IRS Form 5329 walkthrough (Additional Taxes on Qualified Plans and Other Tax-Favored Accounts)

Вставка

- Опубліковано 14 жов 2024

- Subscribe to our UA-cam channel: / @teachmepersonalfinanc...

Subscribe to our newsletter: tinyurl.com/3b...

Do you use TurboTax? If not, is the reason because you're not sure which TurboTax software is the right one for you? In that case, head on over to this page to learn more about all the things that TurboTax has to offer: tinyurl.com/3d...

Please feel free to check out our article, where we've written step by step instructions to help you walk through this tax form! www.teachmeper...

If you’re looking for tutorials for other IRS Forms that you can file directly through the IRS website, check out our free fillable forms page: www.teachmeper...

Here are links to articles and videos we've created about other tax forms and schedules mentioned in this video or its accompanying article:

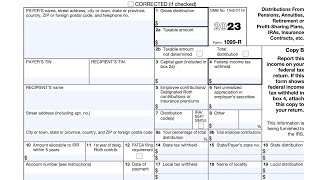

IRS Form 1099-R Instructions (Distributions from Pensions, Retirement Plans, etc)

Article: www.teachmeper...

Video: • IRS Form 1099-R walkth...

IRS Schedule 2, Additional Taxes

Article: www.teachmeper...

Video: • IRS Schedule 2 walkthr...

IRS Schedule 1, Additional Income and Adjustments to Income

Article: www.teachmeper...

Video: • IRS Schedule 1 walkthr...

IRS Form 8915-F, Qualified Disaster Retirement Plan Distributions and Repayments

Article: www.teachmeper...

Video: • IRS Form 8915-F walkth...

What documentation do you have to provide to avoid the 10% penalty from early withdrawals to pay for graduate school? Do you have to attach school receipts?

As long as the early withdrawal is from an IRA, and not a qualified retirement plan (such as a 401(k)), then qualified higher education expenses should be covered as an exception under Internal Revenue Code 72(t)(2)(E).

If this applies, then you would report this on IRS Schedule 2, Additional Taxes, in Line 8. If you received a Form 1099-R marked with Code 1 (Early Withdrawal, no known exception) in Box 7, then you do not need to file Form 5329. You would also check the box next to Line 8 to indicate that you don't need to file.

If Box 7 on your Form 1099-R doesn't show a code, or shows an incorrect code, then you would need to file Form 5329 in addition to Schedule 2.

If you never received a Form 1099-R, then you can request a substitute copy. If they don't provide one, or if the one they provide is incorrect, then you can file IRS Form 4852 as a substitute.

Below are links to articles and videos that cover Schedule 2, Form 1099-R, and Form 4852 in more detail:

IRS Schedule 2, Additional Taxes

Article: www.teachmepersonalfinance.com/irs-schedule-2-instructions/

Video: ua-cam.com/video/Yb_AwqA_sPM/v-deo.html

IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

Article: www.teachmepersonalfinance.com/irs-form-1099-r-instructions/

Video: ua-cam.com/video/xyIt6e33sso/v-deo.html

IRS Form 4852, Substitute for Form W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

Article: www.teachmepersonalfinance.com/irs-form-4852/

Video: ua-cam.com/video/_ribH3TpfWw/v-deo.html

It would have been super helpful if you provided details exactly how you determined the Line 6 amount $1000 assuming there was a scholarship and education credit (Lifetime Learning) involved for a Coverdell ESA. The IRS instructions are very unclear how to do this. There seems to be some kind of fractional calculation required, I can't just use the full scholarship and Credit amounts or I would end up with zero penalty which I know is not correct.

For line 2 (exceptions), exception 19 for the birth of a child says you need to attach a statement with the child's name, DOB and TIN. Any idea what kind of statement they're looking for?

You can create your own statement that explains exactly that. You're eligible to take a qualified birth or adoption distribution because of the birth of your child (fill in DOB and TIN).

Hello, I made an early withdrawal from my IRA account. I received a 1099-R form. I completed part one of the 5329 form. I do not have any other concerns such as excess contributions. I put the gross distribution that was on my 1099-R into lines 1 and 2 and indicated the appropriate exception number. Does this sound correct? Is there another form or section that I must complete?

Given these facts, this seems appropriate. Subtract the difference between Lines 1 and 2, and calculate the early withdrawal penalty based on that difference. If your entire distribution falls under the exception, then Lines 3 & 4 should equal zero.

If there is any part subject to additional tax, then you'll carry over the Line 4 amount to Schedule 2. Doesn't seem like you need it, but I've included links to an article and video on Schedule 2 for reference:

IRS Schedule 2, Additional Taxes

Article: www.teachmepersonalfinance.com/irs-schedule-2-instructions/

Video: ua-cam.com/video/Yb_AwqA_sPM/v-deo.html

@@teachmepersonalfinance2169 Thank you so much. I really appreciate it

Is this an additional tax I have to pay, besides the State and Federal tax I was charged for already?

I'm sorry for the late response. To answer your question, this is an additional tax, on top of state and federal taxes.

What taking only what I've contributed to my roth, (to avoid tax and penalty) which lines do i fill out?

With regard to Roth IRAs, you only need to complete this form if one or more of the following apply:

You received a distribution from a Roth IRA and either:

-The amount on line 25c of Form 8606, Nondeductible IRAs, is more than zero

-The distribution includes a recapture amount subject to the 10% additional tax

-It’s a qualified first-time homebuyer distribution

-Your Roth IRA contribution exceeded the contribution limits

If you overcontributed to your Roth IRA, you'll need to complete Part IV. In that section, you'll see information on how to properly withdraw excess contributions and attributable earnings so that you can avoid tax and penalty.

@@teachmepersonalfinance2169 thanks

Do I have skip part II to IX since I did not make any excess distribution on my IRA since my early distribution come from my company esop? Also, is the amount to be entered in line the gross amount or the Net amount I received on early distribution. Thx. For the help in advance.

From my understanding, you should only complete the parts that apply to your situation. If parts II through IX do not apply (there are instructions for each part on the form), then it should be okay to skip the parts that do not apply. Regarding the distributions-you should enter the gross amount, not the net amount.

Please feel free to check out our article, where we've written step by step instructions to help you walk through this tax form! www.teachmepersonalfinance.com/irs-form-5329-instructions/

If you’re looking for tutorials for other IRS Forms that you can file directly through the IRS website, check out our free fillable forms page: www.teachmepersonalfinance.com/free-fillable-tax-forms/

I was almost done with my online taxes, then this stopped it.