IRS, so I don't know that the IRS office would really be of much assistance for a tax form they probably don't process.

What I might suggest would be to contact the payer directly to see if there is any additional guidance they might have on whether you can direct them to take out a flat percentage. If they won't do this, then (as a last resort), you could calculate the dollar amount separately, then enter it here.

It's not ideal, but it might be the best available option if your payer won't accept guidance other than through filing Form W-4P.

Both are awesome suggestions, thank you for your prompt reply.

@@teachmepersonalfinance2169 IF it's permissible to submit subsequent W-4P form's to fine tune withholding, then would it be best to first submit W-4P with Steps 2-4 left blank (if this is accurate for @DN_5551), see what happens, and then make a subsequent W-4P submission using Step 4(c) to fine tune to their 15% goal?

Thanks for the great explainer, its the best I've found. I do have one specific question however. If you've calculated the amount of tax I want withheld, can I simply put that amount in line 4C and zero's on the rest of the form?

If you did this, you probably would not see the expected result. If you simply put zeros down the form (including Line 4c), then you would have *some* withholding. If you enter an amount in Line 4c, then you would see the same withholding *and* the additional withholding in Line 4c.

If you were going to use this plan, I would start with all zeros, wait for the next payment to hit, and recalculate using the worksheet in IRS Form 1040-ES (see below). From there, make any adjustments in Line 4c.

IRS Form 1040-ES, Estimated Tax Voucher

Article: www.teachmepersonalfinance.com/irs-form-1040-es-instructions/

Video: ua-cam.com/video/MqA_0OX9kxI/v-deo.html

so i plan to retire this July and I am married filing jointly I will also have 2 pensions this 1st one is the smaller one so I included husband salary and half of investments. Why do I have to include husbands salary since his job is currently taking out withholding? Is it so that the pension i have puts me in the right tax bracket? Also will it hurt me to put half of the investments on this form. The investments are in husbands name. Thank you for your help. This is really confusing.

If you include your husband's salary, then your payer should account for this when calculating your tax withholdings. You do not have to list any investments here.

You may want to simply start with listing your husband's salary, then making adjustments later on if you don't feel like enough taxes are being withheld. If you want to see how much taxes you should withhold throughout the year, you can use the worksheet from IRS Form 1040-ES (see the video below):

IRS Form 1040-ES, Estimated Tax Voucher

Article: www.teachmepersonalfinance.com/irs-form-1040-es-instructions/

Video: ua-cam.com/video/MqA_0OX9kxI/v-deo.html

I retired at the end of 2023 and I am 54. My husband is 70 but still works full time, gets Social Security and his IMRF as well. I do not have any other income. My retirement coordinator estimated my Federal withholding. I received my first retirement check and the Federal withholding was more than double what she indicated. I have to call the State Retirement Agency tomorrow but I am curious if I was taxed so high because my tax prep person told me to list my husband’s income on my W 4P. The amount they took was more than what they were withholding before I even retired. The app on the IRS website is a little confusing. It doesn’t say if you are to enter amount pre or post tax.

You might want to take a look at what you entered for Step 2. Based on your husband's other sources of income, I'm inclined to believe you shouldn't have entered anything here. But you can always make adjustments to one of your withholdings (I would do one at a time, whichever is easiest), until you get the amount that you feel comfortable with.

Could you please tell me where I can find the fillable W4P form that you used in the tutorial

Here's a link directly to the form, on the IRS website: www.irs.gov/pub/irs-pdf/fw4p.pdf

If you're interested, we also included this form as an attachment to the article that we wrote: www.teachmepersonalfinance.com/irs-form-w-4p-instructions/

For the total taxable income on 2(b)(i), if you are claiming the standard deduction would you enter your actual income or your income minus the standard deduction? In other words, if married filing jointly with an income of $50,000, would you enter $50,000 or $20,800?

For this line, you would enter the total amount of income from jobs. If all income is from pensions, then you wouldn’t put anything here.

@@teachmepersonalfinance2169 Ok thanks!

