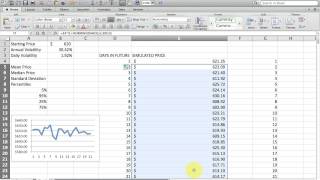

Monte Carlo Simulation of Stock Price Movement

Вставка

- Опубліковано 6 чер 2024

- Modeling variations of an asset, such as an index, bond or stock, allows an investor to simulate its price and that of the instruments that are derived from it; for example, derivatives. Simulating the value of an asset on an Excel spreadsheet provides a more intuitive representation of the valuation of a portfolio

OMG this is amazingly simple and so clear!!! Why cant my professors explain it like you? THANK YOU!!!

This is the video I was looking for. Thanks for this!

12:25-13:40 I've been looking for this explanation everywhere.. thanks !

Very helpful. Although I was searching for clips to explain Monte Carlo methodology used in Project Management and found this video. It relates the practical use case to the concept perfect. Very easy to understand! Thank you!

Thanks

@@OptionTrader Why do you use ln and not just divide the prices?

@@icyboy771z The changes will be also be backwards-symmetrical. a/b and b/a are not the same in the slightest, but log(a/b) and log(b/a) are indifferent in all aspects but the negative sign.

If you are getting Num Errors check the Randbetween function. In general, it should be (total number of rows - 2). So if you have 252 rows you randbetween should by between 1 and 250.

Thanks, I was getting NUMs; let me work on it

Thx, legend

You are really kind to share this, thanks!

Sir this is a great video. Thank you for putting this out.

This video is wonderful, good explanation of the analysis

Thanks for the video! one question,what is your horizontal axis in your example? is it days? So when we are asked about a particular day, you will give VaR from that particular day distribution?

Crystal clear! Really very well explained. Congrats and many thanks

I use a similar technique, but prefer Index/match with randbetween and use adjusted closing prices. I find the program runs faster that way. I run 30day simulations across 1000 columns and plot the discrete prices that emerge on a histogram. I use it to find likelihood of my options getting exercised across a 30 day perioid. The only problem I find with this technique is you limit your data points to the discrete prices in your sample vs. a continuous probability distribution (e.g. normal curve, lognormal, etc.). In other words, we do not allow for all potential %s into our analysis vs. the actual transactions. Its a good starting point.

Why do you use the small formula? I was thinking of applying that to 2 stock prices and generate correlated time series.

Great explanation sir but just one doubt ...Where are we using probability in this...?? and why have we used the exp func...

Thanks it's an awesome video for a newbie like me

Wont adjusted stock price be better for the analysis?

same videos was published by Garg University "Predicting Stock Price Movement using Monte Carlo Simulations".

Thank you Professor Ramanujan!

How will you do the same in Python?

Awesome video, very clear. Can you explain how to price an option using Monte Carlo simulation?

Two more steps will be needed. Building the CDF curve, and multiplying the probability of option to Pay with the its payoff. Will make a video on it soon.

1:13 Why dont u calculate the change as (price today - price yesterday)/price yesterday = (14.67-14.73)/14.73 ? Why do u use the natural logarithm?

I too had that question. However, I believe you meant (14.73-14.67)/14.67.

@@shayag8737 "continuous capitalization" greetings from Peru (South america) my friends.

Bro F4 will put $ symbol.

CTR+shift+down arrow will select till last data.

Thanks Bro!

I can't get my columns to be error free - whats the trick? Some are fine, others get the #NUM! error. Thanks!

Number error could be for several reasons including if you are dicing by zero or taking log of negtive number. So, look out for that.

Any idea on finding the average of, for example, 1000 simulations? Or maybe even expected value of the average?

Need to make 1000 columns, or use VBA in excel. Maybe easier in C++ or Matlab.

Would be more accurate if you choose a gaussian distribution around a pre-defined central tendency (of ema of 5 years for instance) instead of a random number choosen by the software. That's how we use it for defining manufacturing tolerances on blueprints. When the machinists make parts, there is alaways a tendency to hit the nominal values, therefore the probability goes down as the value nears upper and lower spec limits (worst case scenarios) . Stock prices follow similar pattern, there is always a tendency to go back to the mean, to the trendline of a certain period. I think it should be a part of the method here. Nice use of excel by the way!

I will not be more accurate. Both should provide the same results.

can you make a template available ?

Can you kindly provide us with the worksheet please?

hi everyone, ı need help :/ when ı see date ı saw dates appear in reverse order

which one is right

Please make the vedio on utilty calculation of the stock price

can you put the excell file here to download?

It is possible to provide the excel template please?

lol what else do you want, a coffee?

@@davidgutierrez8795 Yes, please!

why are you using ln for daily changes?

That is the formula for continuous compounding.

Is there anyway I can reach you?

Dear Option Trader. Please check my understanding of you using the SMALL function. Have I understood you correctly?

One way of selecting random values from the "change" set (distribution) is to assume it is Normally or LogNormally distributed, calculate the distribution parameters, and select random values from the distribution you define, as needed.

However, you are not doing this, instead, you are selecting the

Is this what you intended to do? If so why? What advantage do you think this method has.

Thank you.

That method will generate new numbers for you as end results. This method will pick auctual numbers from History. Either can be used.

I have a question can you help me to solve it please ?

It would b nice if you could upload the file for us to learn

this technique gave me a great idea but having all those lines in the graph is unnecessary because this is not technical analysis.

The purpose of this simulation is not for technical analysis. The purpose of doing this in relation to options, is to use all of these possible price paths to calculate a theoretical option value. For instance, when I test options trading strategies that I may want to use, I will use this to generate theoretical option prices. When doing this, it is not necessary to plot all curves.

I am getting number errors in excel shet

Number error could be for several reasons including if you are dicing by zero or taking log of negtive number. So, look out for that.

Add concepts of drift and noise and wiener process

great example, but I do not agree with you, your simulation is based upon very old values, in order to make it more accurate you have to add latest days and exclude the old ones as the time passes

This video killed my ears

operators crying in corner

a few python scripts will do the same thing!!!!!

get a more powerful pc dude ahah