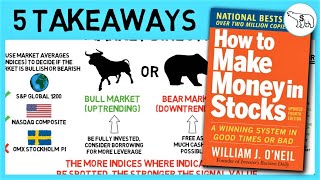

WILLIAM O'NEIL - HOW TO MAKE MONEY IN STOCKS - Cup and Handle Chart Pattern - CANSLIM strategy.

Вставка

- Опубліковано 18 чер 2024

- WILLIAM O'NEIL - HOW TO MAKE MONEY IN STOCKS - Investors Business Daily - Cup And Handle Strategy.

William O'Neil, founder of Investors Business Daily, is a highly acclaimed investor and advocate of the Cup and Handle chart pattern and trading strategy.

Also known for the creation of the CANSLIM strategy which focuses on the fundamental attributes of a growth stock.

William O'Neil combines the fundamental factors of the CANSLIM strategy with the Cup and Handle chart pattern. We explore the top six stock charts from the 100 presented in the book.

To help finding such patterns O'Neil created the stock screener Marketsmith which will help those concerned of the time needed to implement such a trading strategy.

Part two will later focus solely on the CANSLIM method

Risk/Reward trading spreadsheet - bit.ly/3ea6sl8

How To Make Money In Stocks - amzn.to/3oiUM1Q

Links:-

My Brokerage Account (Interactive Brokers) - bit.ly/3UGvn1U

25% Off Stockopedia - bit.ly/2YIcAIn

Risk/Reward trading spreadsheet - bit.ly/3ea6sl8

My Trading Spreadsheet/Calculator - bit.ly/3ea6sl8

Technical Screener - bit.ly/40S034v

Back test software - bit.ly/3oO1exN (20% Discount code)

My Breakout Scanner - bit.ly/40S034v

My Forum - bit.ly/40S034v

FREE Trading Tools/Software/Stuff - bit.ly/3ea6sl8

My Strategy Blueprint - bit.ly/40S034v

Edgewonk Trade Analysis Software - bit.ly/3xS6S7s Coupon Code = FWISDOM

Stock Trading videos:-

Timing The Market - • You CAN Time The Marke...

Best Chart Patterns - • The Best Chart Pattern...

Trend Following Study - • DOES TREND FOLLOWING W...

Trade Like A Casino - • How to Trade Stocks (U...

Dollar Cost Averaging - • Dollar Cost Averaging ...

Stop Loss vs Buy Hold - • Stop Loss Strategy VS ...

Trading Theory - • Best Trading Strategy ...

Dow Theory - • DOW THEORY - What is i...

Past Bear Markets - • PAST BEAR MARKETS & Ho...

Buy & Hope - • FINANCIAL EDUCATION GO...

Warren Buffet - • WARREN BUFFET Investin...

David Ryan US Champion - • BEST Stock Trading Str...

Trading Expectations - • REALISTIC STOCK TRADIN...

Super Trader - • Dr Van Tharp - SUPER T...

Oliver Kell US Champion - • BEST Trading Strategy ...

The Disciplined Trader - • Video

Kristjan Qullamaggie - • KRISTJAN QULLAMAGGIE -...

Avoiding Drawdown - • AVOIDING DRAWDOWN - In...

Breakout Screener - • CONSOLIDATION BREAKOUT...

MACD Explained - • MACD INDICATOR EXPLAIN...

Risk Reward Ratio - • RISK REWARD RATIO - Tr...

William O'Neil Disciples • Trade Like a WILLIAM O...

Dual Momentun • DUAL MOMENTUM | Moment...

Dan Zanger • DAN ZANGER | Breakout ...

Paul Tudor Jones • PAUL TUDOR JONES - Bil...

Spread Betting Naked Trader • NAKED TRADER'S Guide t...

Martin Schwartz Pit Bull • MARTIN SCHWARTZ | PIT ...

Kelly Criterion • KELLY CRITERION | Ed T...

Timothy Sykes • TIMOTHY SYKES - Tradin...

Think And Trade Like A Champion • MARK MINERVINI THINK A...