I am trying to fill out my form but it’s confusing me more than anything. I’m retiring, but my spouse is still working. My pension will be 13k and my husband makes about 80k. On section 2b (I) would I add the 80k plus the 13k?

You would only enter the job income on Section 2b(i).

My husband passed away last summer and I received a packet from the Union pension to complete as his beneficiary. The pension is less than $800/month. A W-4P needs to be completed as per of the packet. I have my own job, when completing the W-4P for the pension, do I include only the income from my actual job since I haven’t receive a payment for the pension yet? Please advise.

If you have a job, then you would enter the job income, in Line 2b(i). You can always make adjustments if you feel the tax withholding isn't correct.

To determine whether you're on track, I would recommend one of the following options:

1. Use the IRS tax estimator from the IRS website (video link below)

How to use the IRS Tax Estimator Tool

Video: ua-cam.com/video/zXA4ut_OTzU/v-deo.html

2. Use the worksheet for IRS Form 1040-ES:

IRS Form 1040-ES, Estimated Tax Voucher

Article: www.teachmepersonalfinance.com/irs-form-1040-es-instructions/

Video: ua-cam.com/video/MqA_0OX9kxI/v-deo.html

I am retiring from my municipal job. My employer has given me a W-4P to fill out. I was told I could just give them a percentage to deduct from my pension for federal tax. I'm not sure what percentage I should give. What is the standard percentage amount that should be deducted? Thank you

You probably cannot use this form to apply a specific percentage. Instead, you should follow the form instructions, as outlined, based on your tax situation, including other forms of income, deductions and credits you might be eligible for, and other factors.

What I might recommend is to complete this form, then use the worksheet in IRS Form 1040-ES to determine if you should make any adjustments later in the year:

IRS Form 1040-ES, Estimated Tax Voucher

Article: www.teachmepersonalfinance.com/irs-form-1040-es-instructions/

Video: ua-cam.com/video/MqA_0OX9kxI/v-deo.html

What if you retired in the year you atre filling out this form? Should I include the wages I made before I retired ? I am not working now.

Generally, I recommend that people estimate their taxes for the year, based upon what their earnings have been to this point. Below are some resources that will walk you through a couple of ways to do this:

How to use the IRS tax withholding estimator tool: ua-cam.com/video/zXA4ut_OTzU/v-deo.html

IRS Form 1040-ES, Estimated Tax Voucher

Article: www.teachmepersonalfinance.com/irs-form-1040-es-instructions/

Video: ua-cam.com/video/MqA_0OX9kxI/v-deo.html

You can use either of these methods to determine whether you're on track or not. From there, you can better understand whether you need to increase withholdings your W-4P (step 4c).

I would suggest either this or simply not entering any information on the form, then submitting it. Once you start seeing tax deductions from your pension/annuity payments, you can re-run the tax estimators (as done above), then determine if you're on track.

Generally, you should plan to rerun your tax projection for the entire year in the year *after* you retire. You might end up needing to recomplete Form W-4P for the following tax year.

I'm a single filer, no dependents. I normally file "0" on my regular W-4. I will be retiring and getting a monthly pension in July 2024 (in Texas).

I'm assuming I will have to complete this form. How do I continue to take the most taxes out, so I don't owe? Also, if I work a part-time job, you would already be required to complete a W-4, why would you have to list it again on a W-4P? I feel like i would be double taxed.

You don't need to complete this form, unless you wish to have taxes taken out of your pension. And if you plan to get a part-time job, you can elect to have your taxes taken out of that, your pension, or both.

It may feel like you're being double-taxed, but all of the taxes that you pay should balance out when you file your tax return the following year. If you receive a big refund, then you could make some adjustments to lower your tax withholdings (and get more of a paycheck each month). If you owe a lot of taxes when you file your tax return, then you might need to withhold some more tax during the year.

You might consider going through the worksheet for IRS Form 1040-ES, which helps you understand how much taxes you *might* need to pay throughout the year. You can pay the IRS directly instead of, or in addition to, having them withheld from your checks.

