- 95

- 360 843

How To Taxes

Приєднався 31 гру 2017

Making taxes not so taxing. Teaches how to prepare a federal tax return Form 1040 and other tax basics. Created by a CPA.

How to save thousands of dollars on your mortgage

How to save thousands of dollars on your mortgage

Переглядів: 33

Відео

Step by step 2023 tax return instruction for single filing status

Переглядів 1404 місяці тому

Step by step 2023 tax return instruction for single filing status. Prepared by CPA.

HOW THE IRS IS UNFAIR TO SINGLE PARENTS

Переглядів 464 місяці тому

HOW THE IRS IS UNFAIR TO SINGLE PARENTS

How to prepare your 2023 Form 1040 SR Tax Return Line by Line Instructions

Переглядів 7 тис.5 місяців тому

Teaches how to prepare your 2023 Form 1040 SR Tax Return Line by Line Instructions. CPA prepared. Link to Form 1040-SR with Itemized Deductions: ua-cam.com/video/Y6TkvGyYEWw/v-deo.html Link to Form 1040-SR with taxable Social Security calculation: ua-cam.com/video/CvpovuJMTCw/v-deo.html Link to: Do Seniors qualify for the Earned Income credit? ua-cam.com/video/pCmzq-SML7c/v-deo.html Link to whe...

How to prepare your 2023 Form 1040SR tax return with Schedule A Itemized Deductions

Переглядів 4715 місяців тому

How to prepare your 2023 Form 1040SR tax return with Schedule A Itemized Deductions When and where and how to file your return: ua-cam.com/video/dmxEoIvEf4s/v-deo.html

How to prepare your 2023 Form 1040SR tax return with W 2 and U S Savings Bond Income

Переглядів 3115 місяців тому

How to prepare your 2023 Form 1040SR tax return with W 2 and U S Savings Bond Income

How to prepare your 2023 Form 1040SR tax return with Schedule B and Social Security Income

Переглядів 1,3 тис.5 місяців тому

How to prepare your 2023 Form 1040SR tax return with Schedule B and Social Security Income

How do you claim unemployment income on your tax return? Step by step instructions.

Переглядів 1005 місяців тому

How do you claim unemployment income on your tax return? Step by step instructions.

Get a tax refund! Do I have to file a Federal Income Tax Return?

Переглядів 645 місяців тому

Get a tax refund! Do I have to file a Federal Income Tax Return?

Do Seniors qualify for the Earned Income Tax Credit

Переглядів 1255 місяців тому

Do Seniors qualify for the Earned Income Tax Credit?

Wait to file your taxes! You could miss a credit of $7k!

Переглядів 1765 місяців тому

Wait to file your taxes! You could miss a credit of $7k!

How to prepare your 2023 Form 1040 Tax Return For Head of Household

Переглядів 6435 місяців тому

How to prepare your 2023 Form 1040 Tax Return For Head of Household Includes child tax credit

How to Fill out 2023 Tax Return in 1 Minute

Переглядів 2366 місяців тому

How to Fill out 2023 Tax Return in 1 Minute

How to prepare your 2023 Form 1040 Tax Return Line by Line Instructions

Переглядів 2,1 тис.6 місяців тому

How to prepare your 2023 Form 1040 Tax Return Line by Line Instructions. Contains child tax credit. How and where to file: ua-cam.com/video/dmxEoIvEf4s/v-deo.html

How to prepare your 2023 Form 1040 Tax Return For a Dependent with more than $13,850 in Income

Переглядів 2826 місяців тому

How to prepare your 2023 Form 1040 Tax Return For a Dependent with more than $13,850 in Income

How to Fill out 2023 Tax Return in 2 Minutes

Переглядів 2556 місяців тому

How to Fill out 2023 Tax Return in 2 Minutes

How to prepare your 2023 Form 1040 Tax Return For a Dependent with less than $13,850 in Income

Переглядів 4756 місяців тому

How to prepare your 2023 Form 1040 Tax Return For a Dependent with less than $13,850 in Income

