Price to Earnings (P/E) Ratio and Earnings Per Share (EPS) Explained

Вставка

- Опубліковано 6 сер 2024

- This video provides a basic introduction into the price to earnings ratio and earnings per share value. It explains how to calculate the P/E ratio using two simple formulas and how to calculate the EPS value using the earnings of a company minus any preferred dividends divided by the shares outstanding. The P/E ratio can be calculated by dividing the price of the stock by the EPS value. It can also be calculated by dividing the market capitalization of the company by the total earnings.

Stock Trading For Beginners:

• Stock Trading Strategi...

Return on Investment:

• How To Calculate The R...

The Dividend Yield:

• The Dividend Yield - B...

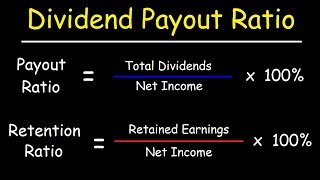

Dividends - Payout Ratio Vs Retention Ratio:

• Dividends - Payout Rat...

Market Capitalization:

• Market Capitalization ...

___________________________________

PEG Ratio Vs Price To Earnings Ratio:

• PEG Ratio vs Price To ...

Trailing PE Vs Forward PE Ratio:

• The Price To Earnings ...

Price to Sales (P/S) Ratio:

• How To Calculate The P...

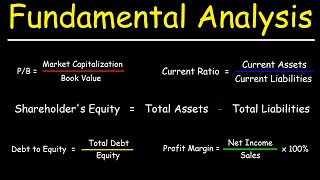

Price to Book (P/B) Ratio:

• How To Calculate The B...

Currency Exchange Rate:

• Currency Exchange Rate...

Profit Margin & Operating Margin:

• Profit Margin, Gross M...

_____________________________________

Return on Assets (ROA) and Return on Equity (ROE):

• Return on Assets (ROA)...

Debt to Equity Ratio:

• Long Term Debt to Equi...

Liquidity Ratios:

• Liquidity Ratios - Cur...

Assets, Liabilities, & Equity:

• Personal Finance - Ass...

The Short Ratio:

• How To Calculate The S...

____________________________

Math and Science Videos:

www.video-tutor.net/

Final Exams and Video Playlists: www.video-tutor.net/

bro literally yesterday i was watching your calculus videos to prepare for next semester. and now today, youre helping me learn stocks. what cant you do?

Holy crap, I watched your video last week for Organic Chemistry homework and now I'm watching ur P/E video as I'm learning stocks.

When I started the video and heard your voice, I thought I clicked on a Chemistry video LOL

I love how this channel does everything to do with numbers

Be careful Tesla p.e very high

@@tonyvo8285 ?

shoya eps .39 per share PE 1,094 very high

Microsoft better than Apple

Microsoft 36.4

You do accounting and finance too!? This channel has everything

Excellent video! The exercises at the end were a great decision for solidifying the concepts

You should definitely do more finance videos. Also, they're really hard to find amongst all the other videos.

omg the organic chemistry tutor knows finance

This man is a genius. His wisdom is large

Beautifully explained. Thanks a lot.

Thank you. This is what I was looking for.

Well explained with examples. I really like the way you set up the study material. Thanks for sharing the knowledge with others!!

Peace ✌️

Agree totally combined with the examples perfect.

Brilliant...one of the BEST videos I've watched.

Will explained regarding how to calculate the absolute the rate, thanks for sharing

Thank you so much! Very instructive.

Excellent video !!! Thank you

You're awesome!! Thank you, so informative. Made 20 minutes feel like 5 minutes! :D

This absolutely amazing: price to earnings and Earnings per share

This is awesome, firet time I understand what P/E is

Thank you for your time.

This video was very helpful and straightforward

very good analysing thanks.

Thank you for this lesson It is most appreciated

Myaannnnnn

I don't have any words to thank you for this outstanding explanation thank you sooo much. :)

(sorry for my bad English)

Thank you. learn PE ratio very clearly here

The video full of information.

Nice video with examples

Your consistency is just

.....wow !!!

Study GF was about to say

Thank you so much. Could never understand this before

Best video I could find!!!!!