IRS Form 1040-ES, Estimated Tax Voucher

Article: www.teachmepersonalfinance.com/irs-form-1040-es-instructions/

Video: ua-cam.com/video/MqA_0OX9kxI/v-deo.html

I am submitting my w-4p with my retirement packet. All I would like is standard deduction as a single head of household with one dependent. Page 3 #6 is $0 and on page 1 I have $2000 for the dependent but the folks at retirement are telling me I filled it out incorreclty? in 4b #2 I listed HOH standard deduction. I have no other income. On the first page the only value above 0 is #3 for the single dependent. I am really confused on where I am wrong???? Please help and thank you

It appears that you're right to include the $2,000 credit for your dependent (assuming that it's for a child under the age of 17 that you'll receive the child tax credit for). If you plan to take the standard deduction, then it should be okay to leave the rest blank.

What I might suggest is this: Wait until after your withholdings have changed. Then use the worksheet in the IRS Form 1040-ES instructions to estimate your tax withholdings for the year. From there, you can determine whether you're withholding enough or need to withhold more. If you need to increase your withholdings, then you can adjust line 4c to make the necessary changes.

IRS Form 1040-ES, Estimated Tax Voucher

Article: www.teachmepersonalfinance.com/irs-form-1040-es-instructions/

Video: ua-cam.com/video/MqA_0OX9kxI/v-deo.html

Hey love your work, I would like to increase your audio if still needed. I rather not force my neighbors to absorb the information.

I plan on taking a monthly payment from my 457 account to supplement my pension. Should I include that monthly 457 payment as other income in step 4a?

You can do this. If you do, then you should make sure that you're not also requesting tax withholdings from that 457 plan.

To make this simpler, I would *start* by doing this, then evaluating your tax situation after the withholdings have started, just to make sure that you're on track for the rest of the year. I often advise people to use the worksheet located in the instructions for IRS Form 1040-ES to see if you're on track. If you need to make some additional payments to 'catch up,' then this also makes it easier to determine how much your quarterly payment should be, and when you should send it.

IRS Form 1040-ES, Estimated Tax Voucher

Article: www.teachmepersonalfinance.com/irs-form-1040-es-instructions/

Video: ua-cam.com/video/MqA_0OX9kxI/v-deo.html

If you use the Form 1040-ES worksheet, you don't necessarily have to use the vouchers to mail in a check. You can also make online payments through the IRS website: www.irs.gov/payments

I need to complete this form to receive a pension payment of approximately $150/month. I file jointly, still work and also receive social security. My husband has a monthly pension greater than $150/month and receives social security. Is completing this form stating "no withholding" in section 4 appropriate as this is such a small payment?

I would start with this, then use the estimation worksheet on IRS Form 1040-ES to determine whether you're on track to pay the correct amount of taxes over the course of the year. You can always add additional withholdings if you need to do so.

IRS Form 1040-ES, Estimated Tax Voucher

Article: www.teachmepersonalfinance.com/irs-form-1040-es-instructions/

Video: ua-cam.com/video/MqA_0OX9kxI/v-deo.html

Under 2b (i) do I enter my job I just retired from, it was January thru June and I had taxes taken out through regular W4. I just retired and receiving a pension shortly. I know my wife's full time job she still has are included, but I was not certain about my just that ended is included in 2b (i).

You would not enter the information for the job that you retired from.

My husband is retiring on August 1, 2024 and his employer gave him this W-4P to complete. Thus, he'll have his job wages for the first 8 mos. of 2024 and his pension for the second 4 mos. I'm retired and I get an annual pension and have taxes automatically taken out of that. I'm confused on how to complete this for 2024. Seems like if I complete it based on his earnings for 2024, I'm going to have to do another one for 2025 when he's only earning his pension as income. Correct?

You may very well end up having to resubmit your husband's W-4P, even before 2025.

What I might recommend is that you take a look at his withholdings after the first month or so, just to make sure that you're on track for 2024. Make any adjustments to avoid underwithholdings for this year, then take a look for 2025 when your household income changes.

The worksheet for IRS Form 1040-ES is a good place to enter all of your taxable income, deductions, credits, and withholdings to see whether you're on track or need to make adjustments:

IRS Form 1040-ES, Estimated Tax Voucher

Article: www.teachmepersonalfinance.com/irs-form-1040-es-instructions/

Video: ua-cam.com/video/MqA_0OX9kxI/v-deo.html

@@teachmepersonalfinance2169 Thank you!

