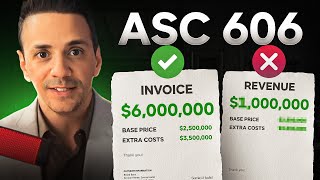

Contract Modification: Revenue Recognition ASC 606 & IFRS 15

Вставка

- Опубліковано 5 жов 2024

- IN this session, I discuss contract modification for the revenue recognition process ASC 606 and IFRS 15.

✔️Accounting students and CPA Exam candidates, check my website for additional resources: farhatlectures...

📧Connect with me on social media: linktr.ee/farh...

#CPAEXAM #intermediateaccounting #accountingstudent

Hi prof, you are very sure at 7:25, the price to use is $10 and not $8. Are you very very sure?

The entry you made after contract modification for a new contract at 7:25 minutes, shouldn't sales be calculated for 100 additional cover by multiplying 100 units with the standalone price of $8? Since, this modification created a new contract, $8 was given as the stand alone price. DR Cash 800 CR Sales 800?

I hope this helps you, due to the contract being treated as a new contract, the standalone selling price at the time of the contract modification results in being the new price charged to the ADDITIONAL covers sold. Therefore on your book of original entry, to account for the covers that are of the contract modification, you would book them separately as their standalone price of $8.

@@XMegaJuni so is it meaning that we will have two journal entry one is for the price when it's 8 and one is the new contract which is when its 10? Thank you for helping!

Good Luck! Pk

Thanks. Please take a look at my website for additional resources: farhatlectures.com/