Van Tharp • VAN THARP Trade Your W...

Turtle Traders • TURTLE TRADERS STRATEG...

Ed Seykota • ED SEYKOTA Interview b...

Thomas Bulkowski Candlestick patterns • CANDLESTICK PATTERNS b...

Nicolas Darvas • NICOLAS DARVAS Box Tr...

Swing Trading • SWING TRADING STRATEGI...

Lone Stock Trader • LONE STOCK TRADER - Fr...

Mark Douglas • NICOLAS DARVAS Box Tr...

Jesse Stine • JESSE STINE INSIDER BU...

Stan Weinstein • STAN WEINSTEIN - SECRE...

Peter Brandt • DIARY OF A PROFESSIONA...

Mark Minervini • MARK MINERVINI- Trade ...

Alexander Elder • TRADING FOR A LIVING D...

Investing videos:-

Joel Greenblatt - • JOEL GREENBLATT - THE ...

Tony Robbins - • MONEY MASTER THE GAME ...

Robert Kiyosaki - • RICH DAD POOR DAD REVI...

The Naked Trader - • THE NAKED TRADER - Rob...

Common Stocks Uncommon Profits - • COMMON STOCKS AND UNCO...

A Random Walk Down Wall Street - • A RANDOM WALK DOWN WAL...

Vanguard Index Investments - • VANGUARD INVESTMENTS |...

As a professional trader I have consumed hundreds of financial books and endured countless hours of self education. My hope is that this channel will reduce the learning curve duration of many aspiring traders by providing the key information in a concise and enjoyable manner.

I also offer a paid subscription service for those looking to see all my investment decisions.bit.ly/40S034v

Watching this, I'm able to understand it 50/50. Seems like there's always a learning curve but I know that it will be worth it. Better to have and not need, to need and not have.

Mate, I just want to say that your chanel is the most valueble asset in youtube. Thank you

Glad you think so!🙏

Looking forward to the CANSLIM part 2 video. You are the best. I’ve been learning a ton from your videos.

Great to hear - Thanks👍

eagerly waiting for the 2nd part.. CANSLIM

This book is life changing!! Your videos are pure gold. Thanks

Glad you like them!👍

🖕It's really nice meeting you here and I'm very willing to teach you about trading,coach you on how to invest and work with you dealing on cryptocurrencie

Thanks for this. Looking forward to watching the CAN SLIM video.

I've learnt a lot from CANSLIM, however, I don't think that you can generalise a RR from O'Neils charts as those presented are both selective and the result of survivorship bias. In no case are failures emphasised. This is common to most trading books ... Anyway back to RR. The reward part can only be guestimated in advance; it is easy to look at any historic chart that moves from the bottom left to top right, 'see' consolidation patterns, and declare them tradable on a breakout. What you've found subjective is probably the result of this occurring. However, I found the video very useful as I've stared at many of the examples and thought - 'nope, just don't see that'. Consolidation & tight closes (volatility contraction) are useful setups that seem to be associated with sharp moves. A breakout in the direction of prevailing relative strength helps with the correct direction.

Hi Andrew - You make some very valid points. Your are right in regard to the survivorship bias, this was the main reason for the Monte Carlo Simulator example to show that you could be out of the game if you hit too many losses aligned to the account risk taken. Of course to determine a strike rate you need to have back tested to get that conclusion, hence as you say it can only be guesstimated. RR is by default subjective due to not knowing the 'true' reward in advance. Glad you found it useful if only to conclude the findings of the book flawed, as did I to some degree.. Thanks for the detailed reply, much appreciated.

learnt?

@@somethingclever1234 British English

Hello from Brazil. I'm about to buy Peter Brandt's book because of your video on it. Great work, congratulations. 👍👍👍👍👍

Great to hear, thanks Andre...

🖕 Thanks for watching For correct signals on best coins to trade on , message directly.

This is my first time on this channel, your videos are treasure!

Welcome aboard!

I love your videos! Thank you so much!!

You are so welcome!