Does the total amount of extra withholding on line 4c of the W4P supersede the withholding amount that is selectable on a pension's website? I have a pension website that gives me the option of specifying extra withholding and I was wondering if that amount on the website is superseded by the amount of extra withholding on the W4P. I believe also that you're supposed to state the word "Total" after the W4P extra withholding amount to make it clear that it is not an additional amount withheld.

This is a question that might be better answered by the pension company. Generally speaking, a payer must adhere to the most recent guidance provided by the taxpayer. So if the company offers an online option or the option to file Form W-4P (which should always be available), then they probably would be in the best position to tell you how they handle contrary direction.

As for the extra withholding field, I think the form states: "Enter any *additional* tax you want withheld from each payment"

Form W-4P Step 2(b)(ii) questions: I have two annuities (A1 and A2) and one pension (P). Tax on these has been paid via estimated tax voucher in previous tax years, but in order to simplify things, I would like to instead have the appropriate tax withheld from each annuity and pension by each respective payer.

In terms of periodic annualized payout, A1 is greater than A2, and A2 is greater than P.

I understand that A1’s Form W-4P Step 2(b)(ii) would have A2 + P.

However for A2’s Form W-4P, do I enter P for Step 2(b)(ii) or leave this line blank since P was used on A1’s Form W-4P?

Since I’m planning to submit three W-4P forms to three different payers, should I be concerned that tax withholding could be duplicated? For example: Will additional tax be withheld from A1 payments because A2 and P are used in Step 2(b)(ii) on A1’s Form W-4P?

How does the IRS use the payment amount in Step 2(b)(ii)?

Please let me know - thank you.

You are certainly welcome to approach this how you want. If I were in your situation, I might consider the following:

1. Calculate your estimated tax liability, either using the online calculator, the worksheet in IRS Form 1040-ES (see below), or one of the worksheets in IRS Publication 505. Get a baseline understanding of how much tax you should pay over the course of the year.

2. File Form W-4P for A1 first. Once you understand your new tax withholdings, rerun that estimated tax liability to see how much you overpay/underpay in the given quarter.

3. If you've underpaid for the quarter, then submit an estimated tax payment for the difference (just during that quarter).

4. Adjust your Form W-4P accordingly. You can add additional withholding amounts to your first W-4 form (possibly the easiest adjustment) or file a W-4P for one of the other sources.

The IRS does not care which income source you withhold tax from, as long as your total tax liability is paid in the given quarter/year. I've found it to be easier to adjust one withholding form than to run around trying to get 3 different forms (3 different processors & 3 chances for mistakes) to match up.

To clarify better understand how your withholdings work, you'd have to pull up the tables in IRS Publication 15-T, Federal Income Tax Withholding Methods (www.irs.gov/pub/irs-pdf/p15t.pdf). Surprisingly, no one has asked me to put up a video on this scintillating topic.

In this video (and the article), I spend much of the time walking through the estimated tax worksheet (the voucher is relatively self-explanatory).

IRS Form 1040-ES, Estimated Tax Voucher

Article: www.teachmepersonalfinance.com/irs-form-1040-es-instructions/

Video: ua-cam.com/video/MqA_0OX9kxI/v-deo.html

@@teachmepersonalfinance2169 thank you so much for your detailed response - your suggestions all make sense, and I'll probably proceed accordingly. You basically reinforced my concern about the potential for errors due to multiple forms for multiple annuities and pensions. In my opinion, Form W-4P Step 2 lacks transparency of purpose - the Form really needs to have a means for inputting a desired percentage of withholding for only the annuity or pension in question, and it should leave out requesting information about other income. Thanks again - I liked your video and your article.