This guys know everything

Thank you bro for the explanation, ❤❤

You are the best. thanks

Really good

Great vidéo, thank you

Outstanding

Thank you!

i love you so much 🥺❤❤❤❤❤❤thanks

Easy teaching = Easy learning

What do you mean when you say outstanding shares?

Wow thank you so much ❤

First time viewer ,loved it...quick question, how do calculate the average 5 year of earnings of a stock ?

Awesome job 👍🏽👍🏽👍🏽👍🏽👍🏽

what is another name for outstanding shares

thank you!!

best video

Hai dear can you tell, these earnings here we using is yeraly earnings or quarterly or monthly??

Liked and subscribed ❤

Where do you get your information from? Hope you don't take my question the wrong way, but I am genuinely interested where youre learning this from since I'm interested in learning more about finance.

Im just trying to figure out where preferred and common stocks come into play in the equation... like net income minus preferred dividends,but what about the shareprices? because the number of shares is different then the prices.

Hi. Thanks for the video and explanation. For the first time I know what are P/E and EPS. But I see 1 thing wrong in this video is: P/E ratio doesn't have dollar unit. In video you calculated P/E is $5.

I mean $7

Your voice reminds me of my final exams

What is a preferred dividend??

Civil surgeon certificate keisa banaye. Procesd

Which net income? Quarterly Report? Semi Annual? Or Annual Financial Report?

Is earnings in EPS, anualise or in each quarter (3 months earnings) ?

annual

Hi.Do you offer crypto value or analyze training?

So if u are given proposed dividend and not preferred dividend will u subtract it from your net income

where and how do you determine shares outstanding

how would i calculate the EPS of this David’s Magic Stores has an operating profit of $230,000. Interest expense for the year was $33,000; preferred dividends paid were $29,000; and common dividends paid were $45,000. The tax was $51,600. David’s Magic Stores has 25,000 shares of common stock outstanding.

im so stuck

EBITDA-interest-tax-preferred div, dividedby shares outstanding =116400/25000= ≈4.656

230,000-33000-51600= 145400-116400/25000

Hope this helps

@@cust0mEditi0n thank you!

hello I am pretty sure that your comment that based on higher EPS company A stock is better deal is incorrect hypothesis. Both companies have same Net Income so both are identical in earnings. one company has just issued more stock so the stock price should be 5x difference and P/E should be the same.

Could you use a real world example? Whenever i use this formula on real stocks the numbers dont add up at all.

What is outstanding shares? the whole public shares?

Total issued shares

@@junaidakhtar3407 what is issued?

@@sonyabadass outstanding shares is the combination of shares traded in the open market(float shares) and restricted shares which is owned typically by executives within the company.

A company with a lower E.P.S. may not necessarily be doing bad they just might need to decrease shares outstanding which is why companies do stock buybacks... the company may be doing great on earnings but in order to immediately increase E.P.S. to each shareholder or potential shareholder they may just need to decrease too many perceived shares outstanding while working to still increase earnings more and more overtime just as long as the E.P.S. is not actually negative a person has to do total due diligence on a company that they might want to hold shares of because all is NOT equal between to companies there WILL be differences to compare between two balance sheets even in the same industry and everything has to be considered. Ex comparing Walmart to Target Amazon to eBay or McDonald's to Chipotle same industry but two different companies with two individual different balance sheets.

I was trying to set up my tv and found this

The bigger eps the better, correct?

How tf did I find this from a QR code coming from a tv😂

I don't understand how shares outstanding determines how the company is performing

Ah yes, It’s big brain time.

(I’m a 7th grader)

I'm in kindergarten I win

@@jds189 im a fetus that is investing in the share market from a womb

@@baljeet7217 I bow to your greatness

I stopped at the first ad, but that denominator isn’t right. It should be weighted average shares outstanding, which can be a vastly different number for growth companies. Not surprising that a chemistry tutor wouldn’t understand per-share ratios, but scary to see people say they’re “learning stocks” from these videos.

Earnins

ا

Dawg what can’t you do?😭😭

It shouldnt be called Price-to-Earnings-Ratio. It should be called Stock-Price-to-Earnings-per-Stock-Ratio 🤓