Great summary! Thanks for your value creation. I have a question. What are your top three books you would recommend someone who would like to trade mid and long term in the market? Thanks again.

Love your videos!

So glad!

Your videos are so interesting that I always forget to like. Good that you mention to do that at some point and I always like videos after that.

Awesome! Thank you!

Great sir

My Brokerage Account (Interactive Brokers) - bit.ly/3UGvn1U

My Breakout Scanner - bit.ly/3ea6sl8

My Forum - www.financialwisdomTV.com/forum

My Strategy Blueprint - www.financialwisdomtv.com/plans-pricing

Edgewonk Trade Analysis Software - bit.ly/3xS6S7s

Stock Screener & Backtesting - bit.ly/3oO1exN (20% Off Code = FWSDM)

Stockopedia - bit.ly/2YIcAIn (25% Discount)

Excellent 👌

Thank you😊

You're welcome 😊

Hi, thank you for a nice analysis.. i couldn't find the 2 nd part on canslim talked about at the end..is it made or else do consider a video on it..

well said!

Loving your Videos ..... Bravo...

Glad you like them!🙏

Good Video, as obvious. Thank you for your efforts, Sir. Your Intro Music on this Video was so astonishing to me, it just reminded me on the 80's, BloodSport the Movie, The Kickboxer and so many more of those great Films right out of my Childhood. Keep on Going, you created a very beautiful, nice and very informative while still understandable Channel. I really appreciate it. Keep the Good Up, and see you on the other side

🙏

Thank you 💐

You're welcome 😊

Very useful channel indeed❤

Glad to hear that

If I’m not mistaken, the RR multiples would have been way more. In TASR example buying a BO at approximately $4.4 with 8% stop loss and selling at $108 is a 296RR trade. Only risked 35c for over $103 gain. Love the videos btw

Thanks Boris, ill take a look...

That's exactly what I came here to say. For an $800 risk out of a $10000 account you would be buying approx 1142 shares at the buy point of $4.40 and selling at $108 and would rake in a gain of $123,108 not $18,400.

Other than that, loved this video and the others I've watched - explains the books really well and very entertaining as well.

Thanks Natasha... Yes an oversight it seems, nice to know people are intently watching to pick up these things👍

HOW TO USE THIS IN INDIANMKT

Thanks!

Thank you so much - Sorry for the late reply! 🙏

Thanks for the video. I believe this trading way not easy to be screened easily. You need to give a hard work to establish a trading plan. Also cup and handle in weekly charts maybe not observed so much but when it is happen it could be effective. Thanks for the work FW!

Very true!🙏

you probably dont give a damn but does any of you know a tool to log back into an instagram account??

I somehow lost the password. I appreciate any assistance you can offer me

Where is the part2?

Very very nice video sir 👌

Thanks and welcome🙏

Great 👍

Thank you 👍

Thank you for giving a rather great summary of the first hundred or so pages, this has incentivized me to continue to read the rest of the book.

My first time here and I’m enjoying the channel. Thank you for the hard work!

Glad it was helpful!

Great presentation skills

Thanks Manikantha👍

🖕It's really nice meeting you here and I'm very willing to teach you about trading,coach you on how to invest and work with you dealing on cryptocurrencie

12:14 Should have entered in June 2003. The MA and nearby range was broken on a greatly increased volume.

This channel is underrated.

So good book reviews plus statistical analysis.

Thanks Tywin🙏👍

So, is bill O'Neill Mark Minervini's teacher. This obviously works but seems very complicated.

Great video, just started to read the book, any other recommendations on other books?

The others on the channel😁

Hi, can you make a video of how to screen stocks? As there are many stocks and is there any way we can filter them?

hi, i'll see what i can do...

@@FinancialWisdom Thank you

You didn't cover the take profit part much at all. It's extremely difficult to sell at the top so you're risk reward figure are inflated and assumes that you sell at the near top everytime

Hi Tiny, you are absolutely right, the risk reward figure should only be established retrospectively, although you can estimate it based on the structure of the market i.e an historical resistance line. Personally I use my historical data to confirm long term RR expectations. Apologies if exits were not covered in this video, I try to take out key points that the book offers.👍

@@FinancialWisdom Alright mate. Appreciate the video.