@@teachmepersonalfinance2169 Again, I have two annuities (A1 and A2) and one pension (P), in order of highest to lowest payout. A1 and A2 are almost the same annual payment amount and both pay within the 4th voucher payment period (Sept-Dec). The pension (P) is relatively small and pays monthly. I have not yet submitted W-4P's for any of these and have been paying tax via periodic voucher. Form W-4P for A1 would include the combined annual payments from A2 and P on the line for Step 2(b)(ii), so is this total used to determine only the tax bracket for A1 withholding, or will additional tax be withheld from A1 to cover withholding for A2 and P also?

@@teachmepersonalfinance2169 Believe I've settled on submitting W-4P for only annuity A1, the highest paying. I'll include the combined amounts for lower paying annuity A2 and pension P in Step 2(b)(ii). If it turns out that more tax withholding is needed to cover all three (A1, A2 & P), then I'll pay any withholding shortcoming via voucher for 2024 and refile a W-4P for A1 using Step 4(c) to fine tune withholding for 2025. Therefore, I don't plan to submit W-4P forms for A2 and P - only for A1 - do you have any concerns with this? [Note: Annuities A1 and A2 pay annually during the IRS 4th voucher period (Sept-Dec). A1 is slightly higher payout than A2. Pension P is much smaller than the annuities and is paid monthly.]

I just received my first pension check and 1 percent of my gross was taken out. And less than that for state.

Should the standard be at least 10 percent for federal? If I enter a dollar amount on 4c will this go to federal or state?

There is no standard for tax withholding, in terms of percentage. The IRS has certain requirements, which you can find in the Form instructions for IRS Form 1040-ES (see below). If you enter a dollar amount on Line 4c, that will go towards your federal tax liability.

IRS Form 1040-ES, Estimated Tax Voucher

Article: www.teachmepersonalfinance.com/irs-form-1040-es-instructions/

Video: ua-cam.com/video/MqA_0OX9kxI/v-deo.html

Can I just fill out line 4c to withhold a little more each paycheck?

Yes, you can. Keep in mind that the Line 4c amount applies to each payment. So if you are paid on an other than monthly basis, you may want to make sure to double-check that amount. Sometimes, this trips people up.

Will this dollar amount each pension check go to federal or state?

Hello, I am currently collecting a pension that I'm not claiming as income when filing tax return until I've been paid out my contributions, I am also working and now eligible for a second pension of lesser amount than the first. Should I add this current pension that I am collecting now or fill out another W-4P next year when I start collecting my employer contributions

If you're not being taxed on your first pension, then I would not adjust withholding this year. You can always file a W-4P for the first pension when you reach the point where it becomes taxable income.

As a side note, I've included a link to the IRS website page about after-tax contributions to a pension plan, where the IRS may consider *part* of your pension to be taxable income. www.irs.gov/taxtopics/tc410

If you do decide to change your withholding because of this possibility, then I would consider adjusting one W-4P at a time, then using the estimator worksheet on IRS Form 1040-ES to see whether or not you need to make any adjustments:

IRS Form 1040-ES, Estimated Tax Voucher

Article: www.teachmepersonalfinance.com/irs-form-1040-es-instructions/

Video: ua-cam.com/video/MqA_0OX9kxI/v-deo.html

I have to fill out a W-4 p on me beneficiary I'm getting annuities my wife doesn't work but I'm the sole income we filed jointly though I make around $100,000 a year what should I fill out in step 2 I believe that's probably the 22% tax bracket.

I cannot tell you exactly what to put in this box. Here is what I recommend for everyone:

1. Complete the W-4P form to the best of your ability. If there is a step or a line that you have questions about, leave it blank for now. Submit the form to your annuity company for them to process.

2. When you notice the deductions start, use the worksheet located in IRS Form 1040-ES (see links below for more info) to estimate whether you're on track for the year.

3. If you need to withhold more, you can always refile Form W-4P and request additional deductions on Line 4c (this is for each *payment*, not each month or quarter). Or you can go to the IRS website to make payments, or use IRS Form 1040-ES (estimated tax voucher) to send an estimated tax payment via mail.