How to prepare your 2023 Form 1040 Tax Return For a Single

Переглядів 1306 місяців тому

How to prepare your 2023 Form 1040 Tax Return For a Single

How to prepare your 2023 Form 1040 Tax Return For Married Filing Jointly

Переглядів 4616 місяців тому

How to prepare your 2023 Form 1040 Tax Return For Married Filing Jointly

WHERE & WHEN TO FILE YOUR 2023 TAX RETURN AND WHAT TO ATTACH

Переглядів 926 місяців тому

WHERE & WHEN TO FILE YOUR 2023 TAX RETURN AND WHAT TO ATTACH

How to prepare your 2023 Form 1040SR tax return with Social Security income

Переглядів 10 тис.6 місяців тому

How to prepare your 2023 Form 1040SR tax return with Social Security income

How to avoid interest and penalties on your taxes

Переглядів 406 місяців тому

How to avoid interest and penalties on your taxes

How to prepare your 2022 Form 1040 Tax Return with Unemployment Compensation

Переглядів 830Рік тому

How to prepare your 2022 Form 1040 Tax Return with Unemployment Compensation

How to prepare your 2022 Form 1040 Tax Return for Head of Household

Переглядів 2,1 тис.Рік тому

How to prepare your 2022 Form 1040 Tax Return for Head of Household

How to prepare your 2022 Form 1040 Tax Return With Education Credit

Переглядів 634Рік тому

How to prepare your 2022 Form 1040 Tax Return With Education Credit

How to prepare your income tax return in less than a minute

Переглядів 857Рік тому

How to prepare your income tax return in less than a minute

How to prepare your 2022 Form 1040 Tax Return Line by Line Instructions

Переглядів 8 тис.Рік тому

How to prepare your 2022 Form 1040 Tax Return Line by Line Instructions

How to prepare your 2022 Form 1040SR tax return with social security income

Переглядів 13 тис.Рік тому

How to prepare your 2022 Form 1040SR tax return with social security income

Great video!!! still stuck a bit,What if I have two incomes ?

You are awesome!

Many thanks, I do appreciate this help!

Thank you! This was very helpful.

can you do a head of house hold w/ dependent and the child earned income tax credit video together.

Love you’re videos for some reason i always get lose at after number 16 tax credits. Lol Can you please make a video for amending a tax & a superseding tax.❤

very clear and helpful thanks

wHY DID YOU NOT USE THE (STANDARD DEDUCTION) FOR SINGLE = 15700 OR 17550?

This video is for the 2022 tax year. Correct standard deduction was taken. Thank you for your question.

What if your only income is from SS? 1) you have to fill out this sheet? 2.) would the taxable income be $0?

One other note missed on this was that this form helps to make seniors who don't itemize aware that they likely qualify for an addition to the usual standard deduction: "For 2023, the additional standard deduction amounts for taxpayers who are 65 and older or blind are: $1,850 for Single or Head of Household (increase of $100) $1,500 for married taxpayers or Qualifying Surviving Spouse (increase of $100)"

Is this in all states?

This didn't include a mention that if one has Qualified Dividends (line 3a) that they might be eligible for a reduced tax rate. There is a worksheet in the instruction booklet that they can use in most situations to figure taxes and it usually does amount to much less tax due. I hope this video will be revised to include this, because it has saved me hundreds of $$ over the last few years. A very helpful IRS agent alerted me to look into this. Although in the instructions, I might've easily missed it.

Thank you very helpful and easy to understand

Very nice, thanks

What about states that don't tax Social Security?

This is a federal return.

Perfect. Had no clue what the heck line 16 was for. Now I do. Thanks!

First of all no thanks to the woman with that annoying voice.second andi ind this on ever video..slow down,way to fast and confusing as hell.im a little farther along now but everything is even more messed up.please if you cant be helpful ont try.ive been trying to get through this 1040 for three weeks now countless hours everyday i cant find he right help anywhere.i have paid money they took it and ran tried turbo tax ,vita program in my town way to many problems takes months to complete.h&r block had to go back and pick them up after a month of tomarrow promises.im at my wits end with this simple form and I haven't looked at WI. State tax form yet. Need rope and tree

What about the tax brackets? Aren't we supposed to use them? This example does not even mention them......?

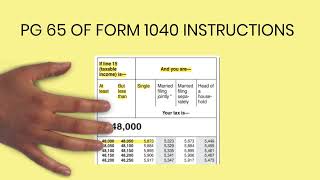

If your taxable income is less than $100,000, you must use the Tax Tables. If your taxable income is $100,000 or more, use the Tax Computation Worksheet right after the Tax Tables. There are also the Schedule D Tax Worksheet and the Foreign Earned Income Tax Worksheet if these apply to you.