This is gold

Thanks Daniel🙏

@@FinancialWisdom no thanks to You all Your content it's SO great

Thank you for doing this .! Liked and subscribed

Thank you!👍

As you stated the JDS graph actually shows what looks like “cup n handle” quite a ways Before the one 0’Neil chose. If one had used it they would have made a profit up to the one O’Neil used.

Qualcomm is subjective with multiple “cup n handles”.

I will pass on ONeil

Does Canslim work in a bear market?

Hello, Can you please provide the link for second part. I could not find it or i missed it not sure

Hi, sorry EnergyWind I never actually got around to do the second part, It will be done in the future though👍

@@FinancialWisdom ok sure.. will be waiting :)

Many thanks Gareth. I've always found the cup and handle pattern rather difficult to spot in real life - maybe because a proper one is quite rare, and also it's more complex than other chart signs, not to mention the element of subjectivity to which you allude. I shall start looking again.

You should read Mark Minervini - "Trade like a Market Wizard". His VCP concept explains the charakteristic of a correct Cup with handle and where it´s works best. They are not that rare. After the Corona Crash there were dozens that worked and more are building up right now.

Thanks again William!

Whats the best website or app for charts with the buy volume below??

I use my trading broker IG index👍

Please sir make videos for intraday trading strategy. Thank you so much 🙏

Hi Kishan ill add something to the list👍

Thank you so much

🖕It's really nice meeting you here and I'm very willing to teach you about trading,coach you on how to invest and work with you dealing on cryptocurrencie

If people are looking for a cup & handle pattern happening live:

12/6/2020 MARA stock cup & handle is very pronounced

**MARA is Bitcoin

where can i do the montecarlo analysis?

On my spreadsheet - www.financialwisdomtv.com

❤

I too like to buy the breakout of a stock that I know is going to increase buy 2000%...

😀

If tge left side of chart had much higher prices months back as price rises the stock price can hit a ceiling even though coming off cup and handle. I prefer long flat bases of brand new stocks.

Those cup handle patterns here look super messy - sometimes just a tiny handle, or a small cup handle overall followed by a long, massive rallye that makes the cup handle look tiny and irrelevant.

Wondering what the general hit ratio of that pattern is nowadays..

Yes it would be interesting, the problem is that there is considerable subjectivity involved an not easy to filter/screen.

DO I HAVE TO PLACE 1 DAY CANDLE OR 1WEEK CANDLE? EG YOU EXPLAIN (5 MIN 24 SECONDS

For exiting a position or placing your stop loss we look at the daily candle

THANK YOU SIR FOR ANSWERING MY QUERY

how to determine target price

Personally i dont use a target price, I look for a change in momentum, a target price IMO stunts risk/reward and this is the foundation of a great strategy.😉

how many stars do you give to the book?

I would probably go 4, its a great book to learn a specific strategy. I have stopped rating them because I could 'apparently' be liable for not scoring books accurately.....🤐

How to identify cup n handle on chart.??

Hi, did you watch the video until the end?

what kind of charts are used here?? this candles only display a daily high, a daily low and a third type of price???

is the Part 2 the one referring to his disciples?

Where is part2 video about CANSLIM method?

In the future no doubt..

I find the cup and handle pattern to be very subjective because I never see it until the lines are drawn to show it.

How to detect stocks which will going to up ?

Digest the videos and i'm sure you will gain the knowledge you need😉

@@FinancialWisdom I digest the videos but all people who use this system don't tell about which are the screener associated. It's like if you sell a car without the keys.

Because Buffet

0:53 Statsitics? What are Statsitics?

Lol

I tend to take my profits too early. How does one ride the wave without using trailing stop?

Hi Chewie, I suggest an objective stop, either a downside break of (obvious) support or perhaps a closing below a certain moving average, my preference is the crossing of the MACD on the weekly chart. Of course its a trade off between the willingness of losing some profit in the hope you eventually gain more profit (rosk reward).