IRS Form 1040-ES, Estimated Tax Voucher

Article: www.teachmepersonalfinance.com/irs-form-1040-es-instructions/

Video: ua-cam.com/video/MqA_0OX9kxI/v-deo.html

On section 2!! should you put the total amount of your yearly RMD, or are to figure out the amount of taxes you should be paying on that amount. signed confused

If you are not receiving regular monthly distributions, and are only withdrawing the RMD each year, you might consider using this form instead:

IRS Form W-4R, Withholding Certificate for Nonperiodic Payments and Eligible Rollovers

Article: www.teachmepersonalfinance.com/irs-form-w-4r-instructions/

Video: ua-cam.com/video/Aa_n50wOA_I/v-deo.html

On Form W-4R, you can select a specified percentage, based upon your income tax bracket. It might be simpler than trying to complete Form W-4P.

So about step 2. I receive a rrb pension plus disability benefits and receive both rrb-1099 and w-2. How to calculate what figure should go in 2 b i and ii? Was advised by the rrb to use this new form. Thank you.

I would follow the instructions as they are literally written on the form itself:

(i): If you (and/or your spouse) have one or more jobs, then enter:

-the total taxable annual pay from all jobs, plus

-any income entered on Form W-4, Step 4(a), for the jobs less

-the deductions entered on Form W-4, Step 4(b), for the jobs.

Otherwise, enter “-0-”

(ii): If you (and/or your spouse) have any other pensions/annuities that pay less annually than this one, then enter the total annual taxable payments from all lower-paying pensions/annuities.

Otherwise, enter “-0-” .

@@teachmepersonalfinance2169 My question is does the disability income count as a job bc I get a w2? If so, do I add the rrb figure on rrb-1099 to the w2 number? Am retired so do not have a w-4. No spouse. How exactly is the tax calculated? Was told my RRB to put the amount I want deducted on line 4c, but then read you cannot request a specific amount. Thanks for clarifying.

@pattiel1108 I don't know that I can completely answer your question without being able to see your paperwork, but I'll try my best.

My question is does the disability income count as a job bc I get a w2?

This depends, because your disability payments may be taxable, or they may not be. The general rule is that if your disability payments came from an insurance policy that *you purchased,* then they shouldn't be taxable. But if they came from an employer-provided policy or employer-provided benefits, then they would be taxable. If it's taxable, then you would enter that amount in Step 2(b)(i).

If so, do I add the rrb figure on rrb-1099 to the w2 number?

No. The instructions state that you should enter the amount from your job income (W-2).

How exactly is the tax calculated?

IRS Publication 15-T gives step by step instructions to employers and other payers on how to withhold based upon the type of W-4 submitted (W-4, W-4V, W-4P, etc.). Instructions for Form W-4P start on Page 6, with specific step by step guidance on Worksheet 1B, beginning on Page 10: www.irs.gov/pub/irs-pdf/p15t.pdf

Was told my RRB to put the amount I want deducted on line 4c, but then read you cannot request a specific amount.

On Line 4c, you can request a specific EXTRA amount, but the withholding tables in Publication 15T determine the base withholding amount, depending on how you completed the rest of the form.

IMO, you might need to review your withholdings once you see them kick in, then go through the withholding worksheet on Form 1040-ES to determine whether that's enough, or whether you need to withhold additional amounts.

IRS Form 1040-ES, Estimated Tax Voucher

Article: www.teachmepersonalfinance.com/irs-form-1040-es-instructions/

Video: ua-cam.com/video/MqA_0OX9kxI/v-deo.html

@@teachmepersonalfinance2169 Thank you for telling me where to find the info on the w-4p. So the w2 taxable income withholding is taken care of with the w-4s form so no need to put that in step 2. The instructions basically say only to fill out step 1 and 5. The way I have it now is $9000 (int and div) in line 4a. $1950 in 4b (over 65) and $710 in 4c (amount I want withheld). Does this seem reasonable? Thank you again for your help.

@@pattiel1108 That seems like a reasonable place to start. I think you should keep an eye on the changes, just to make sure that you don't need to make further adjustments later on.

If all my answers in step 2 AND step 3 are all zeros what will they take from my small pension payment? It’s paid monthly and the annual total is barely 5 digits.

I couldn't tell you, since there are a lot of things that I don't know about your situation. What I would say is that these are tax withholdings that will lower the amount that you have to pay at tax time.