Isnt gross income over 4400? How canyou be claimed as a dependent?

You can be claimed as a dependent if you are a qualifying child. I believe you are referring to a qualifying relative. ($4,700 for 2023).

Well you should specify, because even in the criteria your screen said under 65. I don't know any 25 - 64 year olds that would qualify as a child dependent

Child dependents need to be 17 or younger, correct?

@@dec1slh Under 19 or under 24 and a student

@@howtotaxes2054 still not relevant when your video shows criteria of being under 65....stop responding and fix your click bait video

do I also have to include my tax-exempt interest as a source of income when adding it to my 1/2 ssi

Yes

Great help verifying that I did all the steps correctly--Thank You, very clear instructions.

Hi, thank you for this update. But, WAIT for how long?

Just until you watch the video! :)

How do you get the amount on line 16

From the tax tables in the Form 1040 instructions

Very good info and simple step by step instructions! Very helpful info.

❤❤❤

Thank you!

Rich man doing taxes: what? Never? Got accountants. Got Real Estate. I love the IRS! God bless America! Poor man: Hey, I've gotta pay my rent at a one bedroom apartment, and now, the IRS got me paying it twice! I'm gonna get evicted! Thanks IRS for kicking me onto the streets! 😂

Thanks for the comment.

So helpful. ALso needed it for dependents

how is line 11 on the ssn worksheet zero when it clearly states you have to subtract line 10 from 9 which is showing as 7500 - 9000 on your example? please clarify

You’re the best

#10. how did you get 0...please explain anybody?

Which #10?

THANK YOU

Thank you very much! Did not know that the Line6b can be significantly lower than the simple SocSec half amount! 🙂

Thank you SO much...best video I have seen on tax prep...I had no clue I could reduce my ss income like this...Thank you

excellent video, if you have children under 18 also receiving ss benefits do you add them with the benefits of the parent receiving the SS? Or are they exempt, if exempt, do you have the IRS code showing they're exempt? thanks

very helpful, thanks!

Can I still claim my dad and be head of house. I been doing this for years. But I heard that u can’t do it anymore unless it’s your child. But I have no child. I take care of all my dad needs. My dad doesn’t work.

Aren’t you supposed to subtract 24 from 33?

Thank you.

This video is awesome. Extremely helpful!!!! Thank you so much!!

I rarely comment, but I must thank you for the answers given here! Looking forward to more content.

What line do I put property taxes paid?? I don't have a mortgage, my house is paid off...Also, do I put the exact taxable amount or do I round it up/down?? I have 54 cents on the federal taxed amount. Thanks!!

You would put them on Schedule A, line 5b, if you are itemizing. If you don't have a mortgage, it may be more advantageous to take the standard deduction in lieu of itemizing. Round up or down, you would round 54 cents up.

This is the best video I have seen in a long time! Thank you!

Thank you, thank you. You are the only one that I could find that did line by line.

Do we have to fill out another 1040 with the adjusted numbers and include it with the 1040X?

Complete and attach any applicable forms and schedules to support the amounts you refigured.

Thanks a lot 👍

The audio is so quiet, I can't hear anything!

ua-cam.com/video/Z1F-Rl006Zg/v-deo.html Here is a link to my current year video with improved sound.

Thank you .. I couldn't find were to put my UI benefits on the 1040.. Turns out i had to add a form that i was only able to find after watching your video.. Thank you very very much..

THANK YOU SO MUCH!!! this was perfect and exactly what I needed. you helped me save so much money and I finally learned how to do it. THANK YOU BLESS YOU!!!!!!!!!<3

hi, so if the child who is 18 and qualified dependent file her own tax return just to get her refund, my question is can a parent claim all the credits like EITC and CTC?

Yes

how did you get the amount 228

Subtract line 24 from line 33. (2500-2272)

I'm filing for my widowed mother for 2022 using TurboTax. Income is 2-1099R and 1-SS. One of the 1099R's it has line 2a " UNKNOWN " and there is no box 2b. For the taxable amount of box 1. what do I put in box 2a? Thanks so much for your help!