@@FinancialWisdom had a big drop on CRM recently. It’s like cutting your losses or I plan on keeping for the long run and selling calls against it (but yet again, cutting off my upside potential). Great videos. Thanks for sharing and creating valuable summaries of great traders.

@@chewie1355 Thanks Chewie, yes its a trade off... the tighter the risk management often the less the reward but less risk, the looser the risk management often more reward but more risk. My approach is hybrid and includes fundamentals as well as technical, therefore i use weekly charts and allow for short term drawdown but with greater reward.

An entry point is easy to identify but the climax is near impossible to predict.

Sure, you cant always time them, its ok being late and sacrificing a portion of the move.

Until the bar is closed Its not possible to know the enter point. The stop loss is 2x than in the video.

seems like a horrible book but I liked the video cuz your videos are great! Thank you

Thanks for watching!

How does anyone know the reward? In nine eight sure....but when putting on the trade who know how high it will go?

In hindsight sure

Hi Phil. Either solid back testing or in my situation years of historical results providing and 'average' reward.

*Le chart : moves in random fkn direction

William O'neil : is this cup and handle pattern

I believe in randomness. But you can shift the probabilities in your favour.

@@FinancialWisdom yeah man :).. i liked all your videos ☺️

12:55

thanks

I’m confused on your rewards to risk numbers… you keep saying $800 risk for a $24,000 (yahoo example) return. But if the stock returned a 32x on $10k that would be $320,000… what is the $24,000 figure?

Why that little cartoon dude hate breakouts 😂

Isnt here a Log chart? Take the chart from 5:30 . Entry at 7. SL at 6. Price went up to 125. This isnt a 1 : 16 RR. This is way more....

If I could give some feedback. I prefer to hear the content of the guys book rather than your opinion if it's useful or not no offence. Have a listen to the Swedish investors take on investing books

Fair comment, although they are my videos and I like to give my opinion, no offence :-)

@@FinancialWisdom non taken, but if the person's results are better than should you be 😉

You londoner?

Originally

1000% is X11, not X10.

Some of your content is excellent, but basing a RoR based on the assumption you “sell at the top” should raise serious eyebrows. At least base it on some kind of market structure change

Hi - This is purely theoretical for simplification, you are right real life would need specific rationale. But of course we do not know this in advance therefore we are always using assumptions, when we are at the far right of the chart everything is an assumption.

My p0rtfolio is plummeting significantly, I’ve lost about $320k within a few months and I'm not confident about picking st0cks anymore. Are there really no other options for me to gain from the stock market?

Well the bigger the risk, the bigger the reward and such impeccable decisions are better guided by professionals.

Very true. Despite having no prior investing knowledge, I started investing before the pandemic and pulled in a profit of approximately $950k that same year. In reality, all I was doing was getting professional advice.

I’ve been looking to switch to an advisor for a while now. Any help pointing me to who your advisor is?

There are a lot of independent advisors you might look into. But i work with Nicole Desiree Simon , and she is excellent. You could proceed with her if she satisfies your discretion. I endorse her

I just looked her up on the internet and found her webpage with her credentials. I wrote her a outlining my financial objectives and planned a call with her.

I don't think any of the analysis made sense, let alone the fact that how one would have picked such stocks.

You can look at any correction and say it's a cup and handle.

I hope the book would contain more info.

R:R calculation is false. on invested 10000$ x 630% = 63000$ , stop 800$ so R:R is = Net profit (63000$) / Risk taken ( 800$ ) = 78.75 R. there's no point that on 10000$ investment stock moves 630% and profit is 15200$ .

Other than that great summary !

This content is filled with groundbreaking revelations. I discovered a book with like themes that transformed my outlook. "Mastering Money Mindfulness" by Benjamin Hawk

Can anyone recommend a site to search for cup & handle patterns? I use Finviz now for searches but they don't have the cup & handle pattern

the initial 8 % stop loss wouldnt be enough to have such huge returns, because that's concludes that you sell at the top