When people have concerns, I usually suggest that they either go through the IRS estimator tax tool (see video below) or use the worksheet in IRS Form 1040-ES to see whether they're on track to have paid enough taxes throughout the year (once your new withholdings kick in). From there, you can better determine whether you need to make adjustments:

How to use the IRS estimator tool: ua-cam.com/video/zXA4ut_OTzU/v-deo.html

IRS Form 1040-ES, Estimated Tax Voucher

Article: www.teachmepersonalfinance.com/irs-form-1040-es-instructions/

Video: ua-cam.com/video/MqA_0OX9kxI/v-deo.html

@@teachmepersonalfinance2169 I’m head of household (recently a widow). Only income other than this small pension payment is social security. All my children are adults.

Even if your husband has a W-4 that he fills out for his job, you still have to include him on the W-4 P for your pension

Correct. You would do this in Part 2(b)(i).

What about rental income and Social Security income. Does only income from a job count on here?

If you want to use this form to withhold taxes from other sources of income, you can enter the amount of income in Step 4c. For Social Security, you also have the option of using Form W-4V, which you would send to the Social Security Administration:

IRS Form W-4V, Voluntary Withholding Certificate

Article: www.teachmepersonalfinance.com/irs-form-w-4v-instructions/

Video: ua-cam.com/video/jOVaAqOwL_Q/v-deo.html

@@teachmepersonalfinance2169 thank you

Thank you so much for this video

You are so welcome!

For 2b(i) do you enter gross income or AGI?

Neither. You would enter *taxable* annual income from all paying jobs. If you don't have other jobs, then you should enter 0 in that line. If you have non-work related income, like dividends or interest income, you would include that on line 4(a).

On section 2 line ii if you have a second income that pays more you don't add that, is this correct?

Correct. You would make that adjustment on the higher paying W-4.

@@teachmepersonalfinance2169 What if it's a retirement payment

What if it’s a Retirement? I have two retirement pensions and my little one is asking for the W/P4 form and the big one is not

@@me5768 I probably would start with the larger retirement, complete the W-4P form for that (including Lines 2b(i) through Line 2b(iii) as applicable). From there, I'd consider making adjustments to the smaller one as needed.

You can use the worksheet in the form instructions for IRS Form 1040-ES to see if you're on track for your withholdings, or if you need to make adjustments.

IRS Form 1040-ES, Estimated Tax Voucher

Article: www.teachmepersonalfinance.com/irs-form-1040-es-instructions/

Video: ua-cam.com/video/MqA_0OX9kxI/v-deo.html

I am confused on why you filled out steps 3-4b when step 2bi has an amount listed?

I believe I did this to illustrate what steps 3 & 4b would look like to a viewer.

Under normal circumstances, you would only complete Steps 3-4b if Step 2(b)(i) is blank and this pension/annuity pays the most annually.

I have 4 kids how to make this application please w4 and w2 please

I cannot give you advice on how to complete your Form W-4P without knowing more about your tax situation. However, if you have specific questions after watching the video and reading the article (see links below), I can probably help you answer them.

How would I fill out if my financial institution is over-withholding by $11,000 per year on my Federal taxes. The only income is pre-tax IRA distribution and maybe $18,500 in CDs. No pensions and no Social Security at this time.

I'm not sure what to recommend here, because I don't know what your current W-4P says.

I would start by asking your financial institution whether your need to complete this form to adjust your withholdings, or whether you can do this through an online portal (some institutions, such as Charles Schwab, allow clients to make manual adjustments in their account).

If that doesn't work, then you can complete this form, leave all the lines blank, then compare your new withholdings to your old ones to determine whether you need to make further adjustments.

@@teachmepersonalfinance2169 They are using 20%, their default withholding. The company provided me with a blank paper form to upload back to TIAA. Would it work to simply reduce the income so that the withholding is reduced by $11,000? If so, which W4-P line should that income amount be entered?

@@samboyster8808 You can't really use Form W-4P to tell your financial institution to lower your annual withholding by $11,000. Not directly, anyway.

What I would suggest is that you submit the form as a blank form. If you know about tax credits (Step 3) or itemized deductions (Step 4b), you can enter those, as they might lower your withholdings more.

Then I would use the tax estimation worksheet on IRS Form 1040-ES to see whether you're still on track for the year. Odds are that since we're into August, you'll still be overpaid for the year. But I'd start with a blank one to see if that gets you close enough to the ball park so that you don't need to make future adjustments.

@@teachmepersonalfinance2169 Ok, thank you.

Why is my spouses pension included on my W4P?

You would want to include income from other sources (such as your spouse's pension) so that the proper adjustments are made to your own tax withholdings. Otherwise, your income might not have the correct amount of tax withheld.

I don’t understand what you’re talking about when you talk when you say put in $80,000 from your W-4 I’ve never put in a dollar amount on my W-4

On the new Form W-4, Step 4(a) allows you to enter income from other jobs. This allows for taxes to withheld once for each job. If you don't have income from other jobs, and you've never entered any income into Step 4(a) of a Form W-4, then you don't need to use Step 2(b)(i).

IRS Form W-4, Employee’s Withholding Certificate

Article: www.teachmepersonalfinance.com/irs-form-w-4-instructions/

Video: ua-cam.com/video/a7qxsGYLtkU/v-deo.html

How do you just do 10 % ? Withholding

You cannot withhold a straight percentage on this form. You may consider calculating you expected tax liability for the year on the IRS Form 1040-ES worksheet (see below for the video link), then making your adjustments to this form that get you 'close enough.'

IRS Form W-4V (see below) is the only withholding form where you can select a flat percentage. However, that's only for unemployment (where 10% is the only option) or Social Security (where 10% is one of 4 available options).

IRS Form 1040-ES, Estimated Tax Voucher

Article: www.teachmepersonalfinance.com/irs-form-1040-es-instructions/

Video: ua-cam.com/video/MqA_0OX9kxI/v-deo.html

IRS Form W-4V, Voluntary Withholding Certificate

Article: www.teachmepersonalfinance.com/irs-form-w-4v-instructions/

Video: ua-cam.com/video/jOVaAqOwL_Q/v-deo.html

Can someone please show how to do with 1 pension AND SS income?

Just shot the video today, and it's scheduled to be published tomorrow morning!

@@teachmepersonalfinance2169 Thank you so much.❤💙❤💙❤💙❤💙

This video while I appreciate it doesn’t offer any advice whatsoever we all know how to do the math and fill out a form bottom line I think with this guy is trying to say, which is why I was tuning in is should I have tax withheld or not? that should be the name of this video. Should I have tax withheld or not, if you are already paying a shit load of taxes because you’re still working and collecting a pension, bypass those sections altogether just bypass, the sections just fill out the top portion with your Social Security and name and sign it. That’s it.

That's correct. I don't give specific tax advice on how to complete any tax form, because:

1. Everyone's tax situation is different.

2. This video specifically answers the questions that people have on *how* to complete the form, not whether they should or not.

Whether or not you complete the form largely depends on whether you're paying enough in taxes from other sources of income. So the correct answer would depend on:

1. What other income sources there are

2. How else are taxes being withheld or paid to the IRS throughout the year.

The one thing that I always advise people to do is to use either the IRS withholding estimator or the worksheet on IRS Form 1040-ES to determine whether they've paid enough to avoid underwithholding penalties, or whether they need to increase their withholdings:

How to use the IRS Withholding Estimator tool: ua-cam.com/video/zXA4ut_OTzU/v-deo.html

IRS Form 1040-ES, Estimated Tax Voucher

Article: www.teachmepersonalfinance.com/irs-form-1040-es-instructions/

Video: ua-cam.com/video/MqA_0OX9kxI/v-deo.html

If you're interested, below are some other videos I've created on Form W-4P that might help you decide what to enter:

How to adjust your Form W-4P With Pension Income & Social Security benefits: ua-cam.com/video/OfS9nFy8qH8/v-deo.html

What happens to your Form W-4P after you've submitted it? ua-cam.com/video/VZtYpcjKteY/v-